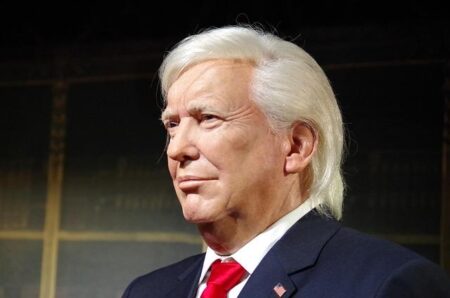

As discussions around economic relief continue amid ongoing financial challenges, questions about the arrival of new stimulus checks have taken center stage. Former President Donald Trump recently put forward the idea of a tariff rebate as a potential measure to bolster household incomes, but experts say this approach is unlikely to materialize. This article examines the current status of stimulus payments and analyzes the feasibility of Trump’s proposed tariff rebate in the broader context of U.S. economic policy.

Stimulus Check Prospects Diminish Amid Political and Economic Challenges

Amid mounting political disagreements and persistent economic uncertainties, the likelihood of a new round of stimulus checks is shrinking rapidly. Lawmakers remain divided over the scope and timing of potential relief measures, with negotiations stalling over spending priorities and fiscal responsibility. Meanwhile, the proposed tariff rebate suggested by former President Trump has failed to gain traction among key decision-makers, further complicating efforts to deliver immediate financial aid to struggling Americans.

Economic experts highlight several obstacles currently standing in the way of stimulus approval, including:

- Inflation concerns: Rising prices have made additional government spending appear risky in the eyes of many policymakers.

- Budget constraints: The national deficit continues to grow, limiting available funds for new stimulus programs.

- Political gridlock: Partisan divides hinder the ability to reach consensus on relief package details.

| Factor | Impact on Stimulus Check Prospects |

|---|---|

| Inflation Rates | Moderate to high inflation discourages new spending |

| Congressional Support | Low bipartisan agreement |

| Economic Recovery Status | Uneven, with some sectors still fragile |

| Political Will | Diminishing as focus shifts to upcoming elections |

Analyzing Trumps Tariff Rebate Proposal and Its Impact on Relief Efforts

Former President Donald Trump’s proposal to offer tariff rebates as a form of economic relief has faced considerable skepticism from both lawmakers and industry experts. Critics argue that the plan, which aims to refund certain tariffs to consumers, presents logistical challenges and may fail to deliver timely assistance to those in need. Unlike direct stimulus checks, the rebate system involves a complex mechanism of tariff calculations and claim verifications that could delay the disbursement of funds, reducing its effectiveness as an immediate relief measure.

The potential impact on ongoing relief efforts remains uncertain, with economic analysts highlighting several concerns:

- Administrative hurdles: Processing tariff rebates would require significant bureaucratic coordination across customs and treasury departments.

- Uneven benefit distribution: Not all industries or consumers pay tariffs equally, leading to disparities in who receives financial support.

- Market distortion risks: Rebate implementation could affect trade relations and import pricing structures unpredictably.

| Relief Measure | Speed of Delivery | Coverage | Potential Drawbacks |

|---|---|---|---|

| Stimulus Checks | Fast | Broad (all eligible individuals) | Inflation Concerns |

| Tariff Rebates | Slow | Selective (tariff-paying consumers) | Complex Implementation |

What Policymakers Should Consider to Address Economic Strains Without Direct Payments

In navigating the current economic pressures without relying on direct stimulus payments, policymakers must pivot toward sustainable strategies that stimulate growth while safeguarding budgets. Emphasis should be placed on targeted fiscal policies such as investments in infrastructure, which not only create jobs but also improve long-term economic productivity. Additionally, enhancing support for small businesses through tax incentives and streamlined regulations can foster resilience in key sectors without the immediate fiscal impact of direct cash disbursements.

- Infrastructure investment: Boosts employment and modernizes critical facilities

- Small business support: Tax breaks and eased regulations encourage expansion

- Workforce development: Training programs aligned with evolving market needs

- Monetary policy coordination: Working alongside the Federal Reserve for balanced economic intervention

Innovative financial tools such as loan guarantees and public-private partnerships can also play a pivotal role. Below is a snapshot of alternative fiscal measures compared by their potential impact and implementation speed:

| Policy Measure | Economic Impact | Implementation Timeline |

|---|---|---|

| Infrastructure Spending | High | Medium-term |

| Tax Incentives for SMBs | Medium | Short-term |

| Workforce Training | Medium-High | Medium-term |

| Loan Guarantees | Medium | Short-term |

Final Thoughts

As discussions around economic relief continue, the likelihood of stimulus checks arriving soon remains uncertain. While former President Trump’s proposal for a tariff rebate has garnered attention, experts suggest it is an unlikely path forward amid political and logistical hurdles. Policymakers and the public alike await definitive action as the nation navigates ongoing economic challenges. For the latest updates on stimulus efforts and related policies, stay tuned to USA Today.