Japan’s bond market turmoil is sending shockwaves through global finance, igniting shifts in interest rates and rattling investor confidence worldwide. Understanding the full impact of this unfolding drama is essential, as it holds the potential to reshape economic policies and markets far beyond Asia

Browsing: bond market

India bonds tumbled sharply Tuesday, wiping out earlier gains after Bloomberg excluded certain debt from its index. This unexpected move sent shockwaves through the market, igniting investor concerns over access and the future flow of foreign investment

Japan’s 10-year government bond yield has soared beyond the crucial 2% mark, reaching levels unseen since 1999. This striking milestone signals a shift in investor confidence amid evolving economic conditions, according to TradingView market data.

Global bonds plunged sharply following hawkish remarks from the Bank of Japan, signaling potential shifts in monetary policy. Investors reacted swiftly, driving yields higher as uncertainty surged

Germany’s 10-year Bund yield edged higher, reflecting a wave of global risk aversion as investors grapple with escalating geopolitical tensions and ongoing inflation concerns, TradingView data shows

Japan’s 40-year government bond sale ignited robust interest, with demand slightly surpassing average levels-showcasing steady investor confidence amid a stable economic outlook, Bloomberg reports. Even amid global uncertainties, the long-term debt auction attracted strong bids, highlighting remarkable market resilience

The Indian rupee teeters on the edge of sharp declines as upcoming liquidity and growth reports threaten to rattle market confidence. At the same time, bond yields are set to move, reflecting investors’ changing economic outlook

A once-banned Chinese bond strategy that catapulted yields from 8% to a staggering 16% is staging a dramatic comeback, defying regulatory crackdowns. Investors are rushing back, driven by an insatiable appetite for high returns, Bloomberg reports

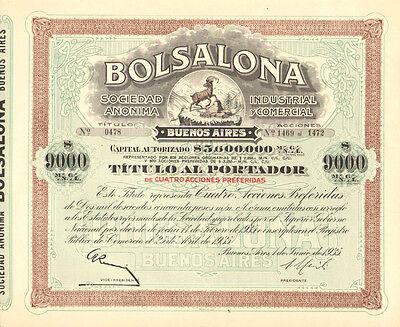

Argentina’s bonds surged in a thrilling trading session as investors reacted to a measured U.S. pledge of support. Market watchers remain on high alert, navigating persistent economic uncertainty and growing demands for further assistance

UK government bonds plunged sharply as uncertainty swirled around Chancellor Rachel Reeves’ future, igniting a surge of market anxiety. Investors reacted quickly, shaken by fears of political upheaval and looming shifts in economic policy

The Milei team moves swiftly to tackle a growing bribery scandal, as Argentina’s bonds and peso plunge, sparking investor alarm and intensifying economic uncertainty in Buenos Aires

PGIM highlights a dramatic surge in France’s bond yields, revealing an exciting tactical buy opportunity for savvy investors. Market experts encourage staying alert to this yield spike, as it may uncover hidden value within French debt assets

Japan’s 10-year government bond yield soared, driven by the Bank of Japan’s surprisingly hawkish signals. This unexpected shift toward tightening has sparked a surge of market excitement on TradingView

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions

Brazil’s infrastructure bond issuance is set to soar in the second half of 2024, driven by growing investor excitement and enticing government incentives, Anbima reports

Japan is gearing up to reduce sales of super-long government bonds in its upcoming fiscal year revision, striving to better control debt issuance and foster greater stability in the market, Reuters reported via Investing.com

Japan has issued rare warnings about its bond market in the latest policy roadmap, highlighting growing concerns over rising yields and potential market turbulence, Reuters reports. This signals a careful shift in the nation’s traditionally steady monetary approach

Japan’s ultra-long government bonds slipped as stock markets soared, capturing the cautious mood of investors amid ongoing stimulus discussions. Traders navigated the delicate balance between potential policy shifts and their impact on yields and equities

Japan has launched an ambitious economic policy roadmap aimed at boosting domestic ownership of Japanese Government Bonds (JGBs). This bold move seeks to enhance financial stability and reduce reliance on foreign investors, Reuters reports

Japan’s recent bond sell-off has sent shockwaves through global markets, igniting concerns among investors. As the world’s third-largest economy faces the pressures of rising interest rates, the fallout could ripple all the way to the U.S., putting Trump’s economic narrative to the test.