A sewing mistake in China sparked an unexpected opportunity, turning a simple error into a thriving business success story. This OpEd in Eurasia Review uncovers how innovation often emerges from the most surprising challenges

Browsing: Asian markets

Japan’s business sentiment has surged to its highest level in four years, sparking excitement about a potential Bank of Japan rate hike. With the economy looking stronger and confidence on the rise, markets are buzzing with anticipation for upcoming policy moves

China’s deflationary challenges continue to loom large, even as consumer inflation soars to a 21-month high, Reuters reports. Service prices are on the rise, yet factory-gate and wholesale goods stubbornly lag behind, highlighting the intricate economic obstacles that lie ahead

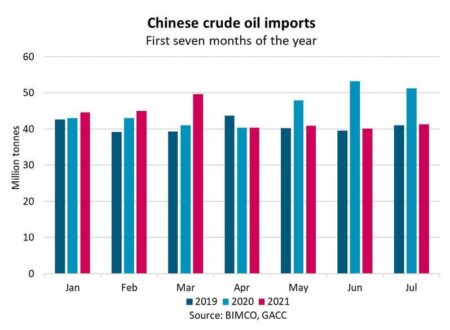

China’s crude oil imports in September rose by 3.9% compared to last year, though they slipped 4.5% from August, Reuters reports. This slight year-on-year gain paired with a monthly decline reveals the shifting demand and dynamic market forces shaping the industry

Japan has just upgraded its Q2 GDP growth figures, powered by an unexpected surge in consumer spending, Reuters reports. This revision shines a spotlight on a revitalized economic momentum, driven by a strong rebound in domestic demand

China’s central bank has subtly boosted the yuan, riding a surge of economic optimism and signaling robust confidence in the country’s growth prospects. This calculated step aims to stabilize the currency and attract foreign investment, Bloomberg reports

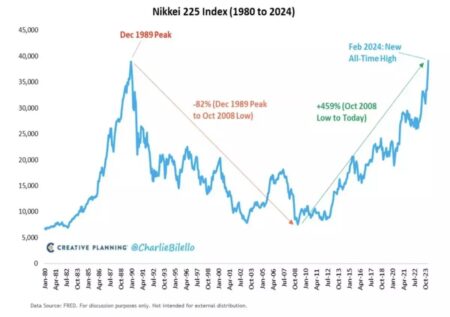

Japan’s Nikkei skyrocketed to a record-breaking high, propelled by SoftBank sparking a dynamic tech rally driven by stellar earnings and soaring investor excitement. This surge signals a renewed wave of optimism in Japan’s bright growth prospects

Exclusive: China Galaxy and CICC are set to unveil investment funds exceeding $1 billion, targeting the vibrant markets of Southeast Asia. This ambitious initiative seeks to deepen regional economic ties and capitalize on exciting growth prospects in emerging economies, Reuters reports

China’s Lenovo reported a quarterly profit significantly below analyst estimates, leading to a sharp decline in its shares. The tech giant cited ongoing challenges in the global PC market, raising concerns about its future performance.

Foreign investment in Japan’s stock market has skyrocketed, sparking a wave of enthusiasm among local authorities to rally domestic participation. With global investors fueling the market’s momentum, exciting initiatives are being launched to enhance awareness and accessibility for Japanese citizens. This effort is set to cultivate a more vibrant and resilient economic landscape.

In a bold move towards stability, Japan’s asset managers are increasingly embracing domestic equities as a safer investment option. As uncertainties loom over China’s economic landscape, this strategic pivot underscores their quest for refuge in these turbulent market conditions.

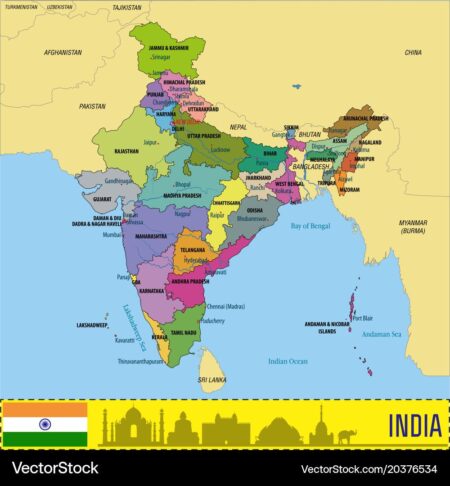

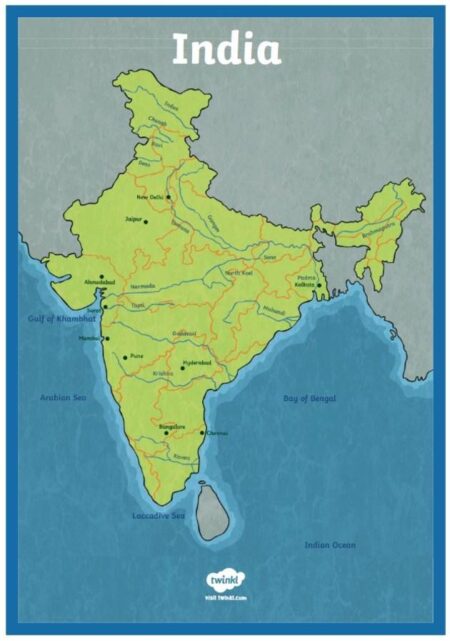

India is set to overtake Japan as the world’s fourth largest economy by 2025, as revealed by the International Monetary Fund (IMF). This remarkable achievement highlights India’s swift economic ascent, driven by robust consumer demand and innovative reforms.

Meta has unveiled a striking drop in digital advertising spending from Chinese retailers, hinting at possible shifts in the market dynamics. This emerging trend may ripple through the wider advertising landscape, prompting companies to rethink their strategies as they navigate economic uncertainties.

Japanese and Australian markets bounced back with a surge of positive momentum after a rollercoaster session on Wall Street, as investors embraced a sense of cautious optimism. Meanwhile, most Asian markets took a breather for the holiday, resulting in limited trading activity across the broader region.

In light of President Trump’s attempts to smooth over trade tensions, a wave of skepticism has swept across China. Analysts and officials alike are voicing their doubts, casting a critical eye on the sincerity of these gestures. With tariffs still in place and economic frictions simmering, many are left wondering if this olive branch is genuine or just another political maneuver.

Nomura Holdings has taken a bold leap in Japan’s overseas financial landscape, clinching its most substantial deal since 2008. This acquisition is not just a transaction; it’s a game-changing milestone that enhances its global footprint as market dynamics evolve, showcasing Nomura’s revitalized ambitions on the international stage.

India is on the brink of seizing a substantial portion of U.S. business that has long been under China’s influence, as companies actively search for alternatives in response to rising geopolitical tensions. With its competitive labor costs and an expanding market, India is set to become a pivotal player in the global supply chain landscape.

Governor Wes Moore is gearing up for a trade mission to Japan and South Korea, aimed at boosting economic ties and attracting investment to Maryland. The trip will focus on opportunities in technology, sustainability, and cultural exchange.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

A recent study highlights that Japan’s scrap metal supply can effectively support the country’s electric arc furnace (EAF) sector. This shift towards increased recycling could enhance sustainability while bolstering domestic steel production capabilities.