Bank of Canada Governor Tiff Macklem warns that if the U.S. Federal Reserve loses its independence, it could set off significant ripple effects for Canada-disrupting trade, rattling exchange rates, and putting economic stability at risk

Browsing: Canada economy

Canada’s stock market edged lower as the S&P/TSX Composite Index dipped 0.32%, capturing a mix of conflicting economic signals and cautious investor sentiment. Traders remain vigilant, carefully steering through persistent global uncertainties

Canada stands at a pivotal moment as the global gold rush intensifies, putting its leadership in the precious metals market on the line. Experts warn that without a bold boost in investment, the country could soon fall behind its toughest competitors

Canada is aiming high with an exciting goal: to double its non-US exports within the next decade, Prime Minister Carney announced. This bold plan focuses on forging new trade partnerships across the globe to drive economic growth and reduce reliance on the US market

Canada’s auto industry, a cornerstone of the economy, has weathered tough challenges before-and emerged more powerful than ever. Experts are confident that with smart strategies and bold innovation, this vital sector won’t just overcome today’s obstacles but will accelerate forward with renewed strength and resilience

The Canadian Federation of Independent Business is sounding the alarm: soaring tariffs in the Canada-U.S. trade war are threatening the survival of small businesses. They’re urging the government to take swift action to protect cross-border trade and secure our economic future

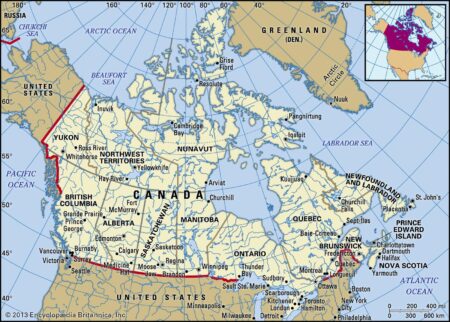

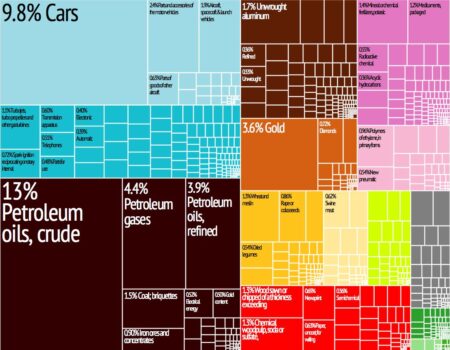

Canada continues to shine as a global trade powerhouse, exporting prized commodities like oil and timber while importing crucial machinery and vehicles. Its robust trade ties with the U.S., China, and Mexico highlight Canada’s key role in connecting North America with the wider world

The Bank of Canada caught markets off guard by slashing interest rates, despite ongoing uncertainty surrounding the inflation outlook, according to minutes from the latest meeting. Officials weighed economic risks with caution before deciding to ease monetary policy

Here are five can’t-miss developments in the Canadian business world this week, spotlighting major earnings reports, key economic data releases, and policy updates set to shake up markets and sway investor sentiment

Canada’s economy contracted by 1.6% in the second quarter, as rising U.S. tariffs dealt a heavy blow to exports, underscoring how ongoing trade tensions are slowing down growth, CBC reports

The Bank of Canada has just revealed its 2026 calendar for policy interest rate announcements and key publications, providing markets and policymakers with clear, reliable guidance throughout the year

Canada is facing mounting economic challenges as a trade dispute with the U.S. escalates, throwing exports and supply chains into turmoil. Key industries such as agriculture and manufacturing are feeling the heat, battling soaring tariffs and an increasingly uncertain market landscape

Economists are sounding the alarm, declaring that Canada has slipped into a recession. With consumer spending taking a hit and inflation on the rise, the outlook is concerning. Analysts predict that these persistent economic pressures may spell extended difficulties for Canadian households and businesses alike.

In a defining moment for Canadian economic leadership, Mark Carney steps into the spotlight with the ambitious mission of transforming the nation’s economy. His appointment marks a significant turning point as Canada embarks on a journey through intricate fiscal landscapes, all while striving for sustainable growth.

The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Homebuyers in Canada are facing tough times as soaring interest rates and escalating housing costs force many to step back from the market. This shift is not just tightening household budgets; it also poses a risk of cooling the overall economy, raising alarms among policymakers and economists alike.

The OECD warns that the Bank of Canada may have to raise interest rates by up to 1.25% in the event of a full-blown tariff war. This increase aims to combat inflationary pressures stemming from heightened trade tensions, impacting economic stability.

Mark Carney, renowned for his crisis management, aims to steer Canada through the ongoing trade war. As he navigates economic uncertainties, his leadership is pivotal in shaping fiscal policy and bolstering national resilience against global market fluctuations.