In the latest episode of The AAF Exchange, American Action Forum experts delve into critical economic issues shaping global and domestic markets. Episode 178 explores the growing economic bifurcation both within and between nations, with a particular focus on Argentina’s unfolding financial challenges. The discussion further highlights the strategic importance of rare earth elements amid shifting global supply chains, and examines the evolving landscape of tariffs and trade policies. This in-depth analysis sheds light on the complex interplay of factors influencing economic stability and growth in an increasingly interconnected world.

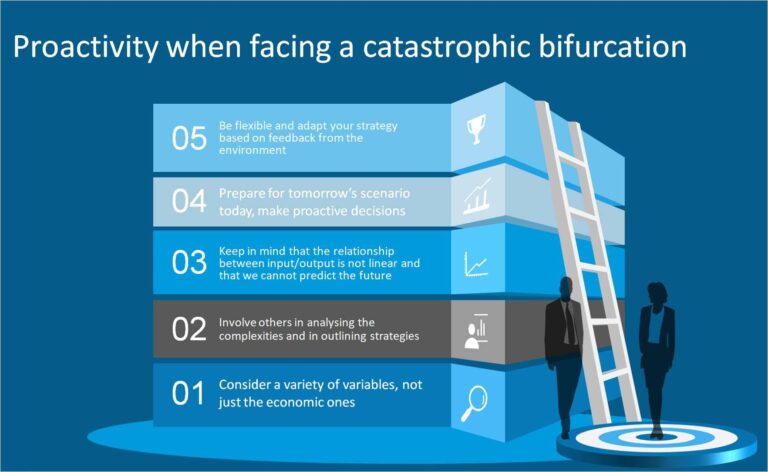

Economic Bifurcation Challenges Global Markets and Policy Responses

The ongoing division of the global economy into two competing blocs poses significant risks for market stability and international trade. As nations realign their economic policies, businesses face heightened uncertainty surrounding supply chain reliability, access to technology, and regulatory compliance. This bifurcation accelerates the fragmentation of global markets, forcing policymakers to balance national security concerns with the imperative to maintain open economic channels. The emergence of parallel financial systems and localized technology standards further complicates efforts to integrate international commerce, while fostering new arenas of geopolitical tension.

Policy responses to this dynamic have varied widely but generally emphasize strategic autonomy and resilience. Governments are increasingly adopting targeted measures such as:

- Implementing export controls on critical technologies and materials

- Promoting domestic production of essential goods

- Negotiating alliances to secure rare earth and mineral supplies

- Adjusting tariff structures to protect key industries

| Region | Primary Strategy | Focus Area |

|---|---|---|

| North America | Supply Chain Resilience | Semiconductors & Rare Earths |

| Europe | Technological Sovereignty | Green Energy & AI |

| Asia | Infrastructure Investment | Manufacturing & 5G Networks |

Argentina’s Economic Turmoil Signals Urgent Need for Structural Reform

Argentina’s economic landscape remains fraught with challenges that underscore a pressing need for comprehensive structural reforms. Persistent inflation rates have spiraled beyond control, eroding purchasing power and destabilizing markets. The ongoing currency devaluation has heightened uncertainty among investors, constraining foreign direct investment and stymying economic growth. Moreover, the government’s reliance on short-term fiscal fixes instead of long-term policy adjustments has perpetuated cycles of debt and austerity, dragging the nation deeper into financial instability.

Key areas demanding urgent attention include:

- Tax system overhaul: Simplifying and streamlining taxation to enhance compliance and revenue generation.

- Labor market flexibility: Reforming rigid labor laws to boost employment and productivity.

- Monetary policy reform: Establishing credible frameworks to curb inflation and stabilize currency.

- Investment climate improvement: Reducing bureaucratic obstacles to attract sustainable foreign investment.

| Economic Indicator | Current Level | Target Goal |

|---|---|---|

| Inflation Rate | 95% | 20% |

| Unemployment Rate | 10.4% | 6% |

| Foreign Direct Investment (FDI) | USD 7.8B | USD 15B+ |

Rare Earth Elements in the Spotlight Amid Rising Tariff Pressures and Supply Chain Risks

As global tensions escalate, rare earth elements (REEs) have emerged as a critical flashpoint in the ongoing battle over trade and supply chain sovereignty. Countries heavily reliant on imports of these key materials face mounting pressure to diversify sources amid unpredictable tariff regimes and export restrictions imposed by dominant producers. The geopolitical landscape is shifting rapidly, driving governments and corporations alike to reassess their strategic reserves and investment in domestic mining capabilities.

Several factors converge to heighten supply chain vulnerabilities:

- Concentration risk: Over 80% of global REE production is centered in a handful of countries, primarily China.

- Tariff volatility: Recent tariff escalations have disrupted pricing and availability, complicating downstream manufacturing sectors.

- Technological dependency: REEs are essential in green technologies, defense systems, and consumer electronics, linking supply chain health directly to broader national security and economic resilience.

| Country | REE Production Share | Tariff Impact |

|---|---|---|

| China | 80% | High |

| USA | 15% | Medium |

| Australia | 5% | Low |

Future Outlook

In summary, Episode 178 of The AAF Exchange provides a comprehensive exploration of pressing economic issues ranging from the growing bifurcation in global markets to Argentina’s evolving economic landscape, the strategic importance of rare earth elements, and the ongoing debate over tariffs. As these topics continue to shape policy and international relations, the discussion highlights the complex interplay between domestic economic priorities and global trade dynamics. For policymakers and stakeholders alike, understanding these developments remains crucial in navigating the uncertain economic terrain ahead.