U.K. stocks closed higher in today’s trading session, with the Investing.com United Kingdom 100 index rising by 0.35%. The modest gains reflect investor optimism amid ongoing economic developments and corporate earnings reports. Market participants appeared encouraged by positive sentiment, helping to lift key sectors and underpin a broadly steady performance across the index.

UK Stocks Rise to Close Boosted by Financial and Technology Sectors

Financial and technology sectors played a pivotal role in pushing the market upward today, as investor confidence grew amid mixed global economic signals. Leading banks and fintech firms posted solid gains, supported by positive quarterly results and strategic acquisitions. This momentum helped the Investing.com United Kingdom 100 index close the session with a 0.35% increase, reflecting broad optimism across the capital markets.

Key contributors to the rally included:

- Financial Services: Major banks reported enhanced earnings, benefiting from increased lending activity and robust trading volumes.

- Technology: Tech giants saw a surge after announcing innovative product launches and expanded cloud service contracts.

- Consumer Goods: Select stocks demonstrated resilience despite inflation concerns, boosted by strong consumer demand.

| Sector | Top Performer | Daily Gain |

|---|---|---|

| Financial | Barclays | +1.2% |

| Technology | ARM Holdings | +1.7% |

| Consumer Goods | Unilever | +0.8% |

Detailed Market Analysis Reveals Key Drivers Behind United Kingdom 100 Index Gains

The recent uptick in the United Kingdom 100 Index can be attributed to several fundamental and technical factors that have positively influenced investor sentiment. Key among these is the robust performance of the financial and energy sectors, supported by strong quarterly earnings reports from leading banks and oil companies. Additionally, the gradual easing of inflationary pressures and encouraging manufacturing data boosted confidence across market participants.

Primary Drivers Behind the Gains:

- Renewed investor optimism following improved UK GDP forecasts

- Strengthening of the British pound against major currencies

- Positive corporate earnings exceeding analyst expectations

- Government policy announcements aimed at stimulating economic growth

- Global commodity prices stabilizing, benefiting resource-heavy companies

| Sector | Impact on Index | Notable Contributors |

|---|---|---|

| Financials | +0.12% | HSBC, Barclays |

| Energy | +0.10% | BP, Shell |

| Consumer Goods | +0.06% | Unilever, Reckitt Benckiser |

Investment Strategies to Capitalize on Current Momentum in UK Equity Markets

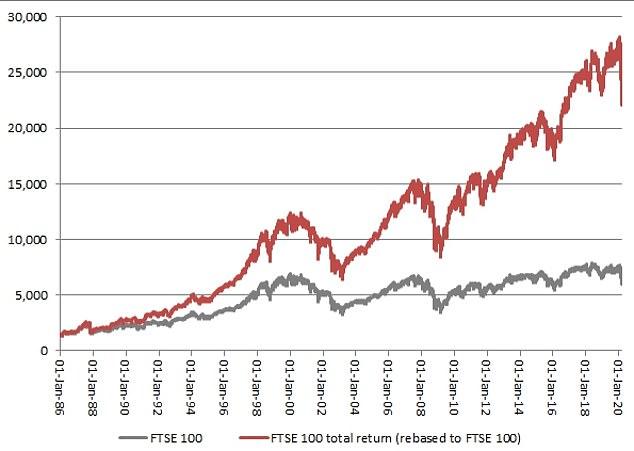

As trading volumes swell and confidence in the market gathers pace, investors are advised to adopt diversified equity portfolios that capitalize on the upward momentum within the UK stock market. Targeting sectors displaying robust earnings growth, such as technology and renewable energy, can deliver attractive returns amid the current rally. Additionally, leveraging exchange-traded funds (ETFs) focused on the FTSE 100 allows investors to gain broad exposure while mitigating sector-specific risks.

Strategic allocation should also consider the macroeconomic backdrop, particularly the Bank of England’s monetary stance and post-Brexit trade developments. Key investment tactics include:

- Incremental buying: Gradually increasing equity positions to manage volatility risks.

- Dividend stocks: Prioritizing companies with stable dividend histories to balance growth and income.

- Market timing awareness: Monitoring momentum indicators for optimal entry and exit points.

| Strategy | Target Sector | Risk Level | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETF Exposure | Financials & Industrials | Moderate | |||||||||

| Dividend Growth | Utilities & Consumer Goods | Low | |||||||||

| Sector Rotation |

As trading volumes swell and confidence in the market gathers pace, investors are advised to adopt diversified equity portfolios that capitalize on the upward momentum within the UK stock market. Targeting sectors displaying robust earnings growth, such as technology and renewable energy, can deliver attractive returns amid the current rally. Additionally, leveraging exchange-traded funds (ETFs) focused on the FTSE 100 allows investors to gain broad exposure while mitigating sector-specific risks. Strategic allocation should also consider the macroeconomic backdrop, particularly the Bank of England’s monetary stance and post-Brexit trade developments. Key investment tactics include:

|