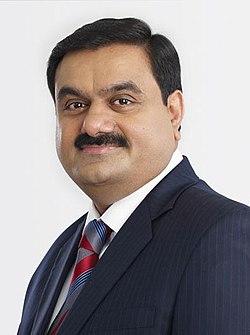

India’s securities regulator continues to scrutinize more than a dozen allegations leveled against the Adani Group, according to sources familiar with the matter, Reuters reports. The ongoing review comes amid growing scrutiny of the conglomerate’s business practices following recent investor concerns and media investigations. The outcome of the regulator’s examination could have significant implications for one of India’s largest and most influential corporate entities.

India Regulator Intensifies Scrutiny Over Multiple Adani Allegations

Indian regulatory authorities have stepped up their examination of various allegations targeting the Adani Group, a major conglomerate in the country. Sources familiar with the ongoing probe reveal that over a dozen claims, ranging from financial irregularities to corporate governance lapses, remain under meticulous review. The increased vigilance underscores the regulator’s commitment to maintaining market integrity and ensuring compliance with legal frameworks amid growing scrutiny of large business houses.

Key areas under investigation include:

- Alleged market manipulation linked to stock price swings

- Related-party transactions requiring detailed disclosures

- Compliance with foreign investment regulations

- Transparency in debt financing approaches

The regulatory body is expected to release a summary of findings once the comprehensive review concludes. Meanwhile, the Adani Group continues to assert its adherence to all applicable laws and regulations.

| Allegation Type | Status | Expected Action Timeline |

|---|---|---|

| Financial Reporting | Under Review | Q3 2024 |

| Corporate Governance | In-depth Analysis | Q4 2024 |

| Market Conduct | Preliminary Assessment | Q2 2024 |

Detailed Insights Into Regulatory Challenges and Market Implications

The ongoing scrutiny by Indian regulators highlights the complex interplay between compliance oversight and market dynamics that major conglomerates like Adani face. With more than a dozen allegations under review, authorities are meticulously examining issues ranging from accounting irregularities to alleged manipulation of stock prices. This extensive probe could potentially reshape regulatory frameworks, as it underlines gaps in transparency and enforcement mechanisms within India’s fast-evolving corporate sector. Market participants are closely watching these developments, as regulatory outcomes may set new precedents for disclosure standards and corporate governance norms.

From a market implication perspective, uncertainty surrounding regulatory actions has caused notable volatility in the shares of entities linked to the group, triggering ripple effects across related sectors. The broader investor community is expressing concern over the heightened risk profile, which could result in adjusted capital flows and valuations. Key factors under consideration include:

- Impact on foreign investments: Heightened scrutiny may affect inbound foreign portfolio inflows eager for stable investment environments.

- Sector-wide reassessment: Other conglomerates may proactively enhance compliance measures to avoid similar pitfalls.

- Policy recalibration: Regulatory bodies might introduce stricter guidelines to foster financial integrity and market confidence.

| Regulatory Focus | Potential Outcome | Market Reaction |

|---|---|---|

| Accounting transparency | Enhanced disclosure norms | Volatility in stock prices |

| Stock price manipulation allegations | Possible sanctions or fines | Investor caution increased |

| Corporate governance review | Board restructuring | Improved long-term confidence |

Recommendations for Enhanced Transparency and Corporate Governance in Adani Group

To foster greater trust among investors and the public, Adani Group should prioritize the implementation of robust disclosure frameworks. Enhanced transparency involves regular and detailed reporting on financial transactions, related-party dealings, and corporate restructuring activities. Independent audits, coupled with real-time disclosure of material events, can help mitigate speculation and provide stakeholders with clear insights into the conglomerate’s operations and governance structure.

Strengthening corporate governance requires the adoption of best practices, including:

- Independent board members with relevant expertise who can exercise unbiased oversight

- A formal risk management committee dedicated to identifying and addressing financial, ethical, and operational risks

- Clear separation of roles between the CEO and board chairmanship to avoid conflicts of interest

- Periodic third-party evaluations of governance policies to ensure alignment with global standards

| Governance Aspect | Recommended Action | Expected Outcome |

|---|---|---|

| Board Composition | Increase independent directors | Improved oversight and objectivity |

| Disclosure Practices | Regular financial and risk reporting | Enhanced investor confidence |

| Risk Management | Establish dedicated risk committee | Proactive mitigation of vulnerabilities |

Future Outlook

As the India regulator continues its review of more than a dozen allegations against the Adani Group, market participants and observers await further developments that could have significant implications for one of the country’s largest conglomerates. The ongoing scrutiny underscores the challenges facing Indian regulators in ensuring corporate accountability amid growing concerns over transparency and governance. Reuters will continue to monitor the situation closely and provide updates as new information emerges.