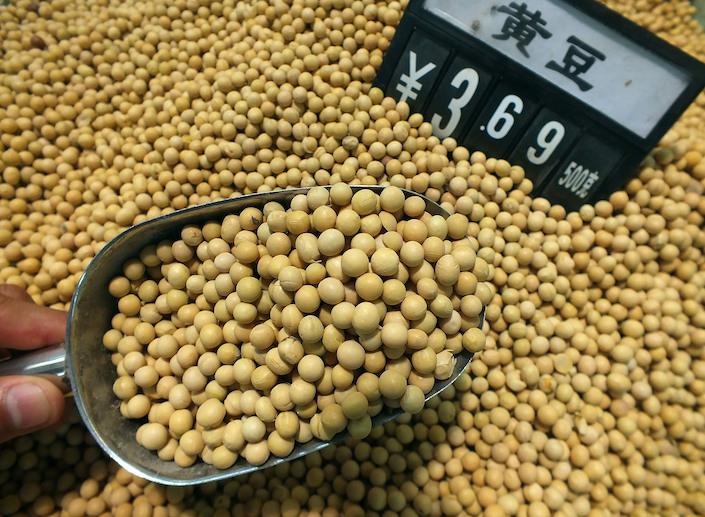

China is bracing for a prolonged trade standoff with the United States over soybeans, as it significantly ramps up imports from Brazil to meet domestic demand. The move underscores Beijing’s strategy to diversify its agricultural supply chain amid ongoing tensions with Washington, highlighting the broader economic and geopolitical implications for global soybean markets.

China’s Strategic Shift to Brazilian Soybeans Amid US Trade Tensions

In an effort to circumvent ongoing trade tensions with the United States, China is accelerating its soybean imports from Brazil to safeguard its domestic supply chain. This strategic pivot not only secures an alternative source for a critical agricultural commodity but also signals Beijing’s readiness for a protracted dispute with Washington. Brazilian soybeans now represent a significant share of China’s imports, driven by favorable pricing and a desire to diversify away from US products amid tariffs and trade barriers.

Key factors influencing this shift include:

- Increased Brazilian soybean production and export capacity

- Competitive pricing compared to US soybeans under tariffs

- China’s long-term demand to support its animal feed industry

- Geopolitical maneuvering to reduce dependence on US agricultural goods

| Country | 2023 Soybean Exports (Million Tons) | Average Price per Ton (USD) |

|---|---|---|

| Brazil | 85 | 480 |

| United States | 55 | 550 |

| Argentina | 15 | 470 |

Economic and Agricultural Impacts of Soaring Brazilian Soybean Imports

The surge in Brazilian soybean shipments to China is reshaping global agricultural trade patterns and exerting profound economic effects on both supplier and consumer markets. Brazil’s growing role as China’s primary soybean supplier is driving investment in its agricultural infrastructure, notably expanding farmland and modernizing harvesting technology in key producing states like Mato Grosso and Paraná. This explosive growth has bolstered Brazil’s export revenues, creating jobs and stimulating rural economies but has also raised concerns about environmental degradation and deforestation driven by increased cultivation.

On the Chinese side, reliance on Brazilian soybeans has sparked adjustments across domestic agricultural sectors and commodity markets. Key impacts include:

- Reduced demand for U.S. soybeans, complicating trade relations and tariff negotiations.

- Pressure on local farmers, who face challenges competing with cheaper imports.

- Supply chain diversification, as importers seek to mitigate risks associated with a single major supplier.

Below is a comparative snapshot of soybean import volumes and prices illustrating these dynamics:

| Year | Brazilian Soybean Imports (Million Tons) | U.S. Soybean Imports (Million Tons) | Average Price per Ton (USD) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 45.5 | 26.2 | $470 | |||||||

2023 ( It looks like your table got cut off. Would you like me to help complete the table or analyze the data so far? If you provide the rest of the data for 2023, I can compare trends or summarize the key points for you.

Policy Recommendations for Navigating the Prolonged China-US Soybean DisputeAmid escalating tensions and uncertain timelines in the China-US soybean trade dispute, policymakers should prioritize diversifying import sources to mitigate supply chain risks. Encouraging partnerships with Brazilian producers not only secures a steady flow of soybeans but also cushions domestic markets against potential price shocks. Simultaneously, investing in strategic reserves and enhancing storage infrastructure will provide governments with greater leverage and flexibility during prolonged trade disruptions. Trade facilitation improvements, such as streamlined customs procedures and digital tracking systems, can further stabilize soybean inflows from alternative suppliers. In parallel, bolstering soybean supply domestically is crucial for long-term resilience. Governments should implement incentives for local farmers to increase yield through sustainable agricultural practices and technological adoption. Strengthening bilateral dialogues focused on removing tariff barriers and resolving regulatory discrepancies could eventually pave the way for de-escalation in US-China trade tensions. The following table highlights key policy actions and their expected impacts:

Future OutlookAs China braces for a prolonged stand-off with the United States over soybean imports, its pivot toward sourcing massive quantities from Brazil marks a significant shift in global trade dynamics. This strategic realignment underscores Beijing’s determination to diversify supply chains amid geopolitical tensions, while signaling a potential recalibration of agricultural markets worldwide. How this evolving scenario will reshape the U.S.-China trade relationship remains a critical development to watch in the months ahead. |