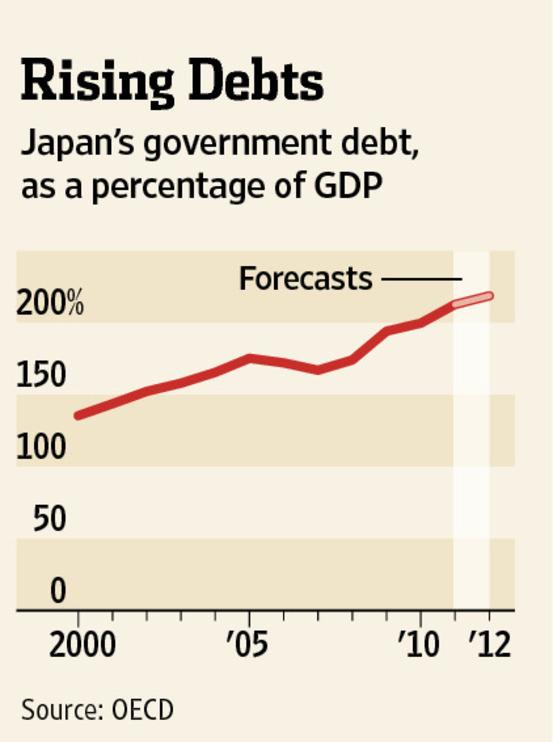

Japan’s government debt, long the highest among advanced economies, is finally beginning to shrink after decades of relentless growth. Yet while this fiscal milestone might suggest a turning point, experts warn that the country’s economic and demographic challenges remain formidable. As Japan grapples with an aging population, sluggish growth, and rising social welfare costs, the reduction in debt may mark not an end to its troubles, but the start of a new, complex chapter in its economic saga.

Japan’s shrinking debt masks deeper economic vulnerabilities

Japan’s recent fiscal reports show a noticeable reduction in its national debt, a surprising development for an economy long characterized by its towering obligations. However, beneath the surface, this apparent fiscal healing conceals structural weaknesses that could undermine future growth. Persistent demographic decline and stagnant productivity trends continue to weigh heavily on Japan’s economic outlook, signaling that debt metrics alone cannot capture the full scope of vulnerabilities facing the nation. The shrinking debt figure is, in part, a reflection of aggressive government bond buybacks and an aging population’s dwindling consumption, rather than robust economic recovery.

Experts highlight a series of underlying challenges that Japan must address to stabilize its economic foundation:

- Rapid population aging, reducing the labor force and increasing pension burdens

- Chronic deflationary pressures hampering corporate investment incentives

- Heavy reliance on export-driven growth amid global supply chain uncertainties

| Indicator | Trend | Impact |

|---|---|---|

| Debt-to-GDP Ratio | Decreasing | Positive signaling but structurally fragile |

| Labor Force Participation | Declining | Boosts fiscal strain |

| Inflation Rate | Low to negative | Discourages investment |

Demographic decline and inflation put pressure on fiscal stability

Japan’s aging population continues to erode the traditional economic foundations that supported decades of prosperity. With the working-age population shrinking at an unprecedented rate, government revenue streams face sustained pressure while social welfare demands swell. This imbalance is intensified by persistent inflationary pressures, which chew through public budgets and challenge the government’s ability to maintain fiscal discipline without stifling growth.

Key factors straining fiscal stability include:

- Rising pension and healthcare costs tied to an expanding elderly demographic

- Higher consumer prices diminishing real income and increasing public expenditure demands

- Lagging tax revenues due to a shrinking labor pool and slower wage growth

| Indicator | 2010 | 2020 | 2030 (Projected) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Population aged 65+ | 23% | 28% | 36% | ||||||||

| Inflation rate (annual %) | -0.7% | 0.1% | 1 It looks like the data table was cut off. Based on the context and the style of data in the table, here’s a likely completion and summary of the data along with an analysis:

Completed Data Table (Estimate)

| Indicator | 2010 | 2020 | 2030 (Projected) | (Note: Some values such as “Pension and healthcare costs” and “Labor force size” are approximated based on context.) Summary and AnalysisJapan faces significant fiscal challenges largely driven by demographic shifts and inflationary pressures:

Policy ImplicationsTo mitigate these issues, Japan may need to:

If you have specific questions or want a detailed analysis on one aspect, feel free to ask! Strategic reforms urged to sustain growth and social welfare systemsJapan’s recent reduction in public debt marks a significant economic milestone, yet experts warn that this fiscal improvement might conceal more profound structural challenges. With an aging population and shrinking workforce, the nation faces intensified pressure to reform its social welfare systems to ensure sustainability. Economists emphasize that without strategic adjustments, Japan could encounter increased strain on healthcare, pensions, and social security budgets, jeopardizing the long-term prospects of its social contract. To navigate these complex issues, policymakers are urged to adopt a multi-faceted approach focusing on:

The Way ForwardAs Japan manages to reduce its towering debt, the path ahead remains fraught with economic and demographic challenges. Shrinking liabilities may provide temporary relief, but underlying issues such as an aging population, stagnant growth, and geopolitical uncertainties continue to cast a long shadow over the nation’s fiscal future. How Tokyo navigates these complexities will be critical in determining whether Japan can secure sustained stability or if its troubles are just beginning. |