China has just received its very first wheat shipment from Argentina, marking an exciting leap forward in their growing trade relationship. This milestone underscores the deepening agricultural ties between the two countries amid shifting dynamics in the global grain market, reports World-Grain.com

Browsing: commodities

Germany is turbocharging its partnership with Australia to lock in essential raw materials that are key to driving the future of green technologies. This dynamic collaboration highlights a strengthening alliance as both countries tackle the challenges of an ever-shifting global supply chain together

Soybean futures on the CBOT slipped as Brazil’s harvest surged ahead, fueling hopes for a bigger global supply. Traders reacted swiftly to the fast-moving crop progress, pushing prices lower amid growing market optimism

BHP has shattered records with its copper production at mines in Chile and Peru, driven by outstanding operational excellence. The company also unveiled thrilling progress on new projects in Argentina, showcasing exciting growth potential across its South American portfolio

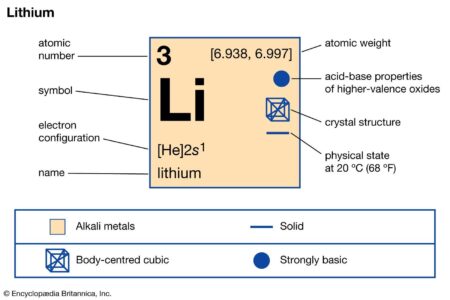

Sigma Lithium shares tumbled sharply after Brazilian regulators ordered an immediate halt to the company’s waste piles due to serious safety concerns. This sudden decision threatens to disrupt operations at a critical time, as global demand for lithium is skyrocketing

Brazil’s Petrobras is boosting gas imports to meet soaring domestic demand amid persistent supply challenges. This bold strategy aims to stabilize the market and strengthen energy security as the company navigates volatile global prices

China and Australia are caught in a mounting showdown, with fierce clashes over rare earths and iron ore fueling the fire. Trade restrictions and fierce competition for resource access lie at the core of this conflict, disrupting global supply chains and putting immense pressure on their already fragile relationship

Pilbara Minerals CEO has sounded the alarm, cautioning that Australia’s dominance in the global lithium market faces a serious challenge from Brazil’s rapidly growing production and investment. This emerging rivalry could disrupt the crucial battery metals landscape across the globe

The US and Australia have teamed up in a bold new partnership to secure rare earth mineral supplies, determined to reduce reliance on China and strengthen their foothold in the crucial critical minerals market

Brazil’s soybean exports soared to unprecedented levels in early 2024, solidifying its position as a global agricultural titan. A surge in demand from China, paired with perfect weather conditions, propelled shipments to record-breaking heights-igniting a booming harvest season and boosting the nation’s trade balance like never before

Oil prices slipped on Wednesday, dragged down by persistent concerns over a global supply glut. Heightening market unease, escalating US-China trade tensions added further strain, Reuters reports. Investors are proceeding with caution as demand forecasts remain uncertain

Australia (AUS) shines with a dynamic trade landscape, exporting abundant minerals and vibrant agricultural products while importing state-of-the-art machinery and electronics. Partnering closely with economic giants like China, Japan, and the United States, Australia plays a crucial role on the global stage

Brazil’s trading powerhouse Timbro is making a bold leap into the coffee export market, fueled by soaring global demand and thrilling growth prospects. This strategic move promises to elevate Brazil’s position in the fiercely competitive world of coffee trade, Reuters reveals

USA Rare Earth (USAR) skyrocketed to an all-time high amid thrilling talks with the U.S. government, fueling investor excitement over securing crucial supply contracts for rare earth materials

Japan’s rubber futures plunged sharply, hammered by a soaring yen and sluggish demand. Traders highlight the currency’s rally and weak global consumption as key factors driving prices lower, reports Finimize

China has dramatically increased its soybean purchases from Argentina and Uruguay amid escalating trade tensions with the US, according to Reuters sources. This bold move aims to diversify supply chains and skillfully sidestep rising tariff hurdles

Brazil eagerly looked to the U.S. for support in developing rare earth mining to meet soaring demand for these vital materials. However, escalating tariff tensions have cast a shadow over this partnership, slowing progress in strengthening supply chains essential for cutting-edge technologies

USA Rare Earth stock is plunging today amid growing concerns over supply chain disruptions and skyrocketing production costs. Investors are on high alert as rising geopolitical tensions add fuel to the fire, putting extra pressure on the rare earth materials market

Lithium Argentina AG, featured on Baystreet.ca, is making impressive strides in its lithium exploration projects across Argentina, tapping into the booming demand for battery metals fueled by the worldwide transition to clean energy and electric vehicles

On the eve of new U.S. tariffs, Brazilian beef exports soared to an all-time high in July, showcasing strong global demand despite looming trade restrictions, Reuters reports