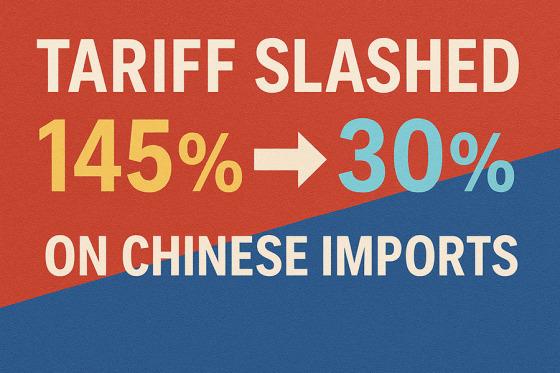

In a significant escalation of trade tensions between the United States and China, former President Donald Trump has announced the implementation of an additional 100% tariff on Chinese goods set to take effect next month. The move marks a dramatic intensification of economic pressure aimed at addressing longstanding disputes over trade imbalances, intellectual property, and market access. This development, reported by CBS News, is expected to have wide-ranging implications for global markets, supply chains, and diplomatic relations between the two economic powerhouses.

Trump Imposes Additional 100 Percent Tariff on Chinese Imports To Begin Next Month

The administration has escalated trade tensions by announcing a significant increase in tariffs on Chinese imports, which will take effect starting next month. This move imposes an additional 100 percent tariff on a broad range of goods originating from China, aiming to address ongoing concerns regarding trade imbalances and intellectual property disputes. Key sectors expected to be impacted include electronics, textiles, and consumer goods.

Industry experts warn that this aggressive tariff hike could lead to several immediate consequences, including:

- An increase in manufacturing costs for U.S. companies relying on Chinese materials

- Potential price surges for everyday consumer products

- Heightened tensions affecting global supply chains

| Affected Product Category | Estimated U.S. Impact |

|---|---|

| Consumer Electronics | Rise in retail prices by 15-20% |

| Apparel and Textiles | Supply chain delays up to 30% |

| Household Goods | Increased manufacturing costs |

Economic Impact of the New Tariffs Explored Through Industry and Consumer Lens

Industries heavily reliant on Chinese imports are bracing for substantial cost increases as the new 100% tariffs threaten to double the expenses of a wide array of goods. Key sectors such as electronics, automotive, and retail are expected to adjust supply chains and explore alternative sourcing to mitigate the financial strain. Analysts suggest that manufacturers may face shrinking profit margins, potentially leading to cautious hiring freezes or scaled-back investments in technology upgrades. Conversely, some domestic producers might seize this opportunity to capture market share, though the transition is unlikely to be seamless.

On the consumer front, shoppers could see noticeable price hikes on everyday products from smartphones to clothing. Economic experts warn that inflationary pressures may escalate as retailers pass on increased costs, disproportionately affecting lower and middle-income households. The ripple effects include slower consumer spending, which could dampen overall economic growth in the coming quarters. Below is a simplified forecast contrasting potential impacts on industries and consumers:

| Impact Area | Potential Outcome | Timeframe |

|---|---|---|

| Manufacturing Costs | Increase by 30-50% | 3-6 Months |

| Consumer Prices | Rise by 10-20% | 6-12 Months |

| Supply Chain Adaptation | Shift to new suppliers | 12-18 Months |

| Employment Trends | Potential slowdown in hiring | 6-12 Months |

- Industries: Higher operational costs, supply chain disruptions, potential domestic production boost.

- Consumers: Elevated product prices, reduced purchasing power, cautious spending habits.

Experts Advise Businesses to Reassess Supply Chains Amid Rising Trade Tensions

In response to the recent announcement of a 100% tariff on Chinese imports set to take effect next month, industry specialists are urging companies to urgently evaluate and diversify their supply chain strategies. The steep increase in tariffs threatens to significantly escalate costs for businesses heavily reliant on Chinese manufacturing and exports. Experts emphasize the importance of identifying alternative sourcing options to mitigate risks associated with trade disruptions and potential retaliatory measures.

Critical considerations for businesses now include:

- Assessing current supplier dependencies and exploring regional or domestic alternatives

- Revisiting inventory management to adapt to longer lead times and increased expenses

- Enhancing supply chain transparency to anticipate and respond to geopolitical developments swiftly

| Supply Chain Factor | Potential Impact |

|---|---|

| Cost of Goods | Up to 40% increase |

| Shipping Delays | Extended by several weeks |

| Alternative Sourcing | Higher initial investment |

| Inventory Levels | Need for larger safety stock |

Future Outlook

As the new tariff takes effect next month, its economic impact and potential repercussions on U.S.-China trade relations remain closely watched by analysts and policymakers alike. Businesses on both sides of the Pacific now face increased uncertainty as they prepare to navigate the shifting landscape of international commerce. CBS News will continue to monitor developments and provide updates on how this significant policy move unfolds.