Australia’s energy landscape continues to evolve, with petroleum playing a pivotal role in meeting the nation’s fuel and industrial needs. The latest release of the “Australian Petroleum Statistics” on Energy.gov.au offers a comprehensive snapshot of production, consumption, imports, and exports within the sector. These statistics provide critical insights into trends shaping Australia’s petroleum supply chain, helping policymakers, industry stakeholders, and the public understand the dynamics influencing energy security and market stability. This article delves into the key highlights and implications of the newest data, reflecting on Australia’s position in the global petroleum arena.

Australian Petroleum Production Trends Reveal Shifts in Supply and Demand

Recent data from Energy.gov.au highlights significant fluctuations in Australia’s petroleum sector, driven by evolving domestic consumption patterns and shifts in global markets. While production volumes have seen a steady incline over the past five years, reflecting advancements in extraction technology and new field developments, the demand landscape tells a different story. Increasing adoption of renewable energy sources and stricter emissions regulations have tempered growth in traditional petroleum consumption, compelling producers to diversify their portfolios.

Key dynamics shaping the market include:

- Growth in liquefied natural gas (LNG) exports supporting export-oriented petroleum outputs

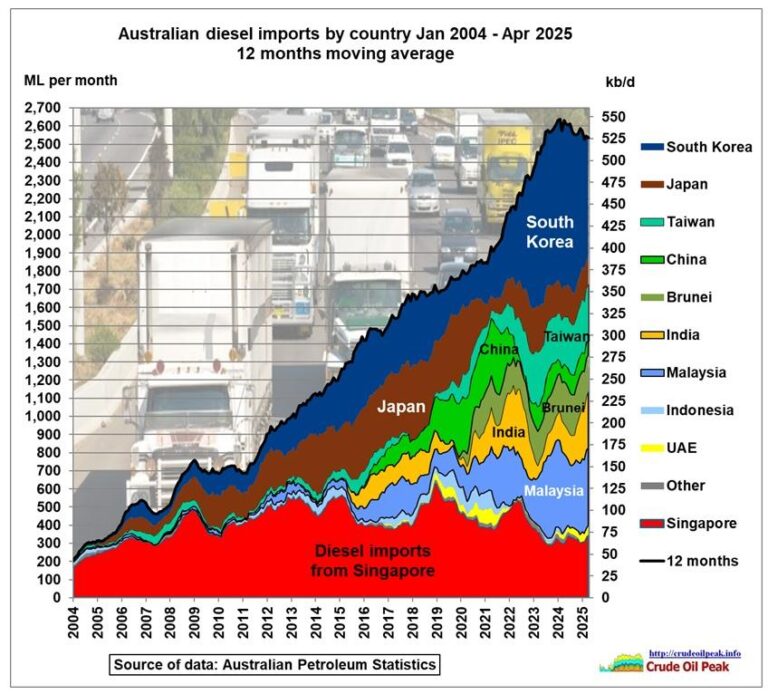

- Declining domestic refining capacities, resulting in higher crude oil exports and reliance on imported refined products

- Shifts in transportation fuel preferences with electric vehicles gaining traction

| Year | Crude Oil Production (million barrels) | Refined Petroleum Output (million barrels) | Domestic Consumption (million barrels) |

|---|---|---|---|

| 2019 | 79.5 | 65.2 | 70.8 |

| 2020 | 81.3 | 62.7 | 68.1 |

| 2021 | 84.7 | 60.4 | 65.6 |

| 2022 | 87.9 | 58.0 | 63.5 |

| 2023 | 90.2 | 55.6 | 61.2 |

Impacts of Regional Consumption Patterns on National Energy Security

Regional consumption trends play a pivotal role in shaping Australia’s approach to maintaining a stable and resilient energy supply. Variations in industrial demand, urbanization rates, and transportation needs across states directly influence the allocation of petroleum resources, causing certain areas to experience heightened pressures on infrastructure and supply chains. For instance, rapidly growing metropolitan regions often exhibit surges in fuel consumption, necessitating strategic reserves and adaptive distribution networks to avoid shortages. Conversely, regions with declining industrial activity may contribute to surpluses, affecting national price dynamics and import strategies.

The disparities in consumption patterns also underscore the need for diversified energy policies tailored to each region’s profile. Key factors impacting national security include:

- Infrastructure vulnerability due to uneven demand leading to bottlenecks.

- Supply chain resilience challenged by geographic and climatic variables.

- Investment prioritization in local refineries, storage, and transport networks.

| Region | Annual Petroleum Consumption (PJ) | Key Demand Sector |

|---|---|---|

| New South Wales | 850 | Transport |

| Queensland | 670 | Mining |

| Victoria | 720 | Residential & Commercial |

| Western Australia | 590 | Industrial |

Policy Recommendations to Enhance Sustainable Petroleum Management in Australia

To foster a more sustainable approach to petroleum management, it is crucial for policymakers to prioritize investments in advanced extraction technologies that minimize environmental impact. Encouraging the adoption of carbon capture and storage (CCS) systems within existing facilities can significantly reduce greenhouse gas emissions. Additionally, developing transparent reporting frameworks will ensure that industry stakeholders are held accountable for sustainable practices, promoting greater public trust and encouraging responsible resource utilization.

Strategic implementation of these policies can be supported by:

- Incentivizing renewable energy integration in petroleum operations to lower carbon footprints.

- Enhancing regulatory oversight with adaptive rules reflecting emerging sustainability challenges.

- Promoting community engagement to balance economic benefits with environmental preservation.

| Policy Area | Key Recommendation | Expected Outcome |

|---|---|---|

| Technology Upgrades | Expand CCS adoption | Lower CO2 emissions |

| Regulatory Measures | Mandatory sustainability reporting | Increased transparency |

| Community Involvement | Stakeholder consultation forums | Balanced development |

In Retrospect

As Australia continues to navigate the complexities of its energy landscape, the latest petroleum statistics released by Energy.gov.au provide a crucial snapshot of the sector’s current dynamics. These figures not only highlight production and consumption trends but also offer insights into shifting market demands and policy impacts. Keeping a close eye on such data will be essential for stakeholders, from industry players to policymakers, as they plan for a future that balances economic growth with sustainability goals. For ongoing updates and detailed reports, Energy.gov.au remains a vital resource in understanding Australia’s evolving petroleum industry.