Italy’s distressed assets and NPEs weekly round-up: exciting new developments from Fidera Vecta, Tikehau, DeA Capital, Cherry Bank, Banca Macerata, and more highlight powerful shifts transforming the market. Expert insights by BeBeez International

Browsing: asset management

DeepSeek founder Liang witnessed his funds soar by an astonishing 57% as China’s quant market bursts into life, driven by a booming appetite for AI-powered investment strategies, Bloomberg reports. This remarkable growth highlights a powerful surge of investor confidence in algorithmic trading

Assets left over from the Canada Games often embark on a new journey through sales or donations to local organizations, ensuring that equipment and materials keep making a meaningful difference in communities long after the event has ended, organizers say

The Americas Distribution Awards 2025 honored the brightest stars across Argentina’s asset classes and provider categories. Citywire proudly highlights the visionary winners who are revolutionizing the investment distribution landscape in the region

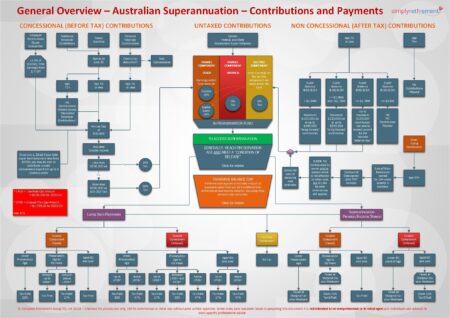

Australia’s colossal $2.7 trillion pension funds are making a bold move away from the US, Bloomberg reveals. This strategic pivot signals a dynamic effort to diversify portfolios amid rising global economic uncertainties

Boreas AM is ramping up its dedication to the Hauts-de-France region with exciting new investments aimed at sparking local development and fueling economic growth, CoStar reports. This bold move highlights the firm’s unwavering confidence in the region’s bright and promising future

ETFGI reveals that assets in Japan’s ETF industry soared to a record-breaking US$614.26 billion by the end of April, showcasing remarkable growth and strong investor confidence in the market

Exciting news is on the horizon! Exclusive reports indicate that Deutsche Bank’s asset management division, DWS, is in talks with Japan’s Nippon Life to forge a dynamic joint venture in India. This collaboration seeks to bolster their foothold in the booming Indian financial market, tapping into its immense potential for growth.

Morningstar, a premier investment research firm, delivers in-depth financial analysis, data, and news that empower investors to navigate the ever-changing market landscape. With its powerful tools and resources at your fingertips, you can uncover valuable insights into market trends and fund performances, enabling you to make savvy investment choices.

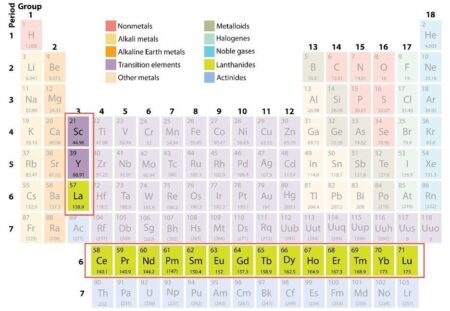

Gina Rinehart, Australia’s wealthiest woman, has built a staggering $800 million portfolio in rare earths. This savvy investment places her at the cutting edge of a rapidly expanding industry that is crucial for technology and green energy. It highlights the surging demand for these indispensable minerals!

A recent map reveals the extent of gold reserves stored by various countries in the United States, highlighting Germany’s consideration of repatriating its gold. As global economic concerns rise, this move sparks debate on the security and accessibility of national assets.

Canada holds billions in U.S. real estate, but recent threats from former President Trump regarding border policies and trade could jeopardize these investments. Experts warn that uncertainty may deter future Canadian buyers, impacting the market significantly.

Seizing Russian assets, while appealing in theory as a response to international aggression, presents significant legal and logistical challenges. This complexity involves navigating international law, diplomatic repercussions, and potential retaliation, complicating enforcement efforts.