Argentina has officially approved significant tax incentives for Galan Lithium, marking a pivotal development in the country’s burgeoning lithium industry. The new measures, aimed at boosting investment and production in one of the world’s richest lithium basins, underscore Argentina’s commitment to becoming a key player in the global clean energy supply chain. This move, reported by Finimize, could accelerate the growth of Galan Lithium and reshape the competitive landscape of the lithium market.

Argentina Approves Significant Tax Incentives to Boost Galan Lithium’s Expansion

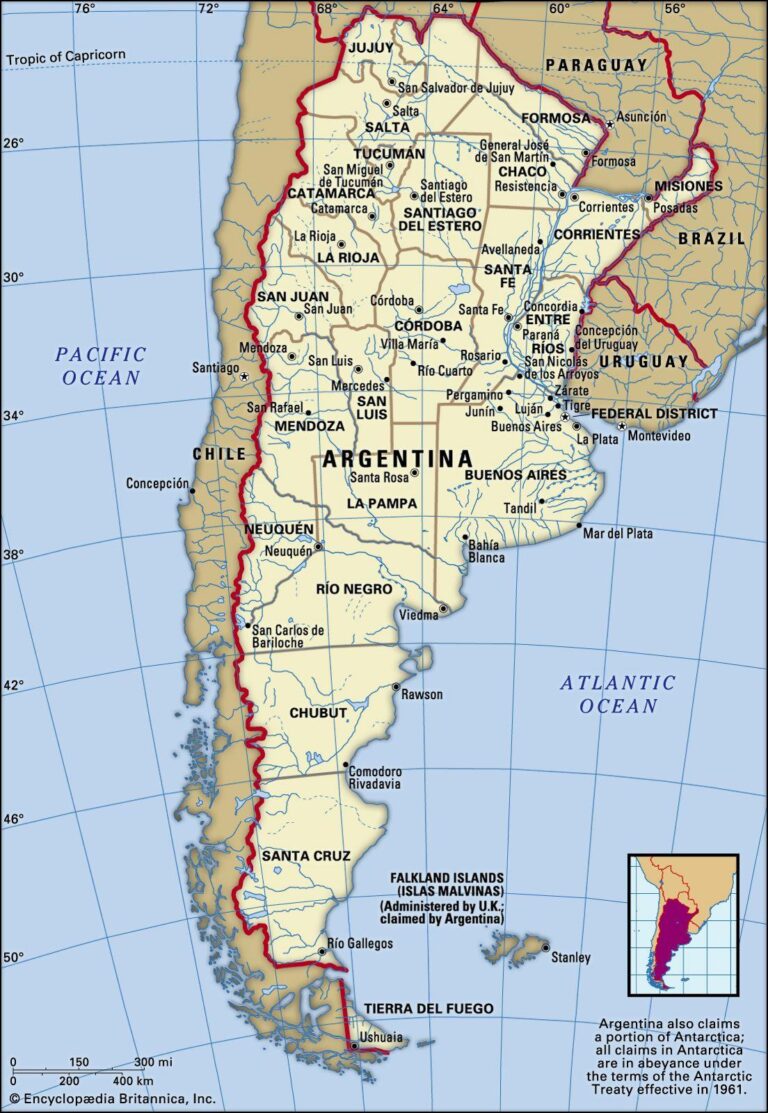

The Argentine government has unveiled a new package of tax incentives designed to accelerate the expansion of Galan Lithium’s operations in the lithium-rich region of Catamarca. These incentives include reduced corporate tax rates and exemptions on import duties for essential mining equipment, aiming to reinforce Argentina’s position as a global leader in lithium production. Industry analysts believe this move could significantly lower operational costs, enabling Galan Lithium to scale up its production capacity and attract further foreign investment.

Key benefits introduced by the government include:

- 10-year corporate tax holiday for new lithium extraction projects

- Zero VAT on imports of machinery and technology crucial for extraction and processing

- Accelerated depreciation on capital investments supporting faster asset turnover

| Incentive | Details | Expected Impact |

|---|---|---|

| Corporate Tax Holiday | 10 years exemption for new projects | Boosts profitability & investment appeal |

| VAT Exemption | Zero VAT on mining equipment imports | Lowers upfront capital expenses |

| Accelerated Depreciation | Faster asset write-offs | Enhances cash flow management |

Analyzing the Economic Impact and Strategic Importance of Galan Lithium’s Growth

The recent approval of substantial tax incentives for Galan Lithium marks a pivotal moment for Argentina’s mining and renewable energy sectors. This move not only accelerates the company’s expansion plans but also positions Argentina as a global contender in the lithium market, a vital resource for electric vehicle batteries and energy storage solutions. Economically, the incentives are projected to spur job creation and stimulate local infrastructure development in the Salta region, transforming it into a lithium production hub. Moreover, the government’s backing underscores a strategic intent to leverage natural mineral reserves to attract sustained foreign investment, diversify the national economy, and reduce dependency on traditional exports.

Strategically, Galan Lithium’s growth enhances Argentina’s footprint in the competitive global battery supply chain. The company’s projects promise to deliver several benefits:

- Increased export revenues through high-purity lithium products.

- Technology transfer opportunities from international expertise.

- Strengthened market positioning amid rising lithium demand fueled by EV adoption.

- Environmental advancements with investments in sustainable extraction methods.

| Economic Indicator | Projected Impact (5 Years) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Direct Employment | +1,200 Jobs | ||||||||||

| GDP Contribution | +0.7% | ||||||||||

| Export Revenue | +$350M USD |

| Economic Indicator | Projected Impact (5 Years) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Direct Employment | +1,200 Jobs | ||||||||||

| GDP Contribution | +0.7% | ||||||||||

Export Revenue

Recommendations for Investors Amid Argentina’s Policies Favoring Lithium DevelopmentInvestors eyeing Argentina’s burgeoning lithium sector should prioritize companies aligned with government-backed incentives, as recent tax breaks significantly enhance project viability. These favorable policies primarily benefit those engaging in large-scale development and export-oriented lithium extraction, positioning certain firms to reap substantial growth opportunities. In this environment, due diligence on compliance with evolving local regulations and investment frameworks becomes paramount, ensuring long-term operational stability amid shifting political landscapes. To capitalize effectively, consider focusing on:

|