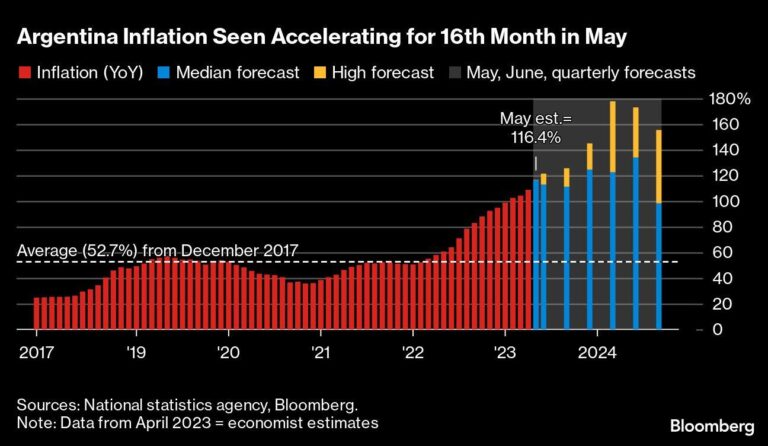

Argentina’s inflation is expected to accelerate in June following a brief slowdown in May, according to Reuters sources. This development underscores ongoing economic challenges as the country continues to grapple with persistent price pressures amid efforts to stabilize its economy. Analysts warn that rising inflation could further strain household budgets and complicate the government’s fiscal management in the coming months.

Argentina Inflation Expected to Surge in June Following Temporary May Deceleration

After a brief easing witnessed in May, inflation in Argentina is anticipated to regain momentum in June, driven by a combination of persistent economic pressures and government policy adjustments. Analysts point to rising food prices and energy costs as key contributors to the renewed upward trajectory. The central bank faces mounting challenges in curbing inflation without severely impacting economic growth, as consumer demand remains robust despite higher price levels.

Key factors influencing the June inflation outlook include:

- Increased utility rates announced mid-month

- Supply chain bottlenecks affecting agricultural produce

- Currency depreciation fueling import cost inflation

- Fiscal measures offering limited relief on essential goods

| Month | Inflation Rate (%) | Food Price Index Change (%) | Energy Cost Change (%) |

|---|---|---|---|

| April | 4.5 | 5.7 | 3.2 |

| May | 3.1 | 2.9 | 1.8 |

| June (Forecast) | 5.6 | 6.8 | 4.5 |

Rising Consumer Prices Driven by Food and Energy Costs Underscore Persistent Economic Challenges

The recent uptick in consumer prices is largely attributed to sustained increases in food and energy sectors, which continue to exert upward pressure on inflation metrics across Argentina. Essential goods like fresh produce, dairy, and grains have witnessed notable price surges, driven by both domestic supply chain constraints and fluctuating global commodity markets. Meanwhile, energy costs have climbed amid tightening international fuel supplies and currency depreciation, further amplifying the strain on households already feeling the pinch from previous inflationary waves.

Analysts highlight several key factors contributing to the persistent economic challenges:

- Supply bottlenecks: Local production shortfalls and import restrictions have limited availability of staple foods.

- Currency volatility: The peso’s depreciation against major currencies increases import costs for energy and raw materials.

- Market expectations: Businesses adjusting prices preemptively amid uncertain policy environments.

| Category | May Inflation Impact (%) | Projected June Impact (%) |

|---|---|---|

| Food | 3.8 | 4.5 |

| Energy | 2.1 | 2.8 |

| Transport | 1.7 | 2.0 |

Policy Measures Urged to Stabilize Currency and Contain Inflationary Pressures Amid Growing Uncertainty

Facing persistent currency volatility and mounting inflationary pressures, Argentine policymakers are urged to implement decisive measures aimed at restoring economic stability. Analysts emphasize the necessity of a multifaceted approach, including tighter monetary policies and fiscal discipline, to mitigate the rapid depreciation of the peso and curb consumer price hikes. Experts suggest that without prompt interventions, inflation could spiral further, undermining public confidence and deepening economic uncertainty.

Key policy recommendations include:

- Strengthening central bank autonomy to enforce interest rate adjustments

- Implementing targeted subsidies to shield essential goods from price shocks

- Enhancing transparency in fiscal spending to boost investor confidence

- Negotiating external debt restructuring to ease financial burdens

| Policy Tool | Expected Impact | Timeline |

|---|---|---|

| Interest Rate Hike | Contain Inflation | Short-term |

| Subsidy Targeting | Protect Vulnerable Groups | Medium-term |

| Debt Restructuring | Improve Fiscal Space | Long-term |

In Summary

As Argentina braces for a potential acceleration in inflation this June following last month’s temporary slowdown, policymakers and market observers alike will be closely monitoring upcoming economic data. The trajectory of inflation remains a critical factor for the nation’s economic stability and the government’s efforts to restore investor confidence amid ongoing fiscal and monetary challenges. Reuters will continue to provide updates as the situation develops.