Fifth Third Bank has proudly earned a spot on USA Today’s prestigious list of top workplaces for 2025! This accolade showcases the bank’s unwavering dedication to employee satisfaction and its vibrant work environment. It‚Äôs a testament to the bank’s continuous efforts in nurturing a supportive and thriving culture for all its team members.

Browsing: business news

Italy is pushing UniCredit to divest from its Russian operations as part of the negotiations to wrap up its deal with Banca Popolare di Milano (BPM), a source reveals. This strategic shift is designed to ensure compliance with European sanctions in light of the escalating geopolitical tensions

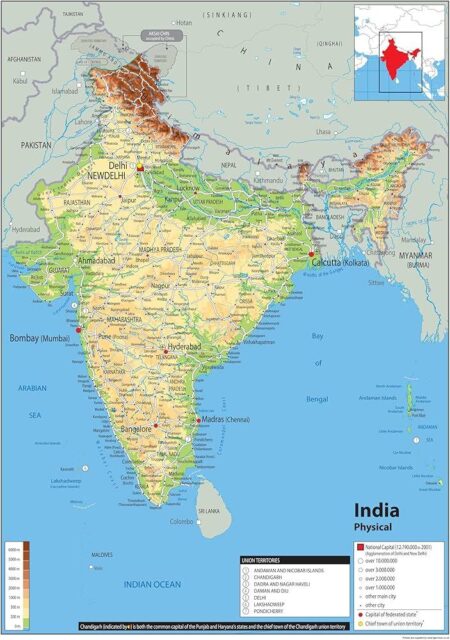

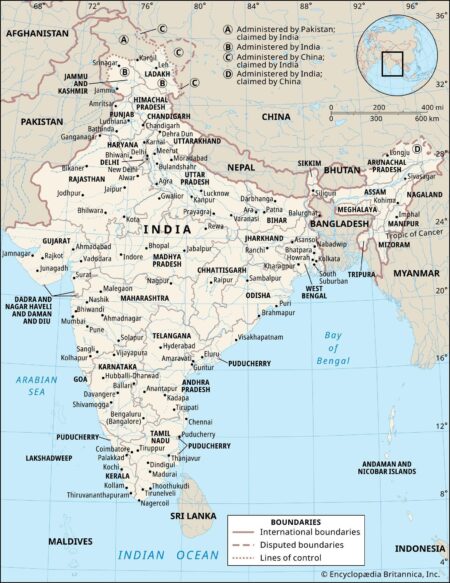

Tesla is actively pursuing a partnership with India to secure vital components for its electric vehicles. This strategic initiative not only aims to enhance local manufacturing but also to fortify supply chain resilience, showcasing India’s emerging significance in the global EV landscape.

In a bold statement aimed squarely at China, former President Donald Trump has accused the nation of “cheating” on tariff agreements. His comments arrive during a time of heightened trade tensions, as he calls for more robust actions to safeguard American industries from unfair competition.

India’s BluSmart, an emerging electric vehicle ride-hailing service and a formidable competitor to Uber, has hit the brakes on its operations as co-founder Tushar Jani finds himself under investigation. This unexpected suspension casts a shadow over the startup’s future in an already cutthroat market

Nvidia CEO Jensen Huang emphasized the vital importance of the Chinese market during his recent trip to Beijing, according to reports from Chinese state media. His comments shine a spotlight on the tech giant’s strategic commitment to forging new partnerships in China’s booming AI sector

Wall Street kicked off the day on a positive note, with the S&P 500 and Nasdaq climbing higher as exciting US-Japan tariff discussions began. However, a 1.5% drop in UnitedHealth cast a shadow over the Dow, highlighting the persistent challenges facing the healthcare sector.

has made a bold move by acquiring , significantly strengthening its foothold in the vibrant South American energy market. This strategic acquisition not only reflects Vista’s ambitious growth plans but also enriches its portfolio and operational prowess in the region, setting the stage for exciting new opportunities ahead

Germany is on the brink of an exciting economic transformation as a fresh “stimulus wave” sweeps in, designed to spark growth and ignite innovation. Investors are eagerly focusing on pivotal sectors, with certain stocks set to thrive from this surge of government backing

In a bold move to ease rising trade tensions, President Trump has called on China to unveil a fresh tariff proposal. This initiative emerges as both countries navigate a web of disputes that are shaking up global markets. Experts believe that any progress in this direction could hint at a potential warming of relations.

Bessent has identified Japan, the U.K., Australia, and South Korea as key priorities for future trade agreements, aiming to strengthen economic ties and enhance market access. This strategic focus signals a commitment to expanding international trade relations.

In a tragic incident, Siemens Spain CEO, who was in New York to celebrate his wife’s birthday, was killed in a helicopter crash. The accident has shocked the corporate community, highlighting the inherent risks of private air travel.

In a significant development, the Lodha brothers have resolved their ongoing dispute regarding branding strategies, paving the way for unified marketing efforts. This resolution is expected to enhance the group’s brand visibility and streamline operations.

Ford Argentina reported a remarkable 99 percent increase in sales for March 2025, signaling a robust recovery in the automotive market. This surge reflects growing consumer demand and revitalized production efforts, positioning Ford for a strong year ahead.

India’s industrial output fell to a six-month low in February, raising concerns over economic momentum. Contraction in manufacturing and electricity sectors has contributed to the decline, signaling potential challenges ahead for growth prospects.

India has asserted its commitment to fair trade practices following Donald Trump’s decision to impose a 90-day pause on tariffs. The Indian government emphasized that negotiations should not occur under pressure, reaffirming its stance on equitable economic dialogue.

In a bold push for domestic manufacturing, Trump’s “Made in USA” initiative could potentially triple iPhone prices, raising concerns among consumers. A recent report reveals significant price disparities globally, highlighting the least expensive markets for the iconic device.

In a recent decision, the Biden administration announced that phones and computers will be exempt from the proposed 125% tariffs on Chinese imports initially suggested by former President Trump. This move aims to alleviate pressure on consumers and tech companies.

In a landmark move for the fashion industry, Prada has acquired Versace for ‚ā¨1.25 billion, uniting two of Italy’s most iconic brands. This deal signals a bold strategy amidst a competitive luxury market, reshaping the landscape of high fashion.

Apple, Nvidia, and Microsoft can ‘breathe a huge sigh of relief’ following the recent exemption from tariffs on key products imported from China. This development is expected to stabilize supply chains and boost profitability for these tech giants.