The Bank of Japan is signaling a bold shift from its ultra-loose monetary policy, hinting at possible rate hikes as the yen weakens and inflation concerns mount. Markets are buzzing with anticipation, closely watching for policy moves and their potential impact on the economy

Browsing: Bank of Japan

The Bank of Japan is gearing up to raise interest rates to a 30-year high, signaling a bold new chapter in its monetary policy as it tackles soaring inflation. All eyes will be on Wednesday’s announcement, with markets buzzing in anticipation of the next big move

Japan’s business sentiment has surged to its highest level in four years, sparking excitement about a potential Bank of Japan rate hike. With the economy looking stronger and confidence on the rise, markets are buzzing with anticipation for upcoming policy moves

Global bonds plunged sharply following hawkish remarks from the Bank of Japan, signaling potential shifts in monetary policy. Investors reacted swiftly, driving yields higher as uncertainty surged

Japan’s two-year government bond yield has surged to its highest level since 2008, driven by growing market excitement over potential rate hikes. Investors are now closely watching the Bank of Japan, eagerly awaiting its next move in shaping monetary policy

The Bank of Japan is preparing to possibly raise interest rates at its December meeting, the Chief Governor revealed, signaling a major departure from the central bank’s decades-long ultra-loose monetary policy

Japan’s Economy Minister Takaichi passionately urged the Bank of Japan to focus on achieving inflation by ensuring steady wage growth, emphasizing that boosting household income is key to powering a robust economic recovery

Analysis reveals that while Takaichi’s win as Japan’s leader may delay Bank of Japan rate hikes, it won’t halt them entirely. Market watchers remain vigilant as the policy outlook stays unpredictable

The Bank of Japan is gearing up for a pivotal rate hike as inflationary pressures intensify. Markets are buzzing with anticipation, bracing for a landmark policy shift that could finally bring an end to decades of ultra-loose monetary easing

The Bank of Japan is preparing to accelerate the sale of its asset holdings, signaling a decisive shift away from its ultra-loose monetary policy amid rising inflationary pressures, The Wall Street Journal reports

Japan’s government has strongly dismissed allegations that the U.S. is pressuring the Bank of Japan to raise interest rates. Yet, as global inflation concerns intensify, investors remain on high alert, scrutinizing every decision from the BOJ and keeping markets tense

Japan’s 10-year government bond yield soared, driven by the Bank of Japan’s surprisingly hawkish signals. This unexpected shift toward tightening has sparked a surge of market excitement on TradingView

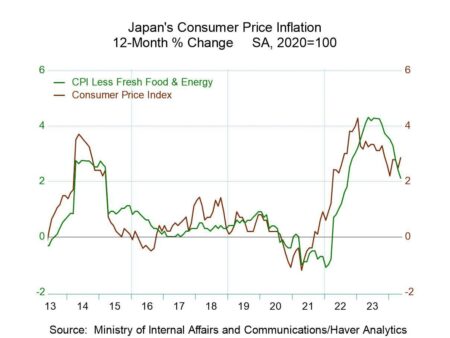

Japan’s core inflation slipped slightly but remained above the Bank of Japan’s 2% target, sparking market excitement over a potential rate hike as policymakers navigate the delicate balance between inflation pressures and economic growth

Tariff anxiety is sweeping across Japan, the Bank of Japan’s latest report reveals. Rising trade tensions and impending tariff increases are rattling businesses, shaking economic confidence, and forcing exporters to proceed with caution

The Bank of Japan held interest rates steady and announced a gradual easing of its bond purchase taper, signaling a cautious approach amid ongoing economic uncertainties, according to the Caledonian Record

The Bank of Japan kept interest rates unchanged and announced plans to slow down tapering bond purchases, signaling a cautious approach amid ongoing economic uncertainties. Markets are eagerly awaiting the next move

In a recent announcement, the Bank of Japan (BOJ) has chosen to keep its interest rates steady, highlighting the current economic stability. However, officials voiced their worries about looming risks from US tariffs that could pose challenges to Japan’s export-driven economy.

The Bank of Japan is calling on local banks to stay alert amidst the rising tide of financial market volatility. In a recent statement, the central bank highlighted the crucial importance of enhancing risk management practices, empowering financial institutions to effectively steer through these unpredictable waters.

In today’s ForexLive Asia-Pacific FX news wrap, Bank of Japan Governor Kazuo Ueda addressed key monetary policy issues, underscoring the central bank’s commitment to maintaining its accommodative stance. His remarks influenced market sentiment, impacting the yen’s fluctuations.

Japan’s inflation rate has slowed more than anticipated, yet remains elevated, prompting speculation about the Bank of Japan’s potential interest rate hikes. Analysts suggest that persistent price pressures may force the central bank to act sooner than expected.