In a move signaling heightened economic pressure on Beijing, former President Donald Trump is reportedly considering imposing secondary sanctions on China reminiscent of those previously applied to India, targeting its continued purchase of Russian oil. According to sources, these potential measures aim to deter China from circumventing international sanctions on Moscow amid the ongoing conflict in Ukraine. The proposed tariffs and financial restrictions could escalate tensions between the U.S. and China, adding a new dimension to the complex geopolitical landscape surrounding energy trade and global diplomacy.

Trump Considers Expanding Secondary Sanctions to Target China’s Energy Imports

Former President Donald Trump is reportedly contemplating the implementation of expanded secondary sanctions targeting China’s energy imports, particularly those connected to Russia’s oil sector. This move would mirror the strategy previously applied to India, which faced similar tariffs over its ties with Russian energy. The potential sanctions aim to tighten economic pressure on Moscow by curbing the capacity of its allies to circumvent existing restrictions, thereby diminishing revenue streams vital to Russia’s energy exports.

Key elements under consideration include:

- Applying stringent financial penalties on Chinese firms involved in purchasing Russian oil

- Extending the reach of U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) enforcement

- Undermining alternative channels that allow Russia to continue energy trade despite international sanctions

| Aspect | Potential Impact |

|---|---|

| Chinese Energy Import Volume | May decrease significantly |

| Russia’s Oil Revenue | Projected sharp decline |

| Global Energy Prices | Possible volatility |

Implications of India-Like Tariffs on China Amid Ongoing Russia Oil Controversy

The potential imposition of India-like tariffs on China represents a significant escalation in the ongoing tensions surrounding Russia’s oil exports. If enacted, these tariffs could disrupt the intricate trade networks that have allowed China to capitalize on discounted Russian crude amid sanctions. Critics argue that such measures might compel China to reassess its energy procurement strategies while also risking retaliation that could intensify trade conflicts between the world’s two largest economies. Key concerns include:

- Supply chain realignment impacting global oil markets

- Heightened geopolitical strain between the U.S. and China

- Potential knock-on effects for allied nations involved in energy trade

Beyond immediate trade disruptions, the adoption of these tariffs could redefine the global sanction landscape with an increase in secondary sanctions targeting third-party enablers. This strategic move aims to close loopholes that allow sanctioned goods to flow undetected but could also complicate international efforts to stabilize energy prices. The following table highlights the comparative impact of current and proposed tariffs on key import sectors relevant to Sino-U.S. trade relations:

| Sector | Current Tariff | Proposed India-Like Tariff | Projected Impact |

|---|---|---|---|

| Crude Oil | 2.5% | 15% | Severe Price Hike |

| Petrochemicals | 5% | 20% | Restricted Imports |

| Refined Fuels | 3% | 18% | Supply Chain Disruption |

| Machinery | 7% | 15% | Increased Costs |

Strategic Recommendations for Businesses Navigating Potential US Sanction Escalations

As the geopolitical landscape intensifies, businesses must proactively adapt to a dynamic sanctions environment that risks expanding secondary restrictions targeting entities linked to Russian oil trade. Companies with cross-border operations, particularly those engaging with Chinese and Indian markets, should prioritize comprehensive risk assessments and develop robust compliance frameworks that emphasize transparency and traceability of supply chains. Leveraging advanced analytics tools to monitor transaction flows and third-party affiliations can help mitigate exposure to unexpected enforcement actions.

Key strategic measures include:

- Enhancing due diligence processes to identify high-risk partners swiftly

- Implementing real-time sanctions screening systems across all trade and finance touchpoints

- Engaging legal counsel specializing in international sanctions to navigate evolving regulations

- Strengthening internal training programs to ensure employees understand new compliance obligations

| Sanction Risk | Recommended Action | Impact |

|---|---|---|

| Indirect ties with sanctioned oil suppliers | Conduct enhanced supplier audits | Reduced legal exposure |

| Cross-border financial transactions | Deploy transaction monitoring technology | Improved compliance accuracy |

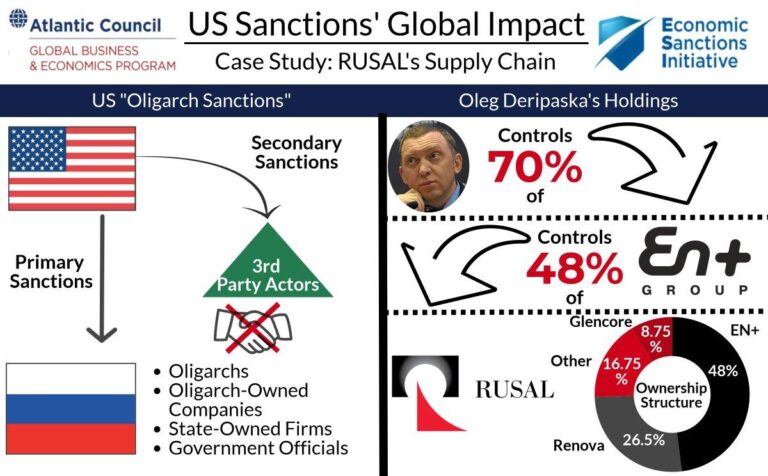

| Complex ownership structures | Map corporate relationships thoroughly | Faster regulatory response |

Key Takeaways

As tensions between Washington and Beijing continue to simmer over Russia’s energy trade, the possibility of expanded secondary sanctions looms large. Should the Trump administration move forward with India-style tariffs targeting Chinese imports linked to Russian oil, it would mark a significant escalation in U.S. efforts to isolate Russia economically. Such measures could further strain U.S.-China relations and reverberate across global markets, underscoring the complex interplay of geopolitics and energy security moving into the coming months. Observers will be closely watching how both governments respond to these evolving dynamics.