As data centres continue to multiply across New Zealand and Australia, insurers are being prompted to reassess their risk frameworks in response to the sector’s rapid growth. With the rise of these critical infrastructure hubs underpinning the digital economy, insurance providers face new challenges in underwriting and managing exposures related to cyber threats, natural disasters, and operational disruptions. This evolving landscape is driving a strategic shift within the insurance industry as it strives to balance opportunity with risk in a transforming market.

Insurers Assess Emerging Risks as Data Centre Developments Surge in New Zealand and Australia

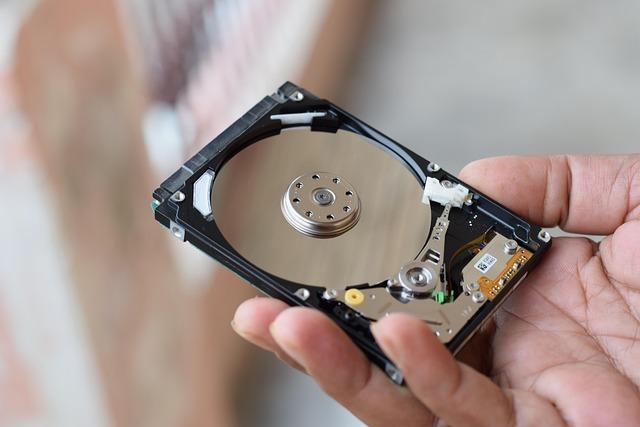

As the data centre industry experiences unprecedented growth across New Zealand and Australia, insurers are recalibrating their approaches to underwriting these technologically vital yet complex assets. The surge in construction and operation of data centres brings a fresh spectrum of risks, ranging from cyber threats and natural disasters to supply chain vulnerabilities. Industry experts highlight that traditional insurance models are being stretched to address these evolving exposures, prompting carriers to develop bespoke policies tailored to the nuanced needs of data centre operators.

Key risk factors under scrutiny include:

- Infrastructure resilience: Evaluating the robustness of physical structures against earthquakes, floods, and fires.

- Cybersecurity measures: Assessing protection against data breaches and ransomware attacks.

- Energy dependencies: Considering the reliability of power sources, including renewable energy integration.

- Operational continuity: Planning for business interruption scenarios linked to system failures.

Insurers are increasingly collaborating with technology firms and engineers to gain deeper insight into these risk matrices. This strategic shift aims to foster sustainable coverage solutions that support the rapid digital expansion while mitigating potential losses in a landscape characterized by high stakes and fast-paced innovation.

Understanding the Impact of Data Centre Expansion on Cybersecurity and Physical Asset Coverage

As the demand for digital infrastructure accelerates across New Zealand and Australia, the expansion of data centres introduces a complex layer of challenges for insurers. The traditional risk assessments are evolving to address not only physical asset vulnerabilities-such as fire hazards, structural failures, and theft-but also an increased exposure to sophisticated cyber threats. Insurers are recalibrating their coverage frameworks to encompass this dual-risk environment, emphasizing the need for enhanced cybersecurity protocols and resilient physical security measures. This paradigm shift reflects a new reality where data centres are both critical information hubs and attractive targets for cybercriminals.

Within this landscape, insurers are prioritizing comprehensive risk mitigation strategies that combine technology and policy innovation. Key considerations now include:

- Real-time monitoring systems to detect and respond to cyber intrusions instantly.

- Robust disaster recovery plans designed to guarantee data integrity and continuity.

- Dedicated physical security controls such as biometric access and perimeter defenses.

- Collaborative risk intelligence sharing between data centre operators and insurers.

With these evolving risk profiles, insurance providers are innovating products that not only protect physical infrastructure but also safeguard against escalating cyber liabilities, reshaping the underwriting landscape across the region.

Strategic Recommendations for Insurers Navigating the Complexities of Tech-Driven Infrastructure Growth

As data centre infrastructures mushroom across New Zealand and Australia, insurers face an evolving landscape of risk that demands a nuanced, proactive approach. Traditional underwriting models must adapt to the unique challenges posed by these tech-heavy facilities, including heightened cyber threats, complex interdependencies, and escalating operational demands. Insurers are urged to integrate advanced analytics and real-time monitoring tools to better anticipate and mitigate potential losses. Collaboration with technology experts and facility operators is becoming essential to gain granular insights into the resilience and vulnerabilities of these digital hubs.

Moreover, embracing flexible policy frameworks that account for rapid technological change is critical. Insurers should consider incorporating coverage extensions that address not only physical risks such as fire and natural disasters but also emerging exposures like data breaches and supply chain interruptions. Building bespoke risk solutions through tailored endorsements and enhanced risk engineering services will enable carriers to remain competitive while safeguarding their portfolios. Strategic partnerships and ongoing education will also empower underwriters to stay ahead in this fast-evolving market where technology and infrastructure intersect.

Final Thoughts

As data centres continue to multiply across New Zealand and Australia, insurers find themselves navigating an evolving landscape of risks and opportunities. The rapid expansion of these critical infrastructure hubs is prompting a reassessment of coverage models, underwriting practices, and risk mitigation strategies. As the sector grows, stakeholders must remain vigilant and adaptive to ensure that insurance solutions keep pace with the changing demands of this digital age.