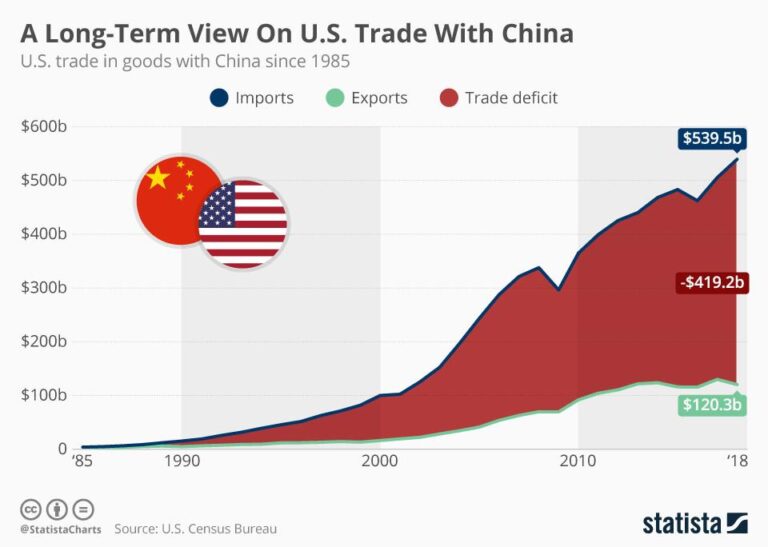

The office of the United States Trade Representative, Katherine Tai, has indicated that the anticipated implementation of tariffs on Chinese goods could occur earlier than previously projected. In recent remarks, U.S. trade envoy Katherine Tai signaled a potential acceleration in the timeline for imposing additional tariffs on China, reflecting growing tensions amid ongoing trade negotiations. This development has prompted increased attention from investors and policymakers as the prospect of heightened trade barriers raises questions about the outlook for U.S.-China economic relations.

US Trade Representative Signals Potential Early Imposition of China Tariffs

The United States Trade Representative, Katherine Greer, indicated this week that tariffs targeting Chinese imports might be implemented earlier than previously projected. This announcement signals a shift in the ongoing trade negotiations, intensifying concerns about escalating tensions between the two largest global economies. Market analysts now anticipate quicker adjustments in import-export dynamics as businesses scramble to adapt to potential disruptions in supply chains.

Key points surrounding the possible tariff acceleration include:

- Increased pressure on China to address trade imbalances.

- Heightened uncertainty for multinational corporations operating across borders.

- Potential market volatility due to sudden policy shifts.

- Impact on consumer prices as tariffs typically translate into higher costs.

| Aspect | Previous Timeline | New Indication |

|---|---|---|

| Tariff Implementation | Mid-2024 | Early-to-Mid 2024 |

| Trade Negotiation Reviews | Quarterly | Monthly |

| Supply Chain Adjustments | 6 months | 3-4 months |

Economic Implications of Accelerated Tariff Implementation on Bilateral Trade

The expediting of tariff implementation between the U.S. and China introduces significant economic ripple effects that extend far beyond immediate trade balances. Businesses on both sides face heightened uncertainty, which could lead to disrupted supply chains and increased costs for manufacturers and consumers alike. Markets may respond with volatility as investors reassess risk profiles across sectors directly tied to transpacific commerce. Key industries such as technology, automotive, and agriculture are especially vulnerable, given their reliance on cross-border inputs and exports.

From a broader perspective, accelerated tariffs risk reshaping trade dynamics through several conduits:

- Supply Chain Reconfigurations: Firms may seek alternative suppliers or relocate production, which can spur short-term inefficiencies and long-term shifts.

- Inflationary Pressures: Increased import costs could filter down to consumer prices, influencing overall economic growth trajectories.

- Bilateral Negotiation Leverage: The move alters the strategic calculus, potentially prompting rapid policy responses and countermeasures.

| Economic Factor | Potential Effect | Sector Impacted |

|---|---|---|

| Supply Chain Disruption | Higher production costs | Manufacturing |

| Import Price Inflation | Increased retail prices | Consumer Goods |

| Regulatory Uncertainty | Investment hesitation | Technology |

| Negotiation Standoff | Prolonged trade tensions | All sectors |

Strategic Recommendations for Investors Navigating Increasing US-China Trade Tensions

In light of the recent statements from the US trade representative, investors should brace for potential accelerated tariff implementations that could disrupt global supply chains and market dynamics. Diversification across sectors less exposed to Sino-American manufacturing dependence becomes crucial. Consider reallocating capital into domestic-focused industries or regions with lesser ties to China to mitigate risks associated with escalating tariffs and retaliatory measures.

Furthermore, maintaining liquidity and prioritizing assets with strong balance sheets can provide flexibility during periods of sudden market volatility. Strategic moves may include:

- Increasing exposure to technology firms with robust local supply chains

- Monitoring geopolitical developments closely to time entry and exit points

- Leveraging alternative markets in Southeast Asia as potential manufacturing hubs

| Investment Focus | Risk Level | Potential Benefit |

|---|---|---|

| Domestic Industrials | Medium | Reduced exposure to tariffs |

| Tech Sector with Local Supply | Low-Medium | Stability amid trade disruptions |

| Southeast Asian Markets | Medium-High | Access to emerging manufacturing hubs |

Final Thoughts

As the possibility of accelerated tariffs on Chinese imports looms, market participants and businesses alike are advised to closely monitor developments on the US-China trade front. With US Trade Representative Greer signaling a potential shift in the timeline, stakeholders should prepare for increased uncertainty and potential market volatility. Further updates from official channels will be crucial in gauging the impact of any forthcoming trade measures.