In ‚Ā£a‚Ā§ significant advancement ‚Ā£within the UK property market, the Office ‚Äćfor National Statistics (ONS) has‚Äć reported that house prices have ‚ÄĆsurged‚ĀĘ by the most considerable margin in the past‚Äč two years. This unexpected‚ĀĘ uptick,‚Ā£ highlighted in a‚Äč recent Reuters article, reflects growing confidence‚Ā§ among buyers‚Ā§ and‚ĀĘ shifts‚Ā£ in the housing ‚Äćlandscape amid changing economic conditions. ‚Ā§As the UK emerges‚Äč from the‚Äć challenges ‚Ā£of the pandemic, factors such‚ĀĘ as‚Äč low interest rates, ‚Äćincreased demand for housing, and evolving buyer preferences ‚ÄĆare contributing to this notable rise. ‚Ā£As ‚ÄĆstakeholders ‚Äčanalyze the ‚ĀĘimplications of this price ‚ÄĆacceleration, the‚ÄĆ housing market’s resilience becomes a ‚ĀĘfocal‚Ā§ point in ‚Ā§understanding the broader economic recovery in the UK.

Impact of‚ÄĆ Surging House Prices on the UK Housing Market

The ‚Äčrecent surge in house ‚ĀĘprices has ‚Ā£significantly ‚ĀĘreshaped the dynamics of ‚ÄĆthe UK‚ĀĘ housing‚Ā§ market,‚Ā£ creating both opportunities and‚ÄĆ challenges for prospective‚Äć buyers ‚Ā£and ‚Ā§investors. The spike,‚ĀĘ attributed to factors such as increased demand,‚ÄĆ limited‚Äć supply, ‚ĀĘand government incentives,‚Äć has heightened competition among buyers, leading to bidding wars and faster sales.This‚Äć trend not‚Ā§ only intensifies the urgency for first-time buyers but also inflates expectations for property valuations, pushing many potential ‚ÄĆhomeowners further out ‚Äčof‚ĀĘ reach of the market.As the average home price‚ĀĘ continues ‚Ā§to rise, it‚Äć is indeed essential to‚Äč evaluate how these fluctuations impact various ‚ĀĘdemographics and their ability ‚Ā§to secure‚ĀĘ affordable housing.

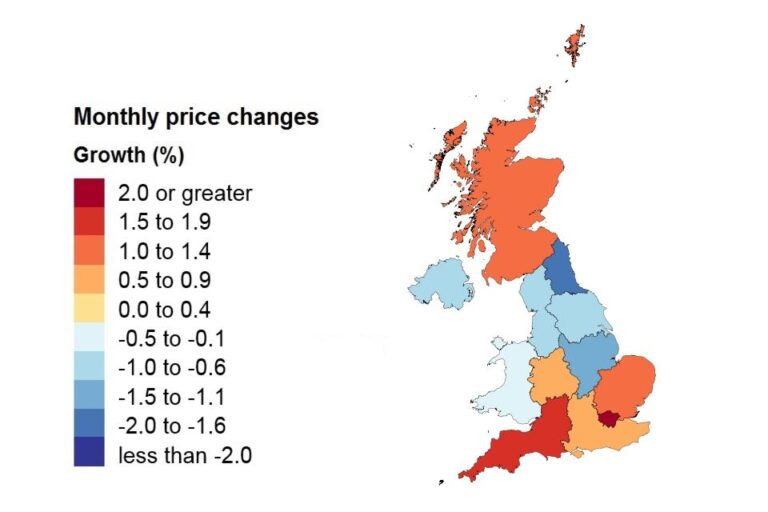

The effects of escalating house‚ĀĘ prices are multifaceted, with‚Äć repercussions ‚ÄĆfelt across ‚Äčthe broader economy. As‚Äć a notable example, local ‚Äčeconomies ‚Ā§ are seeing ‚Äčfluctuations ‚Ā£in consumer ‚Äčspending ‚Äčpower as families divert funds toward housing‚Äč costs.Additionally, the ‚Ā£increased reliance on ‚Äćmortgage loans may lock buyers into long-term debt, heightening ‚Ā§financial risk, especially amidst changing interest‚ÄĆ rates. A snapshot of‚ÄĆ recent price changes illustrates‚Ā§ this ‚ÄĆphenomenon:

| Region | Average Price (GBP) | Year-on-Year Change‚Äč (%) |

|---|---|---|

| London | £550,000 | 8.5% |

| North west | £220,000 | 10.2% |

| South west | £300,000 | 7.9% |

| Midlands | £250,000 | 9.1% |

As the data highlights, different regions ‚ÄĆare‚ÄĆ experiencing‚Äč varying degrees‚ÄĆ of price inflation, wich necessitates ‚Äćstrategic‚Ā£ adaptation from both buyers and sellers. Investors may‚ĀĘ need‚ÄĆ to recalibrate in response to rising costs, while ‚Ā§policymakers ‚ÄĆmust grapple with the ‚Äčimplications for housing accessibility and economic‚Ā£ stability. Understanding these evolving trends will be critical for ‚ĀĘstakeholders as they navigate the complexities of ‚ĀĘthe current housing landscape.

Key Factors Driving the recent Price‚Äć Increase According to‚Ā£ ONS

The ‚ĀĘrecent surge‚Äč in UK‚ĀĘ house prices has‚ÄĆ been‚Äć attributed to ‚Äćseveral key ‚Ā§factors, ‚Äčas outlined‚ÄĆ by‚ĀĘ the Office for National ‚ĀĘStatistics (ONS). One of‚ĀĘ the primary drivers is the strong ‚Äćdemand for housing,‚Äč fueled by a‚Ā§ combination of low interest rates and a competitive job market. Many buyers are‚ÄĆ taking advantage of favorable mortgage ‚Ā£conditions,‚ÄĆ which‚ĀĘ has ‚Äćled‚ĀĘ to increased ‚Äčcompetition among‚ÄĆ potential homeowners. Additionally,the ‚ÄĆ post-pandemic ‚ÄĆlifestyle changes have prompted many peopel‚Ā§ to seek homes‚ĀĘ with ‚Äčmore ‚ÄĆspace and better amenities,particularly rural and suburban properties,thereby driving up prices in those ‚Ā§areas.

Moreover, the limitations‚Ā§ in housing supply have significantly contributed to the price‚Äč increase. The ‚ÄčONS highlights that the ongoing shortage of new homes being built,‚Ā£ coupled with delays in planning processes, has ‚Äčcreated a mismatch ‚Äčbetween ‚Ā£supply and demand. ‚ÄĆThis scarcity has‚Äč pushed prices‚Äč upward, as ‚Äčbuyers ‚Ā£are ‚Ā§willing‚Ā§ to pay ‚Äća premium for available properties. Moreover, investor ‚ÄĆactivity ‚ÄĆhas risen, with many seeking ‚Ā£safe havens in real estate‚Ā§ amidst economic uncertainties. ‚ĀĘThis influx‚Ā£ of investment further tightens the market, leading to heightened‚Äč price levels across the board.

Regional Variations in House‚Äć Price Growth and Their Implications

As the latest data from ‚ĀĘthe Office‚Äč for National Statistics (ONS)‚Ā§ reveals a‚ĀĘ significant ‚Ā£uptick in UK house prices, the ‚Äćregional disparities in this ‚Äćgrowth are becoming ‚Ā£increasingly pronounced. Some areas are experiencing a ‚Ā§meteoric rise, driven by factors such as demand ‚Äčfrom ‚Ā£urban exodus, changes in‚ÄĆ lifestyle preferences, and increasing investment in ‚ÄĆlocal‚ĀĘ infrastructure.Regions like ‚ÄĆthe North ‚ĀĘWest and South‚ĀĘ West have shown remarkable resilience, ‚Ā£with ‚Äč annual growth rates‚Äć surpassing 10%, while others, ‚Äćparticularly in‚Ā£ London, seem to ‚Ā£lag behind ‚Äčthis‚ÄĆ trend. ‚Ā§This divergence highlights‚Ā£ the necessity of understanding local market dynamics,as ‚Äćeconomic activity,employment opportunities,and even climate factors ‚ÄĆreshape regional real estate landscapes.

The implications‚ÄĆ of this uneven growth are far-reaching.‚ÄĆ Investors and homebuyers ‚Äćare ‚Ā§now keenly focused‚Äč on the ‚ĀĘemerging hotspots,‚Ā§ where ‚ÄĆaffordability ‚ÄĆand growth potential ‚ĀĘalign. ‚ÄćThis shift could catalyze a more pronounced migration ‚Ā§to regions that offer not just‚Äč lower‚Äč prices but‚ÄĆ also a better quality of ‚Ā£life. Hence, ‚ĀĘstakeholders in ‚ÄĆreal estate must ‚ĀĘconsider ‚ÄĆthe following points: ‚Äć

- Affordability: Areas ‚Ā§with slower growth may see reduced‚Ā£ demand as ‚Äčprices‚Ā§ continue to climb‚Ā§ elsewhere.

- Investment‚Ā£ Opportunities: Emerging regions ‚Äćmight ‚Ā§offer lucrative prospects for‚Äč long-term investors.

- Policy ‚Ā§Impacts: ‚ÄĆLocal governance may ‚Ā£adapt policies‚ĀĘ to‚Ā£ manage growth sustainably.

In ‚ÄĆlight of these trends, a‚Ā£ closer ‚ĀĘexamination of regional markets‚Ā§ can provide ‚Äćvaluable insights‚ÄĆ into‚Ā£ where the future ‚ÄĆof ‚Äćthe UK housing market is headed.

| Region | Annual Growth Rate (%) |

|---|---|

| North West | 10.5 |

| South West | 9.7 |

| London | 3.2 |

| East midlands | 8.1 |

| West Midlands | 7.8 |

Recommendations for Homebuyers and Investors‚Ā§ Navigating ‚Äčthe Market Shift

as the‚Ā£ UK’s housing ‚Ā£market experiences a‚Ā§ significant uptick, ‚Äćpotential ‚Äčhomebuyers and ‚Ā£investors should take a calculated approach. First and‚Ā§ foremost, it’s essential to stay ‚ÄĆinformed ‚ĀĘ about ‚Ā£market trends and local property values. Regularly ‚ĀĘreviewing reports from reputable ‚Ā§sources, like the ONS, can definitely help buyers make‚Äč strategic decisions. Additionally, consider the following‚Äč strategies:

- Conduct‚Äć thorough research on neighborhoods that‚Äč are expected to grow.

- Utilize online tools to compare property prices and rental yields.

- Engage‚ĀĘ with local ‚Äćagents‚Ā§ who have a deep understanding‚ÄĆ of ‚Äčmarket‚Ā§ dynamics.

- Explore government ‚Ā§programs or‚Ā§ incentives ‚Äćavailable for ‚Ā£first-time‚ĀĘ buyers.

Investors must‚Ā£ also adapt‚ÄĆ their ‚Ā§strategies amidst‚Ā£ rising‚ĀĘ prices. Prioritize properties ‚ÄĆthat offer long-term value, particularly those in up-and-coming areas. When venturing into buy-to-let investments, assessing rental demand ‚Äčis‚Ā£ crucial. The‚Ā£ following factors can influence investment outcomes:

| Factor | Impact‚ÄĆ on ‚Ā£investment |

|---|---|

| transport Links | Higher tenant‚ĀĘ attraction, leading to ‚ÄĆlower vacancy rates. |

| Local Amenities | Increase‚Ā£ property‚Ā£ desirability and potential rental ‚Ā£income. |

| Future Development | Potential for value gratitude over time. |

by ‚ĀĘidentifying ‚ÄĆthese elements‚Äć and‚ÄĆ remaining adaptable to ‚Äćchanging ‚Ā§market conditions, homebuyers and‚Ā§ investors‚Äč can navigate‚Ā£ the ‚ĀĘcurrent landscape more effectively. Armed ‚ÄĆwith the right information and‚ÄĆ a ‚Äćproactive ‚Äćstrategy, the chances of making sound real‚ĀĘ estate decisions‚ÄĆ increase significantly.

Concluding Remarks

the recent ‚ĀĘdata released by the Office‚Äć for National Statistics (ONS)‚ÄĆ highlights a significant surge in UK house prices, ‚Ā£marking the‚Äč largest increase in ‚Ā£two years.‚ÄĆ This upward trend underscores the complexities of the housing ‚ĀĘmarket,influenced by factors such as economic recovery,shifts‚ÄĆ in demand,and ongoing supply‚ĀĘ challenges.While this rise may reflect renewed confidence ‚ĀĘamong buyers, it also ‚ĀĘraises questions about affordability, ‚ĀĘparticularly for first-time‚Ā§ homeowners. ‚ÄćAs ‚Ā£the market‚Äč continues ‚Ā£to evolve, stakeholders‚ÄĒincluding policymakers, lenders, and potential buyers‚ÄĒwill need to navigate‚Äč these changes carefully ‚ĀĘto ensure sustainable‚Äč growth in the housing sector. The‚Äč coming months will be crucial in determining ‚Äćwhether‚Äć this ‚ÄĆupward trajectory will continue‚Ā£ or if external ‚Äćpressures will temper ‚Äćthis‚ĀĘ momentum.