China has received its fourth shipment of liquefied natural gas (LNG) from the Arctic LNG 2 project, despite ongoing international sanctions targeting the ambitious Russian energy venture. According to Reuters, the latest cargo underscores Beijing’s continued engagement with the sanctioned project, highlighting the complex dynamics of global energy trade amid geopolitical tensions. The delivery marks a significant development in the Arctic LNG 2 supply chain, as Western countries maintain restrictions aimed at curbing Russia’s access to critical resources.

China Secures Fourth Cargo Amid Rising Sanctions on Arctic LNG 2 Project

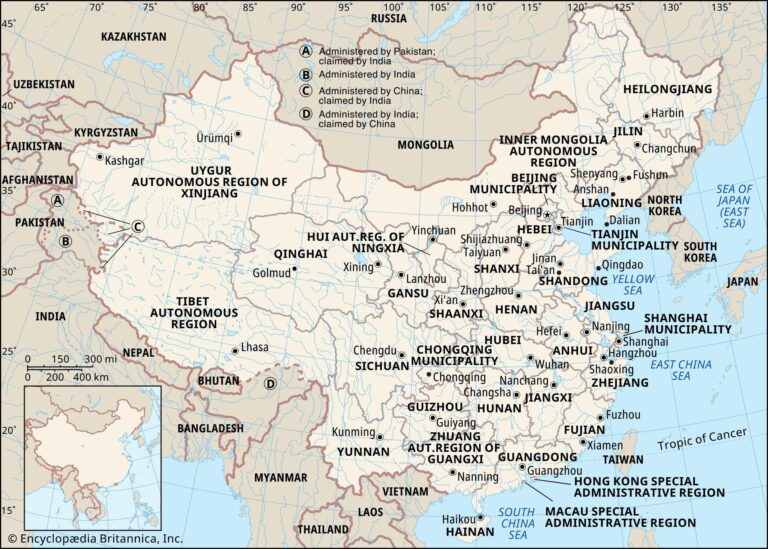

China’s persistence in securing shipments from the Arctic LNG 2 project signals a strategic move despite escalating international sanctions targeting the initiative. The fourth cargo, reportedly loaded from the Sabetta port in northern Russia, underscores Beijing’s commitment to diversifying its energy imports amid geopolitical tensions. This delivery is expected to further solidify China’s role as a major buyer in the Arctic liquefied natural gas market, even as Western nations intensify pressure on Russian energy ventures linked to the region.

Sanctions imposed on the Arctic LNG 2 have focused on restricting financial transactions and technology exports vital for the project’s operations. However, Chinese firms continue to navigate these obstacles through innovative supply chain solutions and agreements with Russian partners. The ongoing deliveries highlight a complex dynamic where economic interests intersect with political considerations.

- Initial sanctions imposed: Late 2023

- Number of cargoes received by China: 4

- Primary port of export: Sabetta, Russia

- China’s LNG import growth YoY: +12%

| Shipment | Departure Date | Destination Port | Volume (million tons) |

|---|---|---|---|

| 1st Cargo | January 2024 | Shanghai | 0.55 |

| 2nd Cargo | March 2024 | Guangzhou | 0.58 |

| 3rd Cargo | April 2024 | Qingdao | 0.60 |

| 4th Cargo | June 2024 | Tianjin | 0.62 |

Implications for Global Energy Markets and Geopolitical Tensions

China’s acquisition of a fourth cargo from the sanctioned Arctic LNG 2 project signals a potential shift in the global energy landscape, emphasizing Beijing’s growing appetite for alternative energy sources amid Western restrictions. This move not only challenges the effectiveness of sanctions aimed at curbing Moscow’s Arctic ambitions but also underlines the deepening energy ties between Russia and China. As European nations scramble to secure diversified energy supplies following geopolitical upheavals, China’s decision could disrupt established supply chains and realign market dynamics, potentially driving up prices and supply uncertainties worldwide.

The deepening cooperation around Arctic energy resources further complicates geopolitical tensions, particularly between Western bloc countries and the Sino-Russian alliance. Some key implications include:

- Energy security recalibrations: Countries may accelerate efforts to explore untapped energy reserves or increase investment in renewable alternatives.

- Sanction Efficacy at Risk: Loopholes in sanction regimes might embolden other actors to bypass restrictions, weakening collective diplomatic leverage.

- Geopolitical Realignments: Energy cooperation in the Arctic could forge stronger strategic partnerships, reshaping influence across Eurasia.

Together, these factors suggest a complex, evolving battleground where energy supply is both an economic asset and a geopolitical tool.

| Impact Area | Potential Effect | Stakeholders |

|---|---|---|

| Global Prices | Increased volatility and upward pressure | Consumers, Importers |

| Supply Chains | Greater unpredictability and diversification | Energy Companies, Governments |

| Diplomatic Relations | Strained West-East ties | Western Allies, China, Russia |

Experts Urge Strategic Diversification as Sanctions Impact Arctic Energy Exports

As the ripple effects of international sanctions persist, energy experts emphasize the critical need for strategic diversification in sourcing and exporting Arctic liquefied natural gas (LNG). China’s recent acquisition of its fourth cargo from the Arctic LNG 2 project, despite sanctions targeting the venture, highlights both resilience and the complexities faced by stakeholders operating in this geopolitically sensitive environment. Analysts warn that relying heavily on sanctioned projects could expose markets to unforeseen risks, urging companies and governments to broaden their energy partnerships and invest in alternative supply hubs to mitigate disruptions.

Industry insiders note several evolving dynamics in response to the sanctions:

- Embargoed Arctic cargoes are increasingly redirected to non-Western markets, complicating global energy flow patterns.

- Investors and insurers are recalibrating risk assessments, impacting financing and contractual arrangements.

- Efforts to develop new LNG infrastructure in other regions are accelerating as players seek stability and compliance.

| Key Factor | Impact | Response |

|---|---|---|

| Sanctioned Cargo Diversion | Supply chain uncertainty | Market realignment |

| Investor Risk Aversion | Funding challenges | New financial instruments |

| Infrastructure Development | Geopolitical shifts | Regional partnerships |

In Conclusion

As China secures its fourth cargo from the sanctioned Arctic LNG 2 project, the move underscores Beijing’s increasing engagement in the Arctic energy sector despite Western sanctions. This development not only highlights the evolving dynamics of global energy supply chains but also raises questions about the effectiveness of sanctions aimed at curbing Russia’s Arctic ambitions. Observers will be closely monitoring how this trend shapes geopolitical and economic relations in the region moving forward.