The Trump Organization has removed the “Made in the USA” label from its gold T1 smartphone, CNBC reports. This move marks a shift in branding strategy amid growing curiosity and speculation about the true origin of the device

Browsing: CNBC

Germany faces mounting pressure to boost its NATO defense spending to 5% of GDP. This ambitious move aims to strengthen the alliance’s readiness, yet it raises concerns about possible economic challenges amid an uncertain global environment, CNBC reports

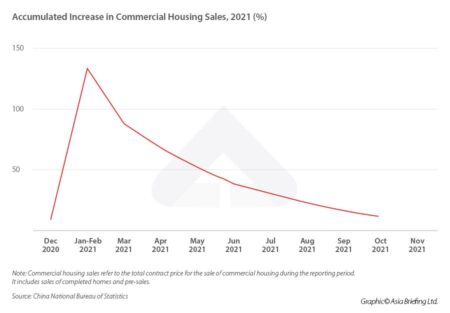

China’s property sector remains trapped in a deepening slump, further complicated by the country’s shrinking population. As demand continues to fall, developers and policymakers are grappling with increasing challenges to steady the market, CNBC reports

Chip stocks tumbled sharply after reports surfaced that the U.S. could revoke export waivers for Taiwan Semiconductor and other industry giants, igniting fears of supply chain disruptions and escalating trade tensions

The UK’s unique “magic formula” caught the eye of former President Trump, effortlessly blending business-friendly policies with rich cultural appeal, CNBC reports. This powerful approach not only boosted trade ties but also forged stronger political bonds

China’s consumer spending remains sluggish despite reopening efforts, as concerns over economic uncertainty, rising debt, and a cautious outlook weigh heavily on demand-posing a major hurdle to the nation’s post-pandemic recovery

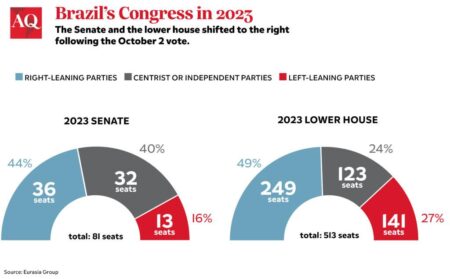

Brazil’s political landscape is buzzing with dynamic shifts, sparking new waves of change that are sending ripples through the markets. Investors need to stay sharp, watch for policy signals, and be prepared to adjust their strategies as uncertainty rattles stocks and currency values

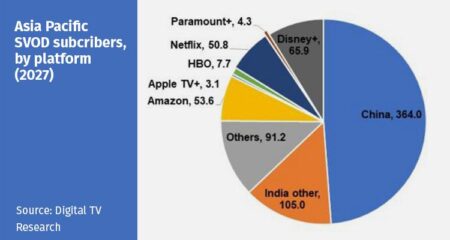

Asia-Pacific markets delivered a mixed bag of results as investors remained on edge, eagerly anticipating key updates from the high-stakes U.S.-China trade negotiations. Traders are intently focused on any clear signals about potential tariffs and groundbreaking agreements that could transform the landscape of global trade

A crypto CEO is at the center of a massive $500 million money laundering scandal tied to sanctioned Russian banks, CNBC reveals. Authorities are diving deep into complex schemes that reportedly aimed to bypass financial restrictions amid rising geopolitical tensions

Germany is exploring the idea of letting six-year-olds start saving for retirement, sparking a bold move to secure financial futures from the very beginning. This proposal highlights rising worries about whether pensions will be enough down the road

China’s BYD experienced a sharp 8% drop in its shares following the announcement of substantial price cuts designed to invigorate sales. This bold strategy, intended to sharpen its competitive edge in an increasingly crowded market, has sparked worries among investors regarding profit margins and the company’s long-term growth potential.

Germany has thrown its weight behind former President Trump’s bold proposal to ramp up NATO defense spending to a striking 5% of GDP. This significant endorsement arrives at a crucial time, as European nations are reevaluating their defense budgets in response to escalating security challenges in Eastern Europe

CNBC’s “Inside India” newsletter delves into the intriguing dynamics of the Make-in-India initiative. It reveals that although U.S. tariffs on China could open doors for India, a host of structural challenges and fierce competition from other countries might stand in the way of assured success.

As Russia grapples with mounting economic pressures from its extended military campaigns, experts believe that a struggling war economy might nudge Moscow toward the negotiating table. With sanctions tightening and resources dwindling, the Kremlin may find itself increasingly motivated to pursue diplomatic solutions

China continues to hold a commanding position in the export of rare earth metals, even as it eases some restrictions for the U.S. market. This strategic decision highlights China’s pivotal role in the global supply chain, significantly impacting industries that depend on these vital materials

Nvidia has officially announced that it will not be dispatching GPU designs to China, especially in light of recent reports about a new operation in Shanghai. This bold move highlights the company’s dedication to protecting its cutting-edge technology as geopolitical tensions continue to escalate

YouTube is gearing up to stream an exciting NFL Week 1 game for free in Brazil, marking a thrilling new chapter in sports broadcasting! This bold initiative is designed to captivate fans across the region and elevate digital engagement with the electrifying world of the NFL

In a bold strategic shift, David Tepper’s Appaloosa Management has dramatically scaled back its investments in China, anticipating the rising tide of trade tensions between the U.S. and China. This proactive decision underscores a heightened awareness of market volatility and the looming regulatory challenges that could impact future growth.

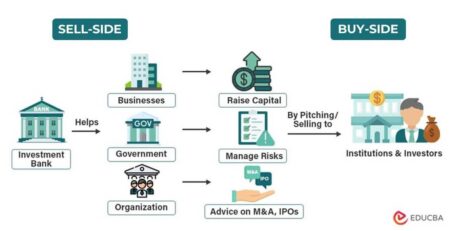

Investment banks are buzzing with optimism as they have upgraded their growth forecasts for China, thanks to an unexpected trade deal with the U.S. This landmark agreement is set to invigorate economic confidence and enhance trade flows, hinting at a promising recovery in bilateral relations and paving the way for greater market stability.

Spain is currently facing the repercussions of a widespread power outage that has sparked an intense discussion about the future of green energy. Detractors are quick to blame renewable sources, while supporters passionately champion their essential role in paving the way for a sustainable energy landscape.