Argentina’s bonds, stocks, and currency surged dramatically following Javier Milei’s presidential victory, igniting a wave of excitement among investors eager for bold economic reforms and a fresh chapter of market-friendly policies, analysts reveal

Browsing: Bonds

The week ahead in FX and bonds is charged with excitement as the Federal Reserve prepares to unveil a long-anticipated rate cut, while pivotal U.S.-China trade talks take center stage. Investors are on high alert, hungry for clues on monetary policy changes and geopolitical developments that could reshape market dynamics

Argentina’s bonds surged in a thrilling trading session as investors reacted to a measured U.S. pledge of support. Market watchers remain on high alert, navigating persistent economic uncertainty and growing demands for further assistance

Japan’s ultra-long government bonds slipped as stock markets soared, capturing the cautious mood of investors amid ongoing stimulus discussions. Traders navigated the delicate balance between potential policy shifts and their impact on yields and equities

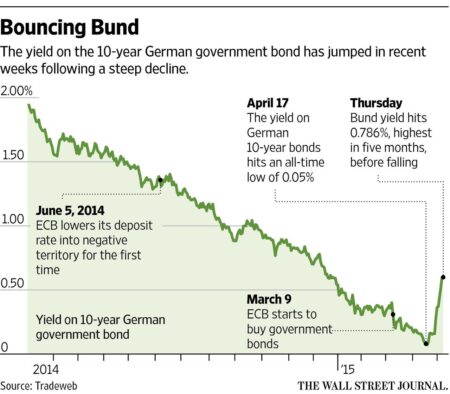

In a flight to safety amid global economic uncertainty, investors are increasingly turning to German government bonds. With their reputation for stability, these bonds offer a refuge from market volatility, reflecting growing concerns over inflation and geopolitical tensions.

As the Federal Reserve prepares to announce its latest policy decision, analysts predict significant implications for the Indian rupee and bond markets. Investors will closely monitor Fed commentary for cues on interest rates and economic outlook, impacting currency stability.

Japan’s 10-year government bond yield has reached its highest level since 2008, driven by investor speculation regarding potential interest rate hikes by the Bank of Japan. This shift marks a significant change in the country’s longstanding monetary policy stance.