Brazil’s soybean exports to China, a cornerstone of the global agricultural trade, may experience slower growth than previously anticipated, according to recent analysis by Valor International. Industry experts point to a combination of shifting demand patterns, domestic policy adjustments in China, and logistical challenges that could temper the expanding trade relationship between the world’s largest soybean producer and its biggest buyer. This potential moderation in growth comes amid evolving market dynamics that may reshape future export trajectories and impact global soybean supply chains.

Brazil’s Soybean Export Growth to China Faces Unexpected Slowdown

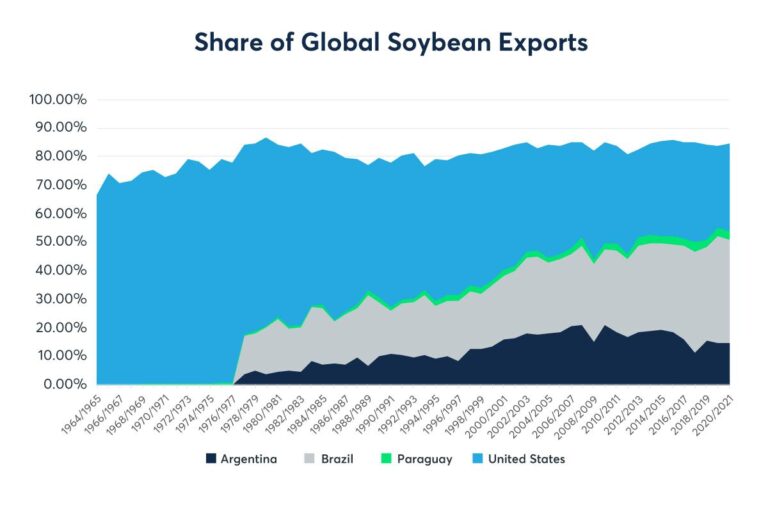

After several years of robust expansion, Brazil’s soybean exports to China are showing signs of deceleration, challenging previous market expectations. Key factors contributing to this unexpected slowdown include logistical bottlenecks at major ports, fluctuating demand in Chinese livestock sectors, and heightened competition from the United States and Argentina. Industry experts emphasize that while Brazil remains a critical supplier, supply chain disruptions and shifting trade policies have introduced uncertainty into the export trajectory for the coming months.

Market challenges currently impacting soybean export growth:

- Increased freight costs due to congested shipping routes

- Chinese government’s efforts to diversify import sources

- Fluctuations in currency exchange rates affecting pricing competitiveness

| Year | Export Volume (Million Tons) | Growth Rate (%) |

|---|---|---|

| 2021 | 82.5 | 12.7 |

| 2022 | 90.2 | 9.3 |

| 2023 (Projected) | 92.0 | 1.9 |

Factors Contributing to Reduced Demand in the Chinese Market

China’s appetite for Brazilian soybeans has encountered several headwinds recently. One significant factor is the country’s cautious approach to stockpiling amid concerns over global economic uncertainties and fluctuating commodity prices. Additionally, the ongoing diplomatic tensions between Brazil and China have cast a shadow on trade relations, prompting Chinese buyers to diversify their sourcing strategies. The increasing domestic production within China also plays a role, as efforts to boost local yields aim to reduce reliance on imports.

Market analysts highlight a combination of logistical challenges and regulatory changes impacting soybean demand. Transportation bottlenecks at key Chinese ports have led to delays and increased costs, discouraging bulk purchases. Furthermore, China’s evolving environmental policies targeting sustainable agriculture create tighter compliance requirements for imported commodities, sometimes restricting volumes. These multifaceted issues collectively contribute to a softer-than-anticipated demand trajectory from one of Brazil’s most critical export markets.

Strategic Recommendations for Brazilian Producers to Navigate Export Challenges

To counteract the anticipated slowdown in soybean exports to China, Brazilian producers must consider diversifying their international market presence. Expanding trade relations with emerging economies in Southeast Asia, the Middle East, and Africa could offset the risks associated with heavy dependence on a single buyer. Additionally, investing in the certification of sustainable practices and improving supply chain transparency will enhance Brazil’s competitive edge, particularly as Chinese buyers increasingly demand traceability and environmental compliance.

Producers should target strategic actions such as:

- Adopting advanced logistics solutions to reduce delivery costs and improve shipment reliability

- Implementing precision agriculture technologies to boost yield quality and environmental sustainability

- Collaborating with government initiatives to secure export credits and insurance mechanisms

- Strengthening partnerships with local and international commodity traders for better market intelligence

| Challenge | Recommended Response | |

|---|---|---|

| Dependency on Chinese demand | Market diversification to new regions | |

| Rising logistic costs | Invest in efficient transport and storage solutions | |

| Pressure on environmental standards | Certify sustainable farming practices | |

| Volatility in global commodity prices | Volatility in global commodity prices | Implement risk management and price hedging strategies |