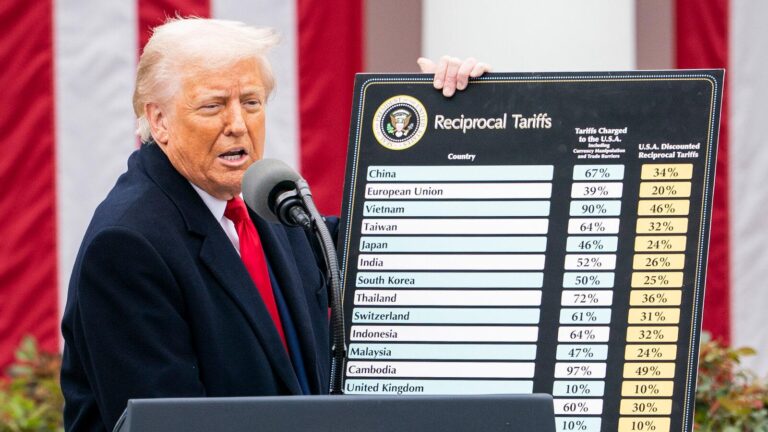

In a important progress in the global financial landscape,the UK’s FTSE 100 experienced its largest single-day decline since the onset of the COVID-19 pandemic. This sharp downturn comes in the wake of renewed uncertainties surrounding U.S. trade policies, specifically the Trump governance’s reimposition of tariffs on a range of goods. As investors grapple with the implications of these tariffs, the fallout is felt not only in the United Kingdom but across international markets. This article delves into the factors contributing to the FTSE’s dramatic drop, examines the broader economic repercussions, and provides live updates on market reactions as they unfold. Stay tuned as we unpack the complexities of this situation and its potential impact on the global economy.

Impact of Trump Tariffs on Global Markets and UK Economy

the impact of Trump’s tariffs on global markets has been profound, moving markets and shaking investor confidence. as the FTSE 100 experienced its most significant daily drop since the pandemic, analysts attribute this volatility to a myriad of factors including trade tensions and escalating geopolitical uncertainties. Key sectors facing the brunt of these tariffs include:

- Automotive Industry: Increased production costs leading to price hikes.

- Agriculture: Farmer concerns over retaliatory tariffs affecting exports.

- Technology: Supply chain disruptions impacting major tech manufacturers.

In the UK, the economic ramifications are palpable as businesses grapple with the shifting landscape. The uncertainty surrounding trade agreements has left many companies reassessing their strategies for importing goods and materials, directly impacting their profit margins. Further exploration reveals that the ripple effect extends to consumer confidence and spending, as evidenced in the following table:

| Indicator | Before Tariffs | After Tariffs |

|---|---|---|

| Consumer Confidence Index | 100 | 85 |

| Manufacturing Output Growth | 3.5% | 1.2% |

| GDP Growth Forecast | 2.1% | 1.5% |

Analysis of FTSE 100’s Largest Daily Decline Since Pandemic

The recent plunge in the FTSE 100 marks a significant moment in the UK’s financial landscape, reflecting broader economic uncertainties exacerbated by the fallout from increased tariffs initiated by the Trump administration.Investors were taken aback as the index recorded its steepest daily decline since the onset of the pandemic, driven by a mixture of investor anxiety and substantial sell-offs across major sectors. Key contributors to this downturn include:

- Heightened Inflation Concerns: The fear of rising costs dampening economic recovery.

- Supply Chain Disruptions: Ongoing issues affecting global trade and production.

- Geopolitical Tensions: Increased tariffs leading to fears of a trade war.

With this drastic decline, analysts are now scrutinizing the potential implications for future market performance and investor sentiment. The table below illustrates the most impacted sectors within the index during this turbulent trading session:

| Sector | Decline (%) |

|---|---|

| Energy | -5.2% |

| Financials | -4.7% |

| Consumer Services | -3.8% |

| Industrials | -4.5% |

This data underscores the pervasive impact across different industries, highlighting the fragility of the market in responding to external shocks. As the situation unfolds, stakeholders are eager to determine whether this will be a short-term fluctuation or indicative of deeper economic challenges ahead.

Investment Strategies in Response to Market Volatility

In times of significant market disruption, such as the recent drastic fall of the UK’s FTSE 100, investors are compelled to reassess their strategies. Maintaining a diversified portfolio becomes crucial, as it helps mitigate risks associated with individual stocks or sectors adversely affected by volatility. Investors should consider the following actions:

- Rebalancing portfolios: Adjust the mix of assets to align with risk tolerance and investment goals.

- incorporating defensive stocks: Focus on sectors like utilities or consumer staples that tend to endure economic downturns better than others.

- Utilizing options and hedging strategies: Leverage these instruments to protect against downturns while maintaining upside potential.

Moreover, practical analysis and proactive measures play a vital role in navigating turbulent financial waters. This includes closely monitoring market trends and economic indicators that may signal impending changes. Setting clear investment goals and timelines is essential:

| Objective | Strategy | Time Frame |

|---|---|---|

| Short-term gains | Active trading and market timing | 1-3 months |

| Long-term growth | Buy-and-hold diversified investments | 5 years+ |

| Risk management | Implement stop-loss orders | Ongoing |

Long-Term Implications of Trade Policies on British Industries

The recent fluctuations in the UK’s FTSE 100 index, exacerbated by news of escalating trade tensions and tariffs, highlight the precarious situation facing British industries. Businesses reliant on exports and imports are finding themselves at a crossroads, where their operating models must adapt swiftly to the changing landscape of international trade. The long-term implications of such trade policies could include:

- Supply Chain Disruption: Increased tariffs may lead to higher costs for raw materials, forcing companies to rethink their supply chains.

- Market Accessibility: British goods may become less competitive on the global stage,limiting market opportunities and reducing overall economic output.

- Investment Slowdown: Uncertainty around future trade agreements can deter both domestic and foreign investment in British industries.

As industries grapple with these challenges, it is crucial to consider the sectors most affected by evolving trade policies. The table below illustrates the possible economic impact on key sectors:

| Industry Sector | Potential Impact |

|---|---|

| Manufacturing | Higher costs of components, reduced competitiveness |

| Automotive | Threat to export markets, risk of job losses |

| Agriculture | Tariffs on exports, reliance on European markets |

| Technology | Challenges in securing international partnerships |

To Conclude

the latest developments surrounding Trump’s tariffs have undeniably sent shockwaves through global markets, with the UK’s FTSE 100 experiencing its most significant daily decline as the onset of the pandemic. This downward trend underscores the fragility of economic recovery in the face of renewed trade tensions and uncertainty.As investors reassess their strategies and await further updates, the implications of these tariffs will likely continue to reverberate across various sectors. Analysts will be closely monitoring the situation, as the effects of trade policy on market stability cannot be underestimated. As we move forward, it remains crucial to stay informed about these evolving dynamics that could shape the economic landscape in the coming months.