In a developing trade saga that continues to shape global markets, the latest US-China negotiations concluded without any announcement of a pause on existing tariffs, signaling ongoing tensions between the two economic powerhouses. Meanwhile, President Donald Trump has unveiled plans to impose new tariffs ranging from 20 to 25 percent on imports from India, further complicating international trade dynamics. This article provides live updates on these unfolding developments, highlighting their potential impact on global commerce and economic relations.

Trump Maintains Tariffs Following US China Trade Discussions

Following recent negotiations with Chinese officials, the U.S. administration has opted to keep existing tariffs in place, signaling no immediate retreat from the trade pressures imposed over the past years. Despite hopes for a tariff pause to ease tensions between the world’s two largest economies, the discussions concluded without any formal announcements or relief measures. White House representatives emphasized the strategic importance of maintaining tariffs as leverage to ensure fairer trade practices and to protect American industries.

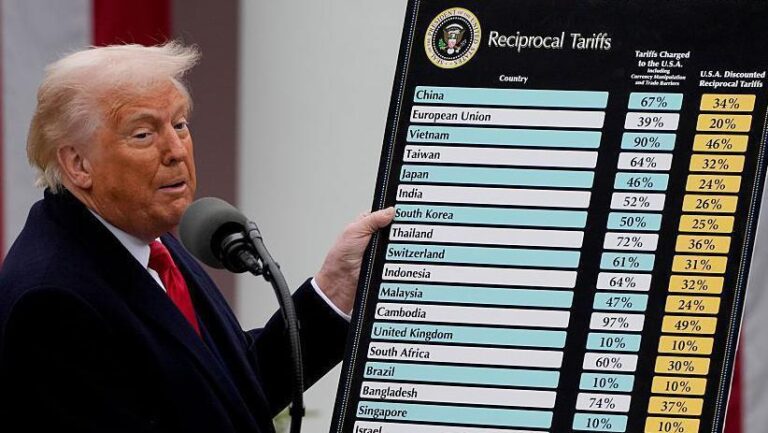

In a parallel move, Trump revealed plans to implement tariffs ranging from 20% to 25% on imports from India, intensifying trade disputes beyond just China. Key points from the latest trade stance include:

- Continuation of tariffs on $350 billion worth of Chinese goods

- Potential expansion of tariffs to new categories targeting India

- Emphasis on leveraging trade policy to encourage better market access and intellectual property protections

| Country | Tariff Rate | Key Products Affected |

|---|---|---|

| China | Up to 25% | Electronics, machinery, textiles |

| India | 20-25% | Pharmaceuticals, chemicals, steel |

Analysis of Potential Impact of New India Tariffs on Global Markets

The announcement of tariffs ranging from 20% to 25% on Indian goods signals a significant escalation in protectionist measures that could ripple across global markets. India, a major exporter of pharmaceuticals, textiles, and information technology services, may face disrupted trade flows, prompting companies to reassess supply chains. The tariffs are widely expected to strain the bilateral trade relationship, with potential retaliatory tariffs impacting U.S. exporters of agricultural products and automotive components to India. Investors may also react with increased volatility, particularly in emerging market currencies and equity indices linked to Indo-U.S. trade exposure.

Several sectors stand out as particularly vulnerable, and the broader impact may extend beyond direct tariffs:

- Technology & IT Services: Potential decline in outsourcing contracts and higher operational costs for U.S. firms relying on Indian tech talent.

- Pharmaceuticals: Increased input costs for generic drug manufacturers that source ingredients from India.

- Consumer Goods: Price pressures on apparel and accessories may alter consumer spending patterns in key markets.

| Sector | Potential Impact | Market Reaction | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Information Technology | Rising costs, contract renegotiations | Volatility in tech stocks | ||||||||||||||

| Pharmaceuticals | Expert Recommendations for Businesses Navigating Heightened Trade Barriers

In response to escalating tariffs and the absence of a trade truce between the US and China, businesses must adapt quickly to unpredictable market conditions. Industry leaders suggest prioritizing supply chain diversification to mitigate risks associated with sudden cost hikes. Key strategies include:

Financial transparency and proactive planning are essential, especially with the proposed 20-25% tariffs on Indian goods. Experts recommend businesses conduct a detailed product-by-product tariff impact analysis. The table below highlights potential immediate effects on key sectors:

Final ThoughtsAs negotiations between the U.S. and China continue with no immediate tariff relief in sight, the economic landscape remains uncertain for businesses and investors alike. With additional tariffs on India reportedly on the horizon, market participants will be closely monitoring forthcoming developments and official statements. Stay tuned for further updates as this complex trade story evolves. |