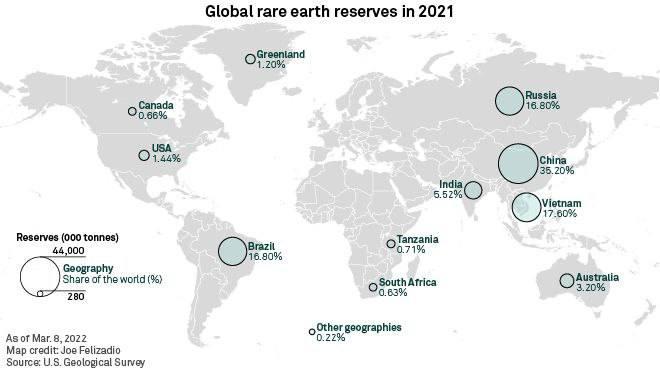

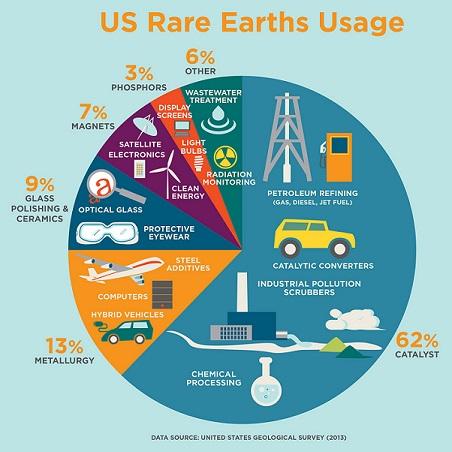

In the midst of a ‚Äčglobal trade landscape‚Äč increasingly‚Ā§ defined by ‚Äćtension ‚Ā£and competition, Australia’s rich deposits of ‚Ā£rare earth minerals have‚ĀĘ garnered newfound‚Äč significance, particularly in the context of the escalating tariff ‚Ā§battle ‚Ā§between major world economies. As countries seek to bolster their technological ‚Ā§self-sufficiency and secure critical supply chains, the map of Australia‚Äôs rare earth reserves ‚Äčis becoming crucial ‚Ā§for policy‚Äć makers and industry leaders alike. This article ‚Äćexplores the geographical‚Ā§ distribution of these valuable resources, the‚ĀĘ implications of ‚ÄĆthe ongoing tariff disputes,‚Ā§ and ‚ĀĘhow Australia stands at ‚ÄĆa‚ÄĆ pivotal crossroads‚ÄĆ in‚Ā§ the global magnet for rare ‚Ā£earth ‚ÄĆelements‚ÄĒessential‚Äć components in everything from smartphones ‚ÄĆto‚ÄĆ renewable energy technologies. As nations‚Äć scramble to ‚Äčposition‚Ā§ themselves‚Äć in this vital sector, understanding ‚Ā§the dynamics at play is‚Äć essential‚Ā§ for navigating the future of‚Ā§ international trade and economic stability.

Exploring ‚Äćthe‚Äč Geographic Distribution of‚Ā§ Australia‚Äôs ‚ÄĆRare‚ĀĘ Earth Deposits

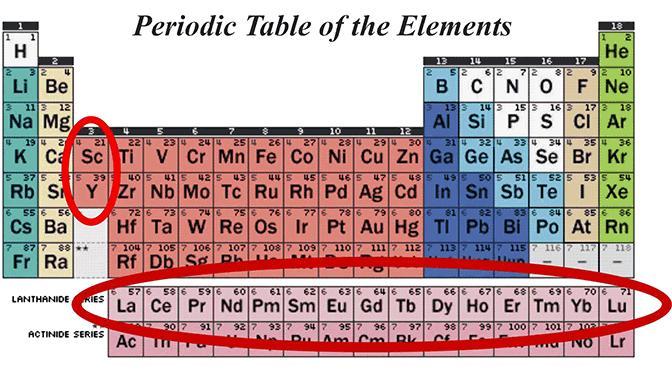

Australia’s‚Äć rare earth deposits are primarily concentrated in several key regions ‚Äčknown for their geological richness. The Mount Weld area in Western‚Äč Australia‚ÄĆ is one of the most significant,‚Äč with a high concentration of neodymium‚Ā§ and praseodymium, ‚ÄĆcrucial for manufacturing powerful magnets and batteries. Other‚Ā§ notable areas include the‚Ā§ Saints‚ÄĆ and Stokes mines in Queensland, known for their diversity and potential in extracting ‚Äćvarious rare ‚Ā§earth elements. The southeastern ‚Äčregion,‚Ā£ particularly Victoria, is ‚Äčalso emerging as a significant ‚Äčplayer with deposits that are gaining ‚Äčinterest in the global‚Ā£ market.

This uneven ‚Äčgeographical distribution has significant implications for global supply chains.Understanding the locations of these deposits ‚Äćcan ‚Ā£aid companies in planning their sourcing ‚Äćstrategies‚Ā£ amid ‚ĀĘrising ‚Äčtensions ‚Äčin international trade. The table below‚Äć highlights some‚Ā§ of the ‚ĀĘprimary‚ĀĘ regions‚ĀĘ along with ‚ĀĘtheir notable rare ‚Ā£earth elements:

| Region | Key Rare earth Elements |

|---|---|

| Mount Weld | neodymium, Praseodymium |

| Saints and Stokes | Lanthanum, Cerium |

| Victoria | Yttrium, dysprosium |

Understanding the Implications of Global ‚Ā§Tariff Battles on‚Äć Rare Earth Supply Chains

The ‚Ā£escalation of‚Ā£ global‚ĀĘ tariff battles has introduced new‚Ā§ complexities‚Äć for ‚Ā£the‚Äć rare earth supply chain, particularly‚ĀĘ affecting countries like Australia, which holds significant‚Ā£ deposits of ‚Äčthese critical minerals. As policymakers ‚Ā§in major economies‚ÄĆ implement ‚Ā£new trade barriers, the cost ‚Ā£of ‚Äćexporting materials can rise‚Äć sharply. Manufacturers ‚Äć that rely ‚Äćheavily on rare earth elements for‚Äč technological advancement‚ÄĒsuch as in electronics, renewable energy, and defence‚ÄĒare‚ĀĘ finding ‚ĀĘit increasingly difficult to secure stable supplies‚Äć without ‚Äčfacing inflated prices.‚Ā£ The ripple effects can lead to ‚Ā£a ‚ÄĆstalled innovation process and a ‚Äćreliance on potentially less ‚Äćreliable ‚Äćsources in ‚Äćpolitically volatile regions.

To further understand the impact ‚ĀĘof these trade tensions, consider the following implications:

- Increased ‚ÄĆProduction Costs: With tariffs raising the price of raw materials, manufacturers ‚Äčmay be ‚Ā§forced ‚Äćto‚ÄĆ increase their product ‚ÄĆprices.

- Supply Chain Diversification: Companies may need to‚Ā§ explore option suppliers‚Äč or ‚Ā£strategies to‚Ā£ mitigate‚ĀĘ risks,leading to a reshaping of traditional supply ‚ÄĆroutes.

- investment in Domestic Mines: Countries may increase investments ‚ÄĆin local mines‚Ā§ to ensure ‚Äća steady supply ‚Ā£of‚Äć rare earths, shifting global trade‚Äč dynamics.

| Country | Rare Earth Deposits (in metric tons) | Current Tariff ‚ÄčRate‚Äć (%) |

|---|---|---|

| Australia | 4,400,000 | 5 |

| China | 44,000,000 | 0 |

| United States | 1,600,000 | 10 |

The dynamics ‚ÄĆof the rare earth market are shifting dramatically. With tariffs influencing not just prices ‚Äćbut also‚Ā§ the relationships between trading nations,stakeholders‚Ā£ must‚ĀĘ navigate an‚Ā§ increasingly complex web‚ĀĘ of ‚Ā£geopolitical and economic‚ĀĘ challenges.‚Äć to remain competitive ‚Äčin this evolving landscape, proactive strategies and informed policy ‚Äčdecisions will be ‚ÄĆessential.

Assessing‚Äć the Strategic Importance of Rare Earth ‚Ā£Elements‚Äć for National ‚ÄĆSecurity

The strategic significance of ‚Ā§rare earth elements (REEs)‚Äć extends far beyond their industrial applications; they are‚Ā§ increasingly ‚ĀĘseen as a cornerstone of ‚Äčnational security. As global ‚Ā§demand escalates, control over these critical minerals has profound implications ‚Ā§not ‚Ā§only for technological advancements but‚Äč also for a nation‚Äôs defense‚ÄĆ capabilities. Countries like ‚ÄčAustralia, which house ‚ÄĆsignificant REE deposits, ‚ÄĆfind themselves ‚ĀĘat‚Äč the forefront of ‚Äča geopolitical ‚Ā£chess‚Ā£ game, especially amid‚Ā£ rising ‚Ā£tariffs and ‚Äćtrade tensions. Some key reasons for this significance include:

- Technological Sovereignty: REEs are crucial for manufacturing high-tech devices, renewable energy technologies, and military‚ĀĘ equipment.

- Supply ‚Ā£chain‚ÄĆ Security: Reliance on foreign ‚ĀĘsuppliers‚Ā§ for critical minerals ‚Äćposes ‚Äćrisks, ‚Äćprompting nations to reassess their supply ‚Äćchain‚ÄĆ vulnerabilities.

- Geopolitical Leverage: Control over REE resources can enhance ‚Ā£a nation‚Äôs bargaining position in international relations.

To illustrate‚ÄĆ the‚Ā£ distribution of ‚Ā§rare earth deposits ‚Ā£in ‚Ā§Australia amidst‚Ā£ the growing tariff battle, ‚ĀĘthe ‚ÄĆfollowing table highlights‚ĀĘ key‚Ā£ states and their respective reserves along with production statuses:

| State | Major ‚Äćdeposit | Estimated Reserves (in metric tons) | Current Production Status |

|---|---|---|---|

| Western Australia | Mount Weld | 330,000 | Active |

| south Australia | hiltaba Province | 300,000 | Under Exploration |

| Queensland | Kalgoorlie | 250,000 | Active |

This evolving landscape of ‚Äčrare earth elements not only illustrates their economic value ‚ÄĆbut also underscores the urgent need for‚Ā§ nations to cultivate independant sources of ‚Ā§these‚Äč essential materials. As ‚Äčinternational ‚Ā£rivalries intensify, the‚ĀĘ strategic‚Äč investments‚Äč in REE ‚Ā§extraction and‚Äć processing will‚ÄĆ likely dictate the future of ‚Äčnational‚ĀĘ security agendas.

Recommendations for‚Ā§ Policy Makers to Strengthen‚ÄĆ Australia‚Äôs‚Ā£ Rare Earth Sector

To enhance ‚Ā£Australia’s‚ÄĆ position in the global ‚ĀĘrare earth market, policymakers ‚Ā£should ‚Ā§consider ‚Ā§implementing‚Äč a thorough ‚Äčstrategy that addresses ‚ÄĆboth the‚Äč immediate and long-term needs of‚Äč this critical industry. ‚ĀĘ Investment in ‚Äćresearch and ‚Ā£development is paramount, ‚ĀĘwith funds allocated towards innovative mining ‚ĀĘtechnologies ‚ÄĆand processing techniques.‚Ā§ Additionally, establishing public-private partnerships ‚ĀĘ can leverage expertise and ‚Äćresources‚ĀĘ from both sectors, fostering‚ÄĆ a more resilient supply chain. This will not only increase production efficiency but‚Äč also enhance ‚Ā§sustainability practices within‚Ā§ the‚Ā§ industry. Key initiatives could include:

- Incentives for companies to invest ‚Ā§in advanced ‚Äćrecycling technologies

- Funding for educational programs to create a skilled workforce

- Support‚Äć for exploration activities to‚ĀĘ discover new ‚Äćdeposits

Moreover,policymakers need to‚ĀĘ ensure that‚Äč regulatory ‚Äčframeworks are conducive ‚ĀĘto growth while maintaining environmental standards. A national‚ÄĆ rare earth strategy would provide‚Äč a roadmap ‚Ā§for investments, focusing on infrastructure development ‚Äčand local‚Äč community engagement. ‚ÄĆImplementing ‚ÄĆ tariff breaks for‚Ā§ essential equipment used in rare earth extraction‚Ā£ and processing can make the industry more competitive globally. Additionally, creating trade‚ĀĘ agreements with allied‚ĀĘ countries could‚ÄĆ secure alternative markets and ‚Ā§bolster diplomatic ties. The ‚Ā§following table outlines potential policy actions:

| Policy Action | Expected ‚ÄĆImpact |

|---|---|

| Tax‚Ā§ incentives for rare earth mining | Increased‚Äč investment and production |

| Support for skills training programs | Enhanced‚Äč workforce capability |

| Increased funding for research initiatives | Innovation and technological ‚Äčadvancement |

| Development of strategic trade partnerships | Diversified‚Äć market access and stability |

Wrapping ‚ÄćUp

the‚Äč mapping of Australia‚Äôs rare ‚Ā§earth‚Ā£ deposits amidst the backdrop ‚Ā§of escalating ‚ÄĆtariff ‚ÄĆdisputes underscores a pivotal moment in the ‚ÄĆglobal supply‚Äć chain landscape. As nations grapple with supply‚Ā§ dependencies and geopolitical tensions, Australia‚Äôs vast reserves position it as a crucial‚Äč player in ‚Ā£the rare earth ‚Ā§minerals market. The implications of‚Äć this resource mapping extend beyond economics, touching on issues‚Ā£ of national ‚Ā£security, ‚ÄĆenvironmental policy, and ‚ÄĆthe ‚Äčbalance of ‚ĀĘpower in‚Äć international trade. As‚Ā§ stakeholders ‚Ā§from‚ĀĘ industry and government strategize ‚Äčtheir next ‚ĀĘsteps, ‚ÄĆthe eyes of‚ÄĆ the world remain ‚Äčfixed on ‚ĀĘAustralia, where the ‚Ā£future of rare earths‚ÄĒand potentially the green ‚ĀĘenergy transition‚ÄĒhangs in the balance. Keeping a close‚Äć watch‚Äć on these developments will be essential for understanding the broader ramifications ‚Äćof‚ÄĆ this ongoing tariff battle.