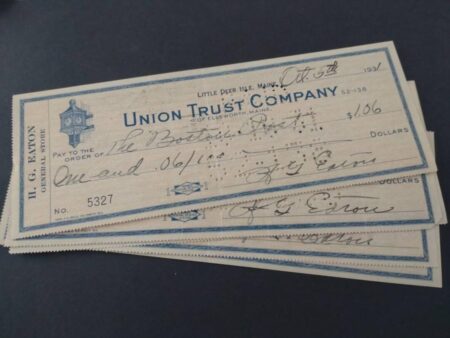

Goodbye, checks? A compelling new report from the Library of Congress explores the rapid decline of check payments in Germany and the U.S., uncovering how evolving consumer habits and the rise of digital alternatives are revolutionizing payment methods in both countries

Browsing: banking

At a recent summit, the Trump administration introduced the $1,000 “Trump Accounts,” highlighting them as an exciting new way for Americans to boost their savings. This groundbreaking initiative represents a bold leap forward in building personal wealth and securing brighter financial futures

Brazilian fintech Agibank is preparing to make waves with a stunning $1 billion US initial public offering, Bloomberg sources reveal. This ambitious leap promises to supercharge its growth and cement its position as a market leader

A warning has been raised about the future of cash in Australia following a groundbreaking government decision. Experts caution that this move could accelerate the shift toward a cashless society, igniting urgent concerns over accessibility and privacy

Argentina is gearing up to significantly increase its foreign currency reserves, currently held at US$251 billion in so-called “mattress dollars.” This bold move aims to stabilize the economy amid soaring inflation and volatile currency swings, reports Malay Mail

China is gearing up to allow banks to pay interest on digital yuan holdings, a bold and game-changing step aimed at fast-tracking the adoption of its central bank digital currency. This thrilling move marks a major leap toward making the digital yuan an essential part of daily transactions nationwide

Brazil’s leading bank now urges savers to consider dedicating up to 3% of their portfolio to Bitcoin, spotlighting the growing embrace of cryptocurrency as a savvy move in building a well-rounded investment strategy, dlnews.com reports

Two of Brazil’s nine Central Bank seats are expected to remain vacant after the January meeting, sources told Reuters, signaling potential delays in key appointments as political negotiations continue to evolve

France’s Ayvens has triumphantly secured a ÂŁ200 million dual-tranche syndicated loan, marking a pivotal milestone in its financing journey. Led by premier banks, this landmark deal is poised to power the company’s bold expansion plans and accelerate dynamic operational growth

Brazil’s Itau Unibanco has unveiled a remarkable $4.4 billion payout in dividends and interest on equity, showering its shareholders with significant returns. This bold move showcases the bank’s robust financial health and steadfast confidence in its future growth

India’s manufacturing powerhouse Zetwerk is gearing up to make a splash with a $750 million IPO, backed by six leading banks driving the offering. This ambitious step signals a major leap forward as Zetwerk sets its sights on expanding its influence in the global supply chain landscape

Argentina’s President Javier Milei is preparing for a pivotal meeting with JPMorgan CEO Jamie Dimon this week, Reuters reports. This high-profile encounter could unlock thrilling new investment opportunities and forge powerful economic partnerships between Argentina and the global financial giant

TD is driving AI innovation in Canada by backing cutting-edge research, empowering startups, and pioneering data-driven solutions that revolutionize customer experiences and supercharge operational efficiency across industries

Argentina’s Central Bank has slashed reserve requirements to unleash a wave of liquidity into the financial system, sparking hopes for a much-needed boost in economic activity amid ongoing market hurdles, Bloomberg reports

Coinbase and Tink have joined forces to launch Pay by Bank crypto payments in Germany, enabling users to buy cryptocurrencies instantly via bank transfers. This thrilling partnership promises to make crypto transactions faster and easier than ever for customers throughout Germany

The Bank of Canada has just cut its key interest rate to 2.25%, hinting at a potential pause in future cuts for now. This calculated step aims to strengthen the economy as it faces ongoing challenges, CBC reports

India’s central bank is accelerating the return of gold held overseas, aiming to strengthen reserves and fortify economic stability, Bloomberg reports. This decisive move underscores a strategic effort to protect financial security amid a rapidly shifting global environment

Australia’s central bank labels its monetary policy as “little restrictive,” showcasing strong confidence in the nation’s economic growth despite persistent inflation concerns. This cautious stance signals potential future moves designed to sustain a steady and resilient recovery

John Ivison uncovers how Mark Carney’s reputation dazzles on the world stage, even as doubts persist at home in Canada-despite his immense influence and pivotal advisory roles in global finance

Australia is quickly leaving cheques behind as digital payments take the spotlight. This exciting shift marks a revolutionary move toward faster, safer transactions, signaling the dawn of a new era free from paper-based payments nationwide