India is moving swiftly to overhaul its complex three-tier taxation system on popcorn, a move prompted by the ripple effects of tariffs imposed during the Trump administration. As the US trade policies disrupted global supply chains and prompted reassessments of customs duties worldwide, India’s government has seized the moment to streamline popcorn taxes, aiming to boost domestic producers and stabilize prices for consumers. This reform signals a broader shift in India’s trade and taxation strategy, reflecting the country’s adaptive response to shifting international economic pressures.

India Reevaluates Popcorn Tax Structure Amid Escalating US Tariffs

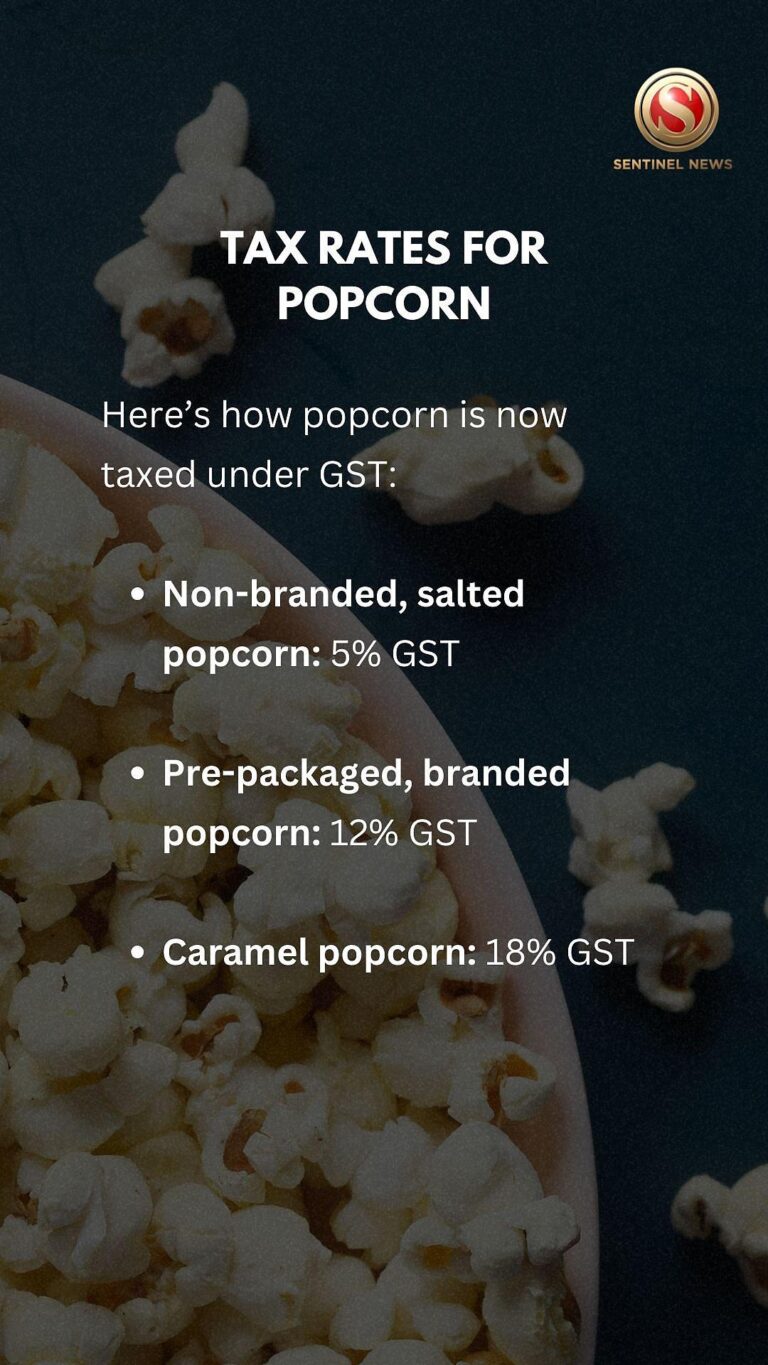

India’s Ministry of Finance is undertaking a critical review of its complex, three-tier tax structure applied to popcorn imports and domestic production, prompted by the recent surge in tariffs imposed by the United States. The escalating duties under the previous administration have disrupted supply chains and inflated costs for the Indian snack industry, prompting policymakers to consider simplification and reduction of internal levies to maintain competitive pricing. Industry representatives advocate for a unified tax slab to prevent cascading taxes that currently undermine profitability.

Key issues under discussion include:

- Differentiation between raw corn and processed popcorn leading to inconsistent tax treatment.

- Impact on small and medium-sized manufacturers facing higher compliance burdens.

- Potential revisions to counteract imported popcorn price hikes affecting consumer affordability.

| Tax Category | Current Rate | Proposed Change |

|---|---|---|

| Raw Corn | 10% | 8% |

| Processed Popcorn (Retail) | 18% | 12% |

| Imported Popcorn | 25% | 18% |

This strategic recalibration aims to bolster domestic snack producers and shield consumers from price volatility while aligning India’s trade policies with the evolving geopolitical tariff landscape. Stakeholders await formal announcements, anticipating that these reforms could set a precedent for tax realignments in other agricultural import sectors.

Financial Impact of Trump’s Tariffs Prompts Urgent Policy Overhaul

In response to the ripple effects caused by the tariffs imposed during the Trump administration, India has embarked on a significant revision of its popcorn taxation framework. The new policy seeks to dismantle the existing three-tier tax structure that disproportionately affected raw materials, intermediate goods, and finished products within the snack industry. By streamlining these levies and introducing a unified tax rate, policymakers aim to mitigate inflationary pressures and safeguard domestic producers, who have faced escalating input costs due to increased import duties.

Key elements of the revamped tax framework include:

- Consolidation of multiple tax slabs into a single, competitive rate

- Incentives for local manufacturers to boost production and exports

- Reduction of administrative overheads in compliance and enforcement

| Tax Tier | Previous Rate (%) | New Unified Rate (%) | Impact |

|---|---|---|---|

| Raw Materials | 18 | 12 | Lowered input cost |

| Intermediate Goods | 28 | 12 | Encourages scaling |

| Finished Products | 5 | 12 | Higher shelf price balanced |

This overhaul reflects a broader strategy to fortify India’s economic resilience amid geopolitical trade disruptions. Analysts suggest that aligning tax rates more closely with global standards will help stabilize supply chains and attract foreign investment in food processing sectors, counterbalancing the negative impacts of prior tariffs. As the government moves forward with these reforms, the popcorn industry is poised to serve as a bellwether for other commodity adjustments and comprehensive trade reforms nationwide.

Experts Advocate for Simplified Tax Regime to Boost Domestic Food Industry

Industry leaders and tax experts are urging policymakers to streamline the existing complex tax structure that currently hampers the domestic food processing sector. The multi-layered popcorn tax system, characterized by multiple levies at different production stages, has been cited as a key barrier to competitiveness and growth. Simplification, they argue, would not only reduce compliance costs but also attract much-needed investments, encouraging innovation and expanding employment opportunities within India’s vibrant food industry.

Recommendations from specialists include:

- Consolidating various indirect taxes into a single, transparent rate

- Implementing uniform tax slabs across all processed food items

- Offering incentives targeted at small and medium enterprises (SMEs) engaged in food processing

| Current Tax Element | Proposed Change | Benefits |

|---|---|---|

| Excise Duty, VAT, and Cesses | Unified Goods and Services Tax (GST) Rate | Lower paperwork, enhanced ease of doing business |

| Varied Tax Rates on Processed Foods | Flat tax rate of 5% | Improved price competitiveness |

| Multiple Compliance Checks | Single-window clearance for SMEs | Faster operations, reduced delays |

The Conclusion

As India moves forward with its three-tier popcorn tax reforms, the ripple effects of U.S. tariffs under the Trump administration continue to influence global trade policies. The Financial Times will continue to monitor how New Delhi balances domestic economic priorities with international pressures, shaping the future landscape of India’s food industry and trade relations.