In the escalating debate over fiscal responsibility in North America, a pressing question has emerged: which nation grapples more severely with government budget woes-Canada or the United States? As both countries confront soaring deficits and mounting public debt, scrutiny intensifies over their spending habits and economic management. This article delves into the latest financial data and expert analyses to determine which of these neighboring giants can be considered the bigger “basket case” in terms of budgetary discipline, shedding light on the implications for taxpayers and the broader economy.

Comparing Fiscal Discipline in Canada and the U.S Insights into Government Spending Patterns

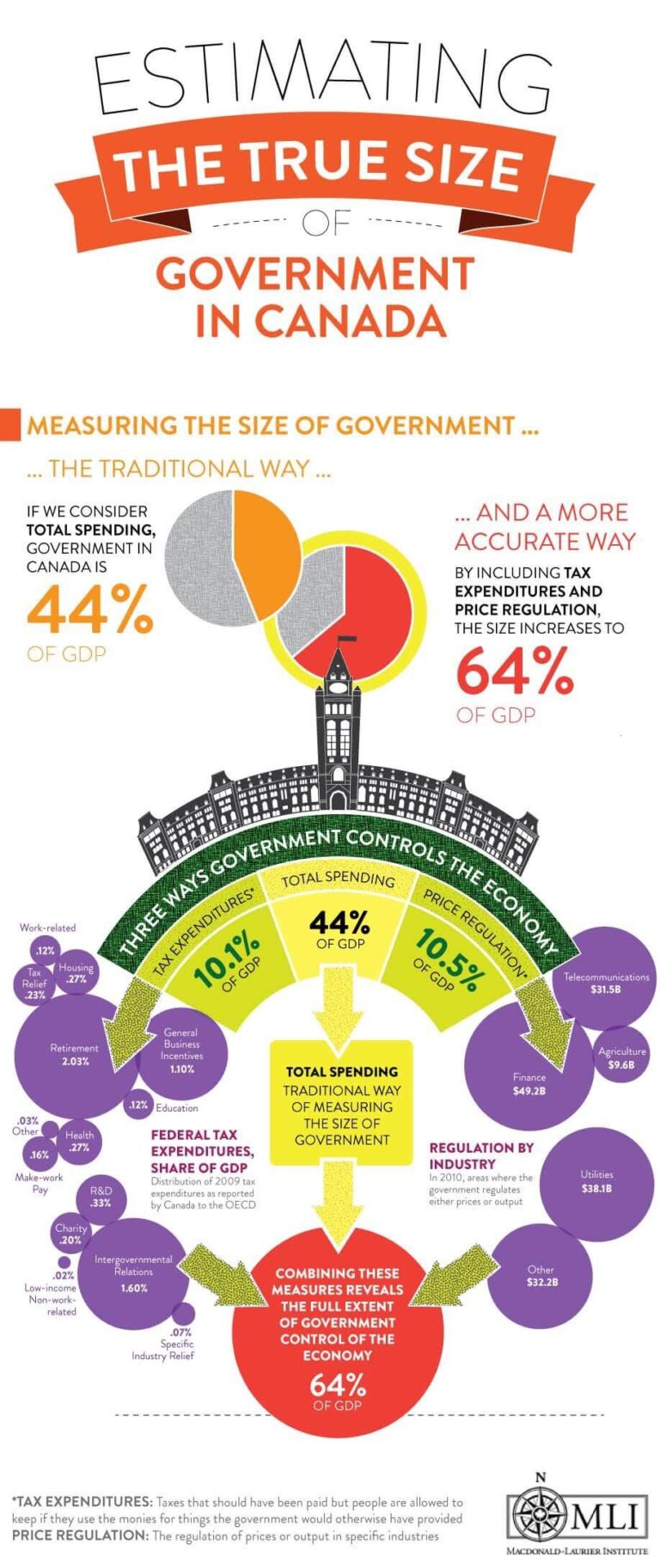

When dissecting fiscal discipline between Canada and the United States, a clear divergence emerges in how each country manages its government spending. Canada’s approach tends to emphasize prudent budgeting and balanced fiscal frameworks, often resulting in comparatively lower deficits and controlled debt growth. Conversely, the U.S. government exhibits a pattern marked by larger deficits fueled by expansive spending programs and less restrictive budget controls. This difference is reflected in the annual budget deficits, where U.S. figures frequently outpace those of Canada both in absolute terms and relative to GDP.

Key factors influencing these disparities include:

- Healthcare Spending: Canada’s single-payer system maintains steadier costs, while the U.S. faces escalating private and public health expenditures.

- Defense Budgets: The U.S. allocates a significantly higher percentage of GDP to defense, directly impacting overall fiscal balance.

- Social Safety Nets: Canada’s programs, although comprehensive, are often more fiscally restrained compared to the U.S. counterparts.

| Aspect | Canada | United States |

|---|---|---|

| Fiscal Deficit (% of GDP, 2023) | 2.1% | 5.6% |

| Government Debt (% of GDP) | 78% | 120% |

| Defense Spending (% of GDP) | 1.3% | 3.8% |

| Healthcare Spending (% of GDP) | 10.6% | 18.2% |

The Economic Impact of Budget Deficits How Overspending Affects Citizens and Markets

Chronic budget deficits strain both economies by forcing governments to borrow extensively, which can lead to higher interest rates and crowding out of private investment. Citizens feel the pinch through a combination of reduced public services and increased tax burdens aimed at closing the fiscal gap. In Canada, for example, persistent overspending has contributed to rising household debt levels, while in the U.S., soaring deficits risk triggering inflationary pressures that erode purchasing power nationwide. The ripple effects extend beyond citizens to financial markets, where investor confidence can waver amid uncertainties about a government’s fiscal discipline and long-term solvency.

The broader economic consequences can be distilled into a few key impacts:

- Interest Rate Volatility: As governments compete for funds, borrowing costs fluctuate, affecting mortgages, loans, and business financing.

- Currency Fluctuations: Deficits can undermine perceptions of economic stability, leading to depreciation that raises import costs and inflation.

- Reduced Policy Flexibility: High deficits limit governments’ ability to respond to economic crises or invest in growth-stimulating infrastructure.

| Country | Estimated 2024 Deficit (% GDP) | Debt-to-GDP Ratio | Forecast Inflation Impact |

|---|---|---|---|

| Canada | 6.8% | 115% | Moderate |

| United States | 8.3% | 130% | High |

Policy Recommendations for Sustainable Budgets Strategies to Curb Deficit Growth and Promote Accountability

Governments must adopt clear-cut fiscal rules to rein in unchecked spending and place the brakes on ballooning deficits. Implementing mandatory spending caps alongside independent oversight bodies can help enforce discipline, ensuring that budgets remain within sustainable thresholds. Transparency in expenditure is crucial; legislatures and watchdog groups need timely access to comprehensive financial reports that detail where every dollar goes. Without this level of accountability, debt accumulation risks spiraling, placing undue burden on future generations.

Practical policy measures include:

- Establishing multi-year budget frameworks to align spending with long-term economic growth

- Linking government disbursements to performance metrics to eliminate waste

- Strengthening tax compliance to close revenue gaps without rash rate hikes

- Prioritizing investments that spur productivity rather than short-term populist payouts

| Policy Measure | Expected Impact |

|---|---|

| Spending Caps | Reduce annual deficit growth by 15-20% |

| Multi-Year Budgets | Improve fiscal predictability and investor confidence |

| Enhanced Oversight | Increase transparency and curb misuse of funds |

| Targeted Tax Enforcement | Boost government revenues by up to 5% |

The Way Forward

As the debate over government spending rages on, the comparison between Canada and the U.S. reveals complex fiscal challenges on both sides of the border. While each nation grapples with ballooning budgets and mounting debt, pinpointing a definitive “worst” budget basket case remains elusive. What is clear, however, is that sustainable financial strategies and transparent policymaking will be crucial for both countries as they strive to balance economic recovery with fiscal responsibility. The ongoing dialogue underscores the importance of vigilance and accountability in managing public funds, regardless of nationality.