Millions of taxpayers across France have reported unexpected deductions from their bank accounts today, raising alarms over an additional French tax charge. This sudden debit has sparked confusion and concern among individuals nationwide, prompting questions about its origin and legitimacy. In this article, we examine who is affected, what the extra tax entails, and how to verify whether you have been impacted.

Millions Face Unexpected French Tax Debits What You Need to Know About the Charges

Starting this month, a significant number of residents across France have noticed unexpected deductions on their bank statements linked to newly applied tax charges. These extra debits primarily relate to adjustments in local property taxes and surtaxes associated with environmental levies, which French authorities have recently tightened to meet budgetary goals. Many affected taxpayers were caught off guard due to minimal prior notification, prompting concerns and a surge in inquiries to tax offices nationwide.

Key points to understand about these tax charges include:

- Scope: The debits affect both French nationals and expatriates owning property or residing in France.

- Amount: Charges vary by region and property value, ranging from moderate supplements to significant increases.

- Payment: Most deductions are automatic, drawn directly from registered bank accounts without prior approval for each instance.

- Disputes: Taxpayers can contest the charges but must follow strict timelines and provide evidence supporting their claims.

| Region | Average Additional Tax (€) | Percentage Increase |

|---|---|---|

| ĂŽle-de-France | 150 | 12% |

| Provence-Alpes-CĂ´te d’Azur | 130 | 10% |

| Nouvelle-Aquitaine | 90 | 8% |

| Occitanie | 85 | 7% |

Understanding the Origins and Legal Basis of the Recent French Tax Deductions

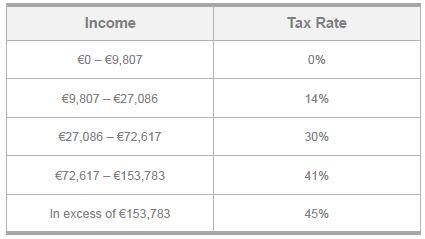

Recent French tax deductions stem from a series of legislative adjustments aimed at addressing budget deficits exacerbated by global economic challenges. Primarily, these deductions are linked to amendments in the Annual Finance Law, which revamped income tax brackets and altered the withholding tax framework applicable to both residents and non-residents. The government’s approach reflects efforts to balance fiscal responsibility with social equity, targeting higher-income brackets while providing relief mechanisms for vulnerable sectors. Furthermore, these measures are implemented under the authority granted by the French Tax Code, which governs taxation modalities including direct and indirect taxes across diverse income sources.

To illustrate the legal grounding, here’s a concise breakdown of the relevant statutes and their direct impact:

- Article 204 A: Establishes withholding tax obligations on employment income.

- Article 156: Details progressive income tax rates and bracket thresholds.

- Decree No. 2024-102: Introduces updated tax deduction parameters effective from January 2024.

| Legislation | Key Change | Effective From |

|---|---|---|

| Annual Finance Law 2024 | Revised tax brackets | Jan 1, 2024 |

| French Tax Code Article 204 A | Mandatory withholding tax on wages | Ongoing |

| Decree No. 2024-102 | New deduction criteria | Feb 15, 2024 |

Steps to Verify Your Account and How to Contest Unauthorized Tax Withdrawals

Begin by logging into your official tax account through the French tax portal. Ensure your credentials are correct and verify your identity using the two-factor authentication method where available. Look out for any unfamiliar bank details or unexplained deductions in your recent transaction history. It’s crucial to double-check your personal information to confirm there have been no unauthorized changes made to your account. For additional security, update your password and review connected payment methods.

If you identify an unexpected tax deduction, do not delay in filing a formal contestation. Prepare your evidence, including bank statements and correspondence, and submit a dispute directly via the portal or at your local tax office. Below is a quick-reference guide outlining the key steps in contesting such withdrawals:

| Action | Details |

|---|---|

| Check Bank Statement | Identify unauthorized amounts and dates |

| Document Evidence | Gather statements & official notices |

| Submit Dispute | Use online form or visit tax office |

| Follow Up | Track status via your account & calls |

In Conclusion

As the controversy around the unexpected French tax deductions unfolds, millions of affected individuals are urged to review their bank statements carefully and seek clarification from their financial institutions or tax authorities. While some discrepancies may be resolved swiftly, others could require formal disputes or further investigation. Stay informed through reliable sources to ensure your rights are protected and avoid any undue financial burden. The Connexion will continue to monitor this developing story and provide updates as more information becomes available.