In a dynamic flurry of activity shaping the insurance landscape, industry stalwarts RSA, Crawford, Broadstone, and Kennedys have announced a series of strategic moves that signal significant shifts within the sector. From high-profile leadership changes to pivotal mergers and innovative service expansions, these developments underscore the evolving priorities and competitive strategies of major players in the U.S. insurance market. This article delves into the latest actions by these key firms, exploring their implications for clients, brokers, and the wider industry.

Insurance Industry Shifts Spotlight RSA, Crawford, Broadstone and Kennedys Changing Market Dynamics

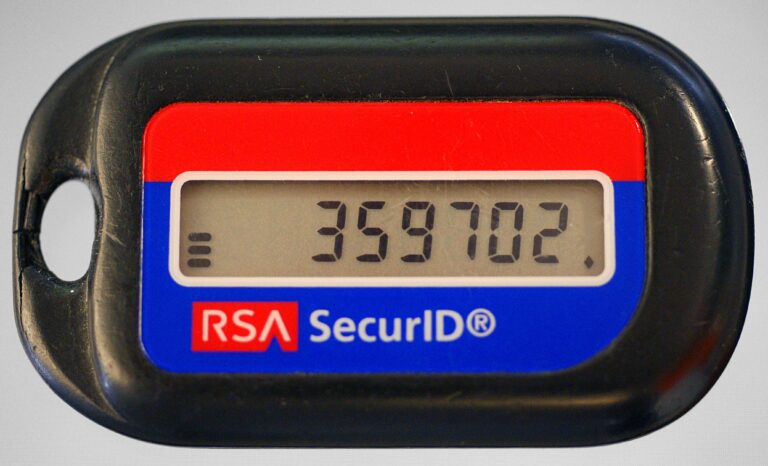

The latest movements within the insurance sector highlight pivotal shifts as key players recalibrate strategies to address evolving market demands. RSA is intensifying its focus on digital transformation, investing heavily in AI-driven underwriting tools to enhance risk assessment accuracy. Meanwhile, Crawford is expanding its global footprint through strategic acquisitions, aiming to bolster its claims management capabilities across both emerging and established markets. These developments underscore a trend towards agility and innovation as companies strive to remain competitive in an increasingly complex environment.

At the same time, Broadstone is capitalizing on advisory services to tailor coverage solutions that meet niche client needs, reflecting a broader industry pivot toward personalization. Legal expertise is also evolving, with Kennedys strengthening its presence in cyber liability and regulatory compliance, responding to heightened scrutiny and rising cyber threats. Below is a quick overview of each company’s key market focus:

| Company | Primary Focus | Strategic Move | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| RSA | AI Underwriting | Tech Investment | ||||||||||||||||||||||||

| Crawford | Claims Management | Acquisitions | ||||||||||||||||||||||||

| Broadstone | Advisory Services | Client Personalization | ||||||||||||||||||||||||

|

– Focus: Digital transformation with an emphasis on AI-driven underwriting tools.

– Focus: Expanding claims management capabilities.

– Focus: Advisory services tailored to niche client needs.

– Focus: Legal expertise in cyber liability and regulatory compliance. Table Summary:| Company | Primary Focus | Strategic Move | If you’d like, I can help further with completing or styling the table or expanding on these company strategies. Let me know! Detailed Analysis Reveals Strategic Implications for Clients and CompetitorsThe recent strategic maneuvers by RSA, Crawford, Broadstone, and Kennedys highlight a transformative shift in the insurance landscape, emphasizing agility and enhanced client solutions. Each company’s initiatives showcase a distinct approach to capitalizing on emerging market trends, regulatory changes, and client demands for more integrated risk management services. Bold investments in technology and partnerships are enabling these firms to streamline claims processing, optimize underwriting accuracy, and foster stronger client relationships in an increasingly competitive environment. Key strategic implications for industry players include:

Expert Recommendations for Navigating Evolving Insurance Partnerships and Service ModelsIndustry experts emphasize that agility and transparent communication stand at the heart of successful insurance partnerships as the landscape shifts dramatically. With companies like RSA and Broadstone redefining service delivery frameworks, insurers are urged to cultivate collaborative environments that prioritize shared innovation and risk management. Key strategies highlighted include:

Meanwhile, service models championed by firms such as Crawford and Kennedys underscore a shift towards holistic risk advisory and bespoke claims management services. These approaches encourage insurers and brokers alike to invest in specialized expertise while fostering deeper client relationships. The table below summarizes essential elements for navigating this evolving ecosystem:

|