Indian pharmaceutical stocks experienced a notable decline following the announcement of new drug tariffs imposed by former U.S. President Donald Trump, Reuters reports. Market analysts characterized the sell-off as largely “sentimental,” suggesting that the immediate market reaction may be driven more by investor sentiments than by fundamental changes to the sector’s outlook. The development adds to ongoing concerns about trade tensions and regulatory risks facing Indian drug manufacturers, who rely heavily on the U.S. market for exports.

Indian Pharma Stocks React to Trumps New Drug Tariffs Market Sentiment Drives Sharp Decline Despite Strong Fundamentals Analysts Urge Cautious Approach and Emphasize Long Term Investment Potential

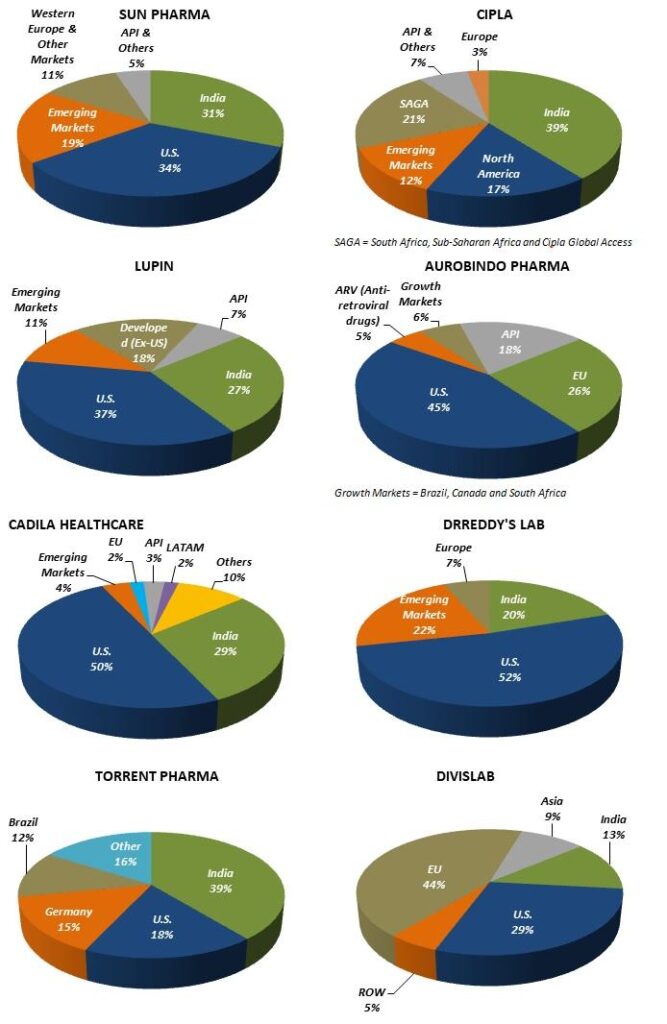

Indian pharmaceutical stocks experienced a marked decline following the announcement of new drug tariffs by the U.S. administration. Market participants reacted swiftly, driven largely by apprehension and speculative sentiment rather than changes in the underlying business metrics. Despite the sudden sell-off, leading companies within the sector continue to demonstrate robust earnings growth, strong order books, and expanding global footprints. Analysts point out that while tariffs introduce immediate headwinds, these are unlikely to derail the long-term fundamentals that support sustained investor confidence.

Key factors influencing the market response include:

- Short-term Capital Outflows: Investors seeking to reduce risk exposure amid geopolitical uncertainty.

- Uncertainty Over Implementation: Lack of clarity on tariff timelines and scope fuels cautious trading behavior.

- Strong Domestic Demand: Continued growth in India’s healthcare market cushions external pressures.

| Stock | Current Price (₹) | 1-Week Change | Analyst Rating |

|---|---|---|---|

| Sun Pharma | 920 | -7.2% | Buy |

| Dr. Reddy’s | 4,350 | -6.5% | Accumulate |

| Cipla | 1,220 | -5.8% | Hold |

With uncertainties persistently clouding the near-term outlook, market experts recommend investors maintain a cautious but constructive stance. Emphasizing the sector’s strong innovation pipeline, regulatory approvals, and export diversification, analysts advise focusing on the long horizon to capitalize on eventual recovery. Strategic buying during dips is seen as a prudent approach, reinforcing that the current downturn is largely sentiment-driven and not reflective of structural weaknesses.

Wrapping Up

As Indian pharmaceutical stocks continue to navigate the volatility triggered by the announcement of new U.S. drug tariffs, market experts urge investors to maintain a measured perspective. While the initial sell-off reflects sentiment-driven reactions, analysts emphasize that the fundamental strengths of the sector remain intact. With ongoing demand for affordable medicines and a resilient export network, industry watchers will be closely monitoring how policy developments unfold and their longer-term implications for Indian pharma companies on the global stage.