The Canadian dollar dipped further on Monday, weighed down by growing global uncertainties and a drop in commodity prices, according to market experts at Mitrade

Browsing: Canadian economy

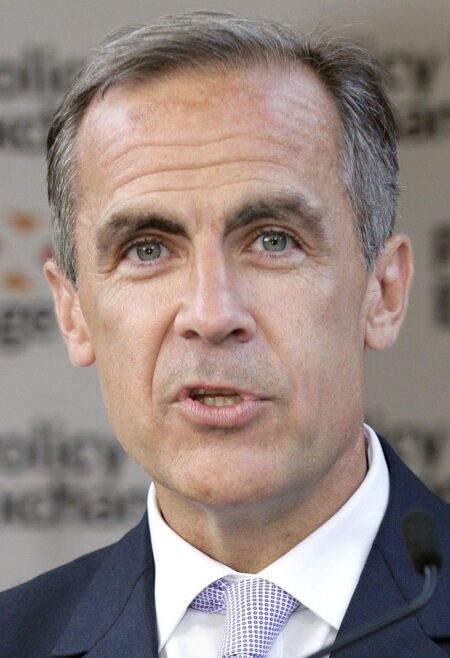

In his latest column for The Logic, Carney boldly announces that Canada’s era of cautious, boy scout politics has ended, paving the way for a new chapter of daring economic and strategic initiatives under Carmichael’s leadership

Here are five can’t-miss developments in the Canadian business world this week, spotlighting major earnings reports, key economic data releases, and policy updates set to shake up markets and sway investor sentiment

Young Canadians are facing a surge in unemployment as job opportunities rapidly vanish, raising urgent alarms about the country’s economic future. Experts warn that this alarming pattern could signal deeper challenges jeopardizing Canada’s recovery and long-term prosperity

Canadian banks have posted impressive earnings, deftly sidestepping the toughest blows from tariff challenges, Reuters reports. Strong consumer spending and well-diversified portfolios were crucial in cushioning the impact

Youth unemployment in Canada is skyrocketing to record highs, driven by persistent economic hurdles. Experts warn that if this urgent issue isn’t addressed swiftly, it could threaten not just the career prospects of young people but the stability of the entire economy

Finance Minister Carney has launched a dynamic new aid package aimed at strengthening Canada’s steel industry and safeguarding workers affected by the U.S. tariffs imposed during the Trump administration, emphasizing steel as the essential backbone of our economy

Canada’s annual inflation rate surged to 1.9% in June, surpassing expectations as soaring energy and food prices dominated the headlines, Reuters reports. This increase underscores ongoing economic challenges despite recent policy measures aimed at stabilizing the market

Canadian businesses are enthusiastically ramping up travel as corporate trips make a powerful comeback, reports TravelPulse Canada. Despite ongoing challenges, companies are doubling down on face-to-face meetings to forge stronger partnerships and unlock exciting new opportunities

Canada’s path to a brighter future shines through bold investments in infrastructure, igniting innovation, and championing social equity. Experts highlight that the key to lasting growth is the dynamic partnership between government, businesses, and communities working together

Canada is boldly charging ahead to secure its spot as a global energy leader by boosting exports of oil, natural gas, and clean energy. Fueled by growing investments, the government is powering initiatives to meet soaring global demand and enhance energy security for years to come

The Bank of Canada held its key interest rate steady at 2.75%, underscoring ongoing uncertainties tied to tariff negotiations. With trade talks remaining unpredictable, the central bank chose a cautious approach amid a clouded economic outlook

The Canada Pension Plan Investment Board has made a bold move by revising its net-zero emissions target, stepping away from its original goal set for 2050. This pivotal decision signals a dramatic shift in the organization’s strategy, reflecting the increasing scrutiny surrounding investment practices and climate commitments.

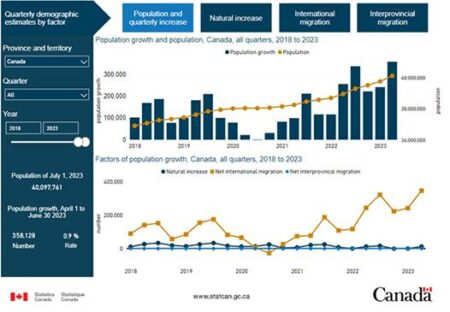

Statistics Canada reveals a striking surge in debt growth, raising alarms for Canadian households and businesses alike. As borrowing continues to climb, experts are sounding the cautionary bell, emphasizing the potential risks this trend poses to our economic stability and overall financial well-being across the nation.

Following Mark Carney’s triumphant win, Canada’s economy is navigating choppy waters. Recent job statistics have unveiled the lowest employment numbers we’ve seen in almost ten years. Experts are sounding the alarm over escalating unemployment rates, urging swift policy actions to address this pressing issue.

In today’s news, all eyes are on Statistics Canada as they prepare to unveil the job numbers for April! This eagerly awaited report promises to shed light on employment trends sweeping across the nation. Analysts are buzzing with anticipation over the crucial data that could shape economic policies and spark vibrant public discussions about job growth.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

Homebuyers in Canada are facing tough times as soaring interest rates and escalating housing costs force many to step back from the market. This shift is not just tightening household budgets; it also poses a risk of cooling the overall economy, raising alarms among policymakers and economists alike.

Canada-made automobiles are set to experience significant price increases in the U.S. market, attributed to recently imposed tariffs. Analysts warn that these higher costs could impact sales and competitiveness, raising concerns for Canadian manufacturers.

A recent central bank survey reveals that more Canadian firms anticipate a potential recession within the next year. Concerns over economic stability are rising, with business leaders increasingly wary of inflation and interest rate impacts on growth.