Oil prices slipped amid rising tensions as the United States publicly criticized India’s recent energy purchases, reigniting concerns over a global surplus in crude supplies. The sharp focus on India’s procurement strategies comes at a critical juncture for the oil market, where demand recovery remains fragile and inventory levels are closely watched by investors. This latest development underscores the complex geopolitical and economic factors influencing oil markets, with implications for producers and consumers worldwide.

US Criticism of India Intensifies Amid Rising Oil Surplus Worries

Tensions between the US and India have escalated amid growing concerns about an emerging oil surplus impacting global markets. The US government has publicly criticized India’s current energy policies, accusing the country of exacerbating market imbalances by increasing crude oil imports despite global calls for supply stabilization. This diplomatic friction comes at a delicate time when oil prices have experienced notable declines, fueled by oversupply fears and subdued demand in key regions.

Market analysts highlight several factors fueling the recent volatility:

- India’s record oil imports have hit new highs, intensifying worries about surplus accumulation.

- US policymakers warn that continued unchecked imports could pressure global oil prices further downward.

- Inventory levels at major storage hubs are rising rapidly, signaling potential oversaturation.

| Country | Oil Imports (Million Barrels) | Monthly Change (%) |

|---|---|---|

| India | 25.3 | +4.5% |

| China | 36.7 | +1.8% |

| US | 13.4 | -2.0% |

Analyzing the Impact of Geopolitical Tensions on Global Oil Prices

Recent developments in global diplomacy have reignited volatility in the oil markets, particularly after the US publicly criticized India’s energy procurement strategies. This diplomatic strain, juxtaposed with mounting concerns about oversupply, has fueled uncertainty among traders and investors alike. As a result, benchmark crude prices have experienced notable declines despite earlier optimism fueled by production cuts and geopolitical friction in other regions.

Key factors contributing to the price drop include:

- US-India diplomatic tensions affecting trade flows and contract agreements

- Rising inventories signaling a possible surplus in the market

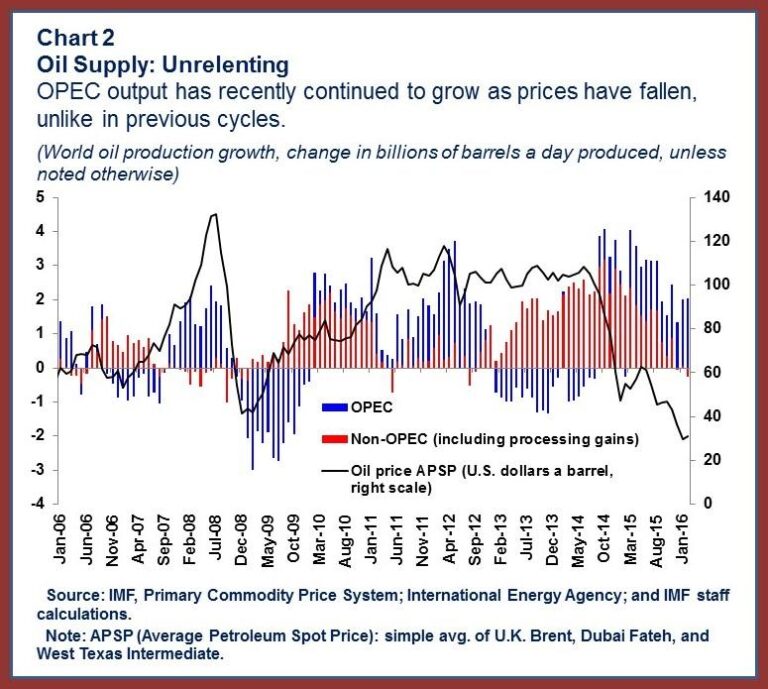

- OPEC+ signals mixed commitments on future output adjustments

- Global economic indicators pointing to potential softened demand

| Factor | Impact on Oil Prices | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| US-India Relations | Negative – Reduced confidence in bilateral trade agreements | ||||||||

| Inventory Levels | Negative – Increased supply pressures | ||||||||

| OPEC+ Production | Mixed – Uncertainty over compliance affects market stability | ||||||||

| Economic Data | Negative – Slower growth forecasts dampen demand outlook |

| Factor | Impact on Oil Prices | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| US-India Relations | Negative – Reduced confidence in bilateral trade agreements | ||||||||

| Inventory Levels | Negative – Increased supply pressures | ||||||||

| OPEC+ Production | Mixed – Uncertainty over compliance affects market stability | ||||||||

Strategic Recommendations for Navigating Volatile Energy MarketsIn the face of persistent fluctuations driven by geopolitical tensions and surplus anxieties, market participants must prioritize diversification and risk mitigation. Energy buyers and investors should evaluate alternative supply channels and embrace flexible procurement contracts to shield themselves from abrupt price swings. Additionally, keeping abreast of policy shifts-such as the recent US criticisms influencing India’s import strategies-can offer critical insights to preempt disruptions and optimize asset allocations. Operational agility remains paramount amid these uncertainties. Companies are advised to leverage advanced analytics for real-time monitoring of inventory levels and demand signals. This approach helps anticipate surplus developments before they materialize in market prices. Incorporating strategic reserves and investing in renewable integration can further buffer against volatility, fostering long-term resilience in an unpredictable energy landscape.

|