In a significant development amid ongoing global tax reforms, the Group of Seven (G7) nations have endorsed a new side-by-side tax proposal that notably exempts American and United Kingdom firms from certain international tax rules. The move, reported by Mint, signals a strategic shift in the global tax landscape, as these major economies seek to balance the objectives of fair taxation with protecting the interests of their domestic corporations. This proposal arrives at a critical juncture in the fight against tax avoidance and the effort to establish a cohesive global tax framework.

G7 Introduces Side by Side Tax Proposal Shielding American and UK Firms from Global Rules

The latest initiative by the G7 marks a significant shift in international tax policy, aiming to protect American and UK firms from some of the most stringent global tax regulations. This “side-by-side” proposal introduces an exemption framework, allowing these companies to maintain favorable tax treatment despite broader moves to enforce global minimum tax rates. Key policymakers from the seven major economies assert this approach will foster competitiveness while navigating complex multilateral agreements currently shaping the international tax landscape.

Critics argue the move could deepen economic divides by creating a two-tier tax environment, raising concerns over fairness and compliance challenges. Supporters, however, emphasize the potential benefits, including:

- Preserving investment incentives within domestic markets.

- Encouraging innovation by reducing uncertainty in tax liabilities.

- Strengthening economic ties between the US and UK through aligned fiscal policies.

| Country | Status | Exemption Impact |

|---|---|---|

| United States | Approved | High |

| United Kingdom | Approved | Moderate |

| Other G7 Nations | Pending | Variable |

Analysis of Impacts on International Tax Compliance and Market Competition

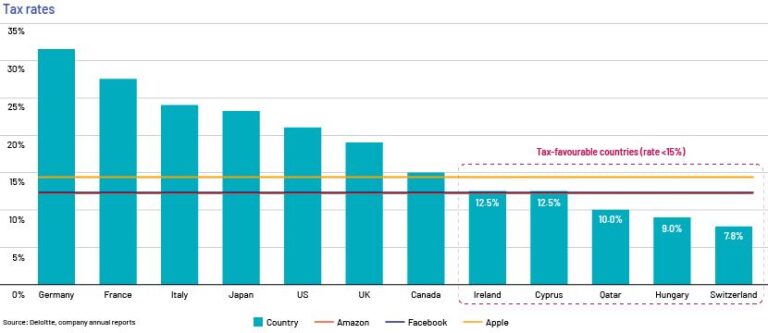

The G7’s decision to advance a side-by-side tax proposal, which notably exempts major American and UK firms from newly established global tax regulations, threatens to reshape the international tax compliance landscape dramatically. This carve-out risks creating divergent standards that complicate multinational enterprises’ compliance efforts, particularly for companies operating across borders without similar exemptions. Critics argue this selective exemption may prompt other nations to pursue their own preferential treatments, potentially undermining the cohesion achieved through previous global tax initiatives.

From a market competition standpoint, the implications are significant. By insulating key players from universal tax rules, the proposal could inadvertently entrench the dominance of U.S. and UK firms, giving them an unfair advantage over competitors from other jurisdictions. This shift is likely to impact investment flows, market entry strategies, and could spark retaliatory measures. Key concerns include:

- Distorted competitive playing field: Exemptions may skew fairness in global markets.

- Fragmented tax regimes: Increased complexity for businesses operating internationally.

- Potential for tax base erosion: Other countries might lose revenue amid uneven rule application.

| Aspect | Impact | Stakeholders Affected | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tax Compliance Complexity | Increases due to mixed rule application | Multinational Corporations, Tax Authorities | ||||||||||||||||||||

| Market Competition | Advantage for exempted firms |

The G7’s decision to advance a side-by-side tax proposal, which notably exempts major American and UK firms from newly established global tax regulations, threatens to reshape the international tax compliance landscape dramatically. This carve-out risks creating divergent standards that complicate multinational enterprises’ compliance efforts, particularly for companies operating across borders without similar exemptions. Critics argue this selective exemption may prompt other nations to pursue their own preferential treatments, potentially undermining the cohesion achieved through previous global tax initiatives. From a market competition standpoint, the implications are significant. By insulating key players from universal tax rules, the proposal could inadvertently entrench the dominance of U.S. and UK firms, giving them an unfair advantage over competitors from other jurisdictions. This shift is likely to impact investment flows, market entry strategies, and could spark retaliatory measures. Key concerns include:

The ConclusionThe G7’s endorsement of the new side-by-side tax proposal marks a significant development in the ongoing global effort to reform international tax regulations. By exempting American and UK firms from certain global tax rules, the agreement reflects the complex balancing act between national interests and broader multilateral tax reform goals. As this proposal moves forward, businesses and policymakers alike will be closely watching how it reshapes the international tax landscape and influences future negotiations among the world’s leading economies. |