A man from China has been accused of orchestrating an elaborate scam that defrauded a woman from Aliquippa out of hundreds of thousands of dollars, according to authorities. The case, currently under investigation, highlights growing concerns over cross-border fraud and the vulnerability of victims to sophisticated online schemes. CBS News has obtained details surrounding the alleged crime and its ongoing legal proceedings.

Man from China Charged in Multi-Hundred Thousand Dollar Scam Targeting Aliquippa Woman

Authorities have charged a man from China following an elaborate fraud scheme that defrauded a woman from Aliquippa out of hundreds of thousands of dollars. The accused allegedly utilized sophisticated tactics involving online communication platforms to gain the victim’s trust before orchestrating the financial deception. Investigations revealed that the suspect exploited vulnerabilities in digital transactions, targeting individuals remotely and capitalizing on their trust to carry out the scam.

Key details of the case include:

- The victim was persuaded through a series of deceptive communications spanning several months.

- Funds transferred totaled in the multi-hundred-thousands, primarily through wire transfers and cryptocurrency.

- The investigation involved collaboration between local law enforcement and international cybercrime units.

| Item | Details |

|---|---|

| Location | Aliquippa, Pennsylvania |

| Suspect’s Nationality | Chinese |

| Amount Lost | $350,000+ |

| Methods Used | Wire transfers, Cryptocurrency |

| Law Enforcement Involved | Local Police, Cybercrime Task Force |

Investigation Reveals Tactics Used in Elaborate Fraud Scheme

Authorities uncovered a sophisticated scheme involving multiple layers of deception, carefully designed to exploit the trust of the victim. The accused allegedly used a combination of fabricated business ventures, fake investment portfolios, and forged financial documents to convince the Aliquippa woman to transfer large sums of money over several months. Investigators noted the use of advanced social engineering techniques that targeted the victim’s emotions and financial aspirations, creating a false sense of legitimacy and security.

Key tactics used in the fraud scheme included:

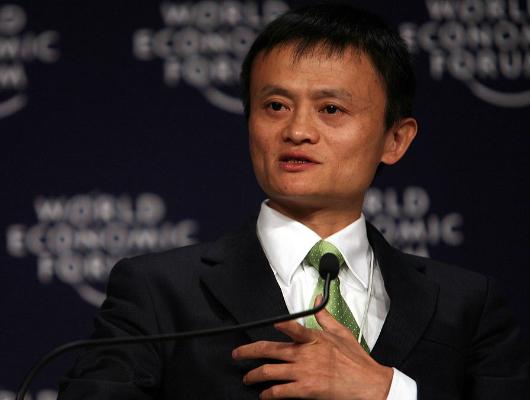

- Posing as a successful entrepreneur with international connections

- Providing counterfeit bank statements and investment receipts

- Employing persuasive communication through emails and video calls

- Pressuring the victim to avoid discussing transactions with family or advisors

| Fraud Element | Description | Duration |

|---|---|---|

| False Identity | Impersonation of a Chinese businessman | 6 months |

| Fake Investments | Fabricated stock purchases and returns | 4 months |

| Communication Methods | Email, video conferencing, social media | Continuous |

Experts Advise How to Protect Against Similar Scams and Report Suspicious Activity

Experts stress the importance of vigilance and proactive measures to safeguard against similar fraudulent schemes. Individuals are encouraged to verify the identity of unknown contacts through independent channels before engaging in any financial transactions. Additionally, maintaining strong, unique passwords and enabling two-factor authentication on all financial and communication platforms can significantly reduce vulnerability. Be wary of unsolicited requests for money or sensitive information, especially when they come from unexpected sources or appear overly urgent.

If you suspect you’re being targeted or have already fallen victim to a scam, report the incident promptly to both local authorities and federal agencies such as the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3). Keeping detailed records of communications and transactions can greatly assist in investigations. The table below summarizes key steps recommended by experts to help protect and report suspicious activity:

| Prevention | Reporting |

|---|---|

| Verify unknown contacts through official channels | Contact local law enforcement |

| Use strong passwords and two-factor authentication | File a report with the FTC or IC3 |

| Be skeptical of unsolicited financial requests | Preserve all evidence and communication details |

| Regularly monitor bank and credit accounts | Inform your bank immediately if fraud is suspected |

The Way Forward

The investigation into the alleged scam remains ongoing, with authorities urging anyone with additional information to come forward. As law enforcement continues to pursue those responsible, the case serves as a stark reminder of the risks posed by online fraud and the importance of vigilance in safeguarding personal and financial information. Updates will be provided as new details emerge.