Brazil is set to seize an impressive 36% share of global trade, fueled by the revolutionary Mercosur-EU trade deal. This game-changing agreement is igniting a boom in exports and forging stronger economic ties worldwide. According to DatamarNews, this landmark pact marks a bold new chapter in international commerce

Browsing: Brazilian economy

Brazil’s new monthly minimum wage has been increased to BRL 1,621 (about $294.5), providing a vital lifeline for workers facing ongoing economic challenges, the government announced

Brazil’s tax revenue for November skyrocketed 3.75% year-on-year, reaching an unprecedented all-time high fueled by strong economic momentum and improved tax collection efforts, according to TradingView data. This impressive surge points to a bright and promising fiscal future ahead

Brazil Potash is thrilled to announce its SUFRAMA registration, unlocking vital tax incentives that fuel rapid growth. This game-changing achievement will turbocharge the company’s mining operations and open the door to exciting new investment opportunities in Brazil’s booming potash sector

Brazil’s indexed minimum wage, adjusted annually to match inflation, is a powerful tool that safeguards workers’ purchasing power and fuels consumer spending. This dynamic system not only brings stability to the labor market but also serves as a vital shield against economic shocks, CEPR reveals

CSN is actively pursuing the sale of its infrastructure assets in Brazil, aiming to streamline its portfolio and enhance liquidity, according to BNamericas. This move plays a crucial role in the company’s broader strategic review

Brazil’s trading powerhouse Timbro is making a bold leap into the coffee export market, fueled by soaring global demand and thrilling growth prospects. This strategic move promises to elevate Brazil’s position in the fiercely competitive world of coffee trade, Reuters reveals

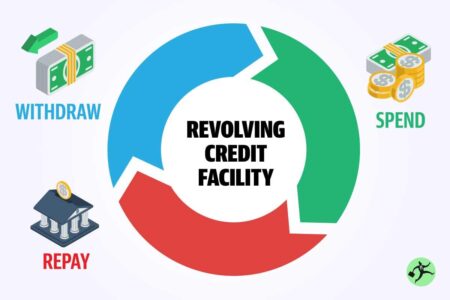

Interest rates on revolving credit cards in Brazil have soared to a staggering 451.5% per year, highlighting the country’s escalating credit cost crisis, Eurasia Review reports. This sharp increase underscores the growing financial strain burdening consumers across the nation

Brazil may extend tax exemptions on select investments, a government official revealed, aiming to boost market confidence and attract foreign capital amid these uncertain economic times, TradingView reports

Brazil’s US$55bn infrastructure boom is revolutionizing the nation’s economy like never before. Driven by robust government investment, vibrant private sector collaborations, and skyrocketing demand in transport and energy, this surge heralds an exhilarating era of growth ahead

Brazil’s infrastructure bond issuance is set to soar in the second half of 2024, driven by growing investor excitement and enticing government incentives, Anbima reports

Marfrig is turbocharging its commitment to Brazil’s mega-factories, pushing production and efficiency to unprecedented levels. This bold strategy highlights the company’s drive to expand operations and tackle soaring global demand with unstoppable momentum

Brazil has just secured an impressive $2.75 billion in its second dollar bond offering of 2025, Reuters reports. This robust demand reflects a surge in investor confidence, as the country’s credit default swaps (CDS) have fallen to their lowest level in a year, signaling optimism about Brazil’s financial future

Brazil’s economy stunned analysts by posting robust growth despite high interest rates. Bloomberg reports that strong consumer demand and export gains are fueling a surprising economic surge.

In a bold move to safeguard its domestic steel industry, Brazil has reintroduced tariffs and quotas on steel products. This strategic decision comes in response to the ever-changing global market landscape, aiming to empower local manufacturers. As trade tensions simmer and challenges persist within the sector, Brazil is taking decisive steps to ensure its steel industry remains resilient and competitive.

Brazil Potash Corp. is gearing up to make a splash at major mining and agriculture investor conferences, seizing the opportunity to connect with stakeholders during a time of heightened scrutiny regarding its financial health. The company is proactively tackling qualifications that may influence its future endeavors.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

Brazil’s central bank has raised interest rates to their highest level since 2016, signaling a cautious approach towards future hikes. With inflation concerns in mind, officials indicate that smaller increases may be on the horizon to balance economic growth and stability.