Argentina has unveiled its draft budget for 2026, placing a strong emphasis on achieving fiscal balance while increasing allocations for social programs, Reuters reports. The proposed financial plan reflects the government’s efforts to stabilize the economy amid ongoing economic challenges, aiming to curb deficits without compromising support for vulnerable populations. This budget draft marks a critical step as Argentina navigates inflationary pressures and seeks to restore investor confidence ahead of the coming year.

Argentina Prioritizes Fiscal Balance in 2026 Budget Proposal

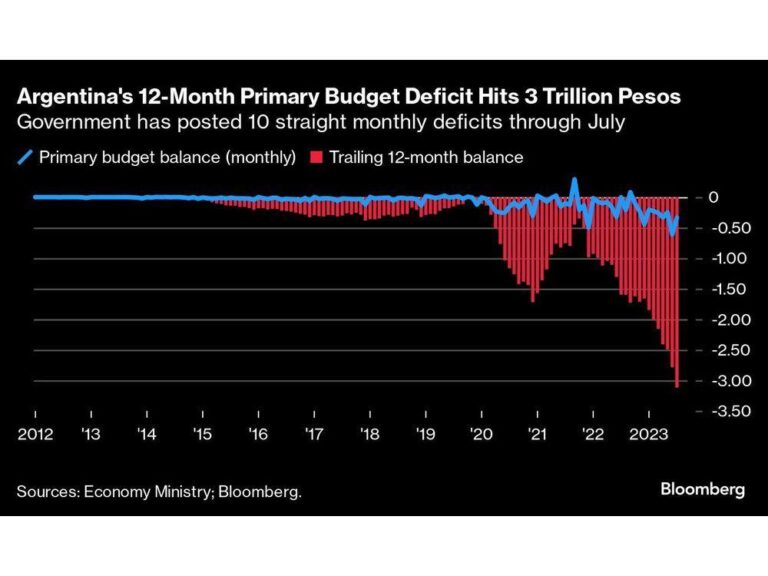

Argentina’s draft budget for 2026 emphasizes a stringent commitment to restoring fiscal discipline amid ongoing economic challenges. The proposal aims to cut the fiscal deficit by implementing tough expenditure controls while safeguarding critical public services. Key measures include limiting non-essential government spending and enhancing revenue collection through tax reforms designed to increase efficiency without stifling growth.

Notably, the budget also increases allocations for social programs, recognizing the need to support vulnerable populations during this transition. Targeted investments focus on health, education, and poverty alleviation, reflecting a balance between austerity and social protection. The government’s approach can be summarized as follows:

- Fiscal deficit reduction: Targeting a decrease from 3.5% to 2.1% of GDP.

- Social spending hike: 8% increase compared to previous fiscal year.

- Tax reform plans: Enhancements to VAT collection and wealth tax adjustments.

| Category | 2025 (USD billions) | 2026 Proposal (USD billions) | |

|---|---|---|---|

| Fiscal Deficit | 45 | 27 | |

| Social Spending | 60 | 65 | |

| Infrastructure | 15 | ||

| Infrastructure | 15 | 18 |

| Social Sector | 2025 Budget (ARS billion) | 2026 Draft Budget (ARS billion) | % Increase |

|---|---|---|---|

| Unemployment Benefits | 180 | 225 | 25% |

| Pensions | 320 | 380 | 18.75% |

| Child Welfare | 95 | 115 | 21% |

| Community Health | 60 | 75 | 25% |

Experts Recommend Sustainable Revenue Strategies to Support Expanded Allocations

Economic experts emphasize the importance of implementing sustainable revenue enhancements to effectively manage the proposed increase in social allocations within Argentina’s draft 2026 budget. Policymakers are encouraged to diversify income sources beyond traditional tax measures, advocating for a balanced mix of tax reform, improved tax compliance, and strategic utilization of non-tax revenues. This approach aims to preserve fiscal discipline while safeguarding social programs critical to vulnerable populations.

Among the key recommendations, specialists highlight the necessity to:

- Strengthen progressive taxation to boost government resources without undermining economic growth.

- Enhance efficiency in public spending to reduce leakages and divert savings toward priority sectors.

- Leverage public-private partnerships as a strategic tool for infrastructure funding and service delivery.

| Strategy | Primary Benefit | Expected Impact |

|---|---|---|

| Progressive Tax Reform | Revenue Growth | Moderate increase in fiscal space |

| Tax Compliance Measures | Reduced Evasion | Improved tax collection efficiency |

| PPP Initiatives | Resource Optimization | Expanded service reach without higher debt |

Future Outlook

As Argentina advances toward 2026, the draft budget underscores the government’s commitment to restoring fiscal balance while addressing pressing social needs. With increased allocations aimed at cushioning vulnerable populations, the plan reflects ongoing efforts to stabilize the economy amid challenging external and domestic conditions. Analysts and stakeholders will closely monitor the budget’s implementation to gauge its impact on Argentina’s broader economic recovery and social stability.