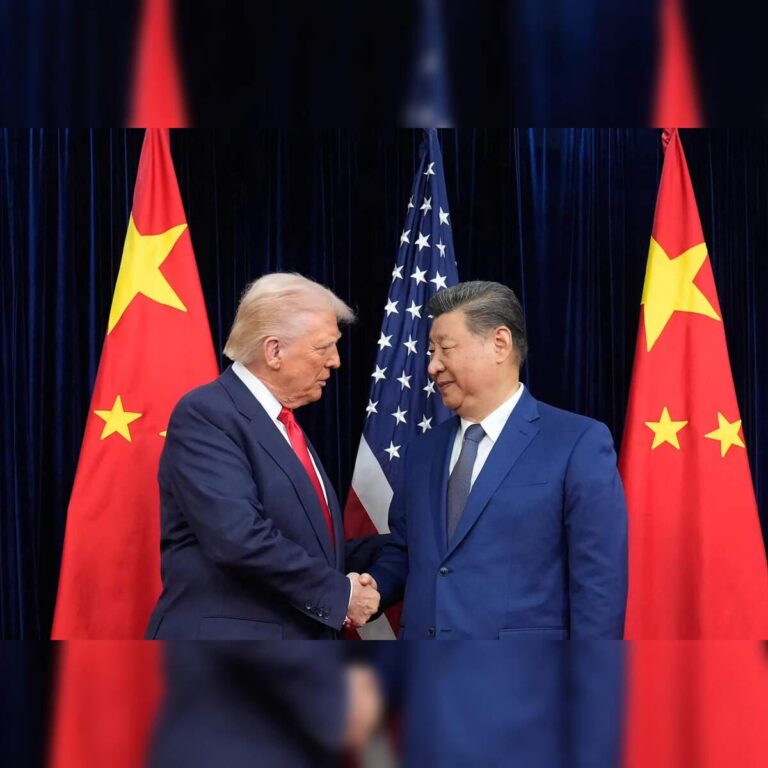

In a significant development for global trade, China and the United States have reached a new trade agreement that reduces tariffs on a range of automotive products. While the deal marks progress in easing tensions between the world’s two largest economies, key details concerning rare-earth elements-a critical component for the automotive and tech industries-remain unspecified. The lack of clarity on rare-earth provisions leaves industry stakeholders cautiously awaiting further negotiations amid growing concerns over supply chain stability.

China Trade Deal Reduces Tariffs Boosting Automotive Sector Confidence

The recent agreement between China and its trade partners marks a significant step forward in easing tensions that have long impacted the global automotive market. With the reduction of tariffs on a broad range of vehicles and automotive parts, manufacturers are anticipating smoother supply chain operations and potentially lower production costs. This move is expected to translate into more competitive pricing for consumers and renewed investor confidence in the sector. Industry analysts highlight that lowered tariffs could invigorate cross-border partnerships and stimulate innovation within electric and hybrid vehicle segments.

However, the deal stops short of clarifying the complexities surrounding rare-earth materials, essential components in the production of batteries and high-tech automotive parts. The uncertainty around these critical resources continues to pose challenges for manufacturers reliant on stable and affordable supply. Key points on the impact of the tariff reductions include:

- Tariff cuts: Reduction of average automotive tariffs by 15-20%.

- Supply chain: Enhanced predictability for manufacturers and suppliers.

- Investment: Increased optimism among investors targeting electric vehicle innovation.

- Rare-earth concerns: Ongoing ambiguity affects long-term resource planning.

| Sector Focus | Tariff Reduction Impact | Remaining Challenges |

|---|---|---|

| Electric Vehicles | Production cost cut by up to 10% | Supply of rare-earth minerals unclear |

| Auto Components | Import tariffs decreased from 25% to 18% | Potential bottlenecks in advanced material access |

| Investors | Boosted confidence and inflows | Cautious on geopolitical risks |

Uncertainty Remains Over Rare Earth Elements Impact on Supply Chains

Despite the recent trade agreement reducing tariffs between China and its trading partners, critical questions about the availability and control of rare earth elements remain unanswered. These elements, essential for the production of electric vehicles and advanced automotive technologies, continue to be a geopolitical flashpoint. Industry experts highlight that while tariff cuts may ease some cost pressures, the absence of clear provisions on rare earth exports means supply chains could still face significant vulnerabilities.

Key concerns include:

- China’s dominant position in rare earth mining and processing

- Potential export restrictions or export quotas

- Impact on the automotive industry’s shift toward electric and hybrid vehicles

| Rare Earth Element | Primary Usage | Supply Risk Level |

|---|---|---|

| Neodymium | Permanent magnets for EV motors | High |

| Lutetium | Advanced battery components | Medium |

| Yttrium | LED lighting and catalysts | Low |

Industry Leaders Urge Clearer Rare Earth Policies to Secure Future Manufacturing

Top executives in the automotive and manufacturing sectors have voiced strong concerns over the recent trade agreement between China and its partners, highlighting a significant gap in the details surrounding rare earth mineral trade. While tariffs have been reduced on a broad spectrum of automotive components and raw materials, the absence of clear regulatory frameworks for rare earth elements poses a potential risk to the stability of supply chains essential for electric vehicles and advanced manufacturing technologies.

Industry leaders emphasize several critical demands:

- Transparent and enforceable policies on rare earth mineral extraction and export quotas.

- Increased investment in alternative supply chains beyond China.

- Long-term collaboration agreements to ensure sustainable sourcing and innovation.

- Government incentives to boost domestic processing capabilities.

| Country | Rare Earth Export Share (%) | Current Tariff Rate |

|---|---|---|

| China | 80 | 5% |

| Australia | 10 | 3% |

| USA | 5 | 7% |

| Others | 5 | Varies |

Closing Remarks

As the China trade deal moves forward with reduced tariffs, the automotive sector welcomes the potential for eased costs and expanded market access. However, the absence of clear provisions regarding rare-earth materials-critical components in electric vehicles and advanced automotive technologies-leaves industry stakeholders cautiously awaiting further clarification. The coming months will be crucial in determining whether future negotiations can address these outstanding issues, shaping the long-term impact of the agreement on global automotive supply chains and innovation.