Gold prices took a notable plunge of 3% as the U.S. and China struck a landmark tariff agreement, effectively easing trade tensions between these two economic powerhouses. This pivotal deal ignited a wave of investor optimism, redirecting attention away from safe-haven assets such as gold.

Browsing: commodities

The Trump administration is actively advocating for lower tariffs and concessions on rare earth minerals in its ongoing trade talks with China. These strategic moves are designed to not only stabilize the economy but also tackle pressing supply chain issues that are impacting U.S. industries.

China is now looking to Canadian and Australian wheat suppliers as soaring temperatures take a toll on its own crop yields. Traders highlight that this strategic pivot not only reflects China’s proactive approach to ensuring food security but also showcases the growing impact of climate challenges on agricultural production

Brazil Potash Corp. is gearing up to make a splash at major mining and agriculture investor conferences, seizing the opportunity to connect with stakeholders during a time of heightened scrutiny regarding its financial health. The company is proactively tackling qualifications that may influence its future endeavors.

China’s bold gold-buying spree has captured global attention. In a time of economic uncertainty and currency fluctuations, Beijing is on a mission to strengthen its financial stability and lessen its dependence on the U.S. dollar, all while establishing itself as a powerful contender in the international market.

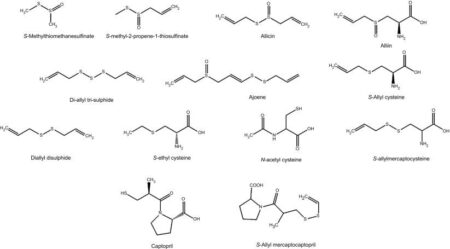

The UK’s organo-sulphur compounds market is set to experience remarkable growth, with projections indicating it will soar to 279,000 tons and an impressive value of $2.3 billion by 2035, as revealed in a recent report from IndexBox. This surge underscores the increasing demand for these dynamic compounds across a multitude of industries.

Vitol is ramping up its oil purchases from Venezuela as the clock ticks down on a crucial U.S. license that allows these transactions. This bold move highlights the trading giant’s strategic maneuvering to lock in supplies while navigating the increasingly stringent sanctions on Venezuelan crude.

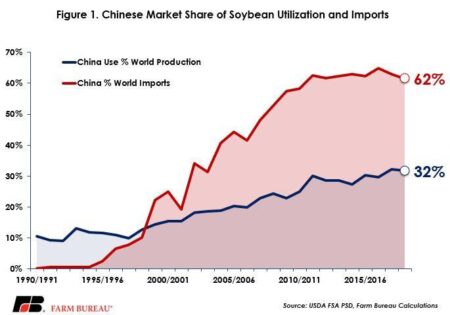

In March, China’s soybean imports from the U.S. skyrocketed, driven by a surge in demand as global supplies tighten. Yet, analysts believe that Brazil will maintain its stronghold in the market, capitalizing on its impressive production capabilities to satisfy China’s long-term requirements.

Exciting news for commodity traders! They are gearing up to submit their bids for Italy’s vital gas storage facility, the Interconnector Pipeline (IP), by May. This strategic initiative is a key part of Italy’s mission to bolster energy security in response to the surging demand for resources.

USA Rare Earth stock soared dramatically after news broke that the Trump administration is set to stockpile essential metals. This development has sparked a wave of optimism among investors, who are eager about the prospects of heightened demand in light of persistent global supply chain challenges.

Exciting news from Pacific Bay Minerals! The company has officially announced the resumption of trading for its highly anticipated Brazil Gold Property, following a significant update. Investors are on the edge of their seats, eagerly awaiting more details as Pacific Bay advances its exploration and development initiatives in this promising region.

Vale has announced a dip in iron ore production for the first quarter, primarily attributed to the heavy rains sweeping across Brazil that have hampered mining activities. This weather-related disruption poses significant challenges for the company as it strives to sustain its production levels. With these adverse conditions in play, concerns are mounting regarding future supply stability.

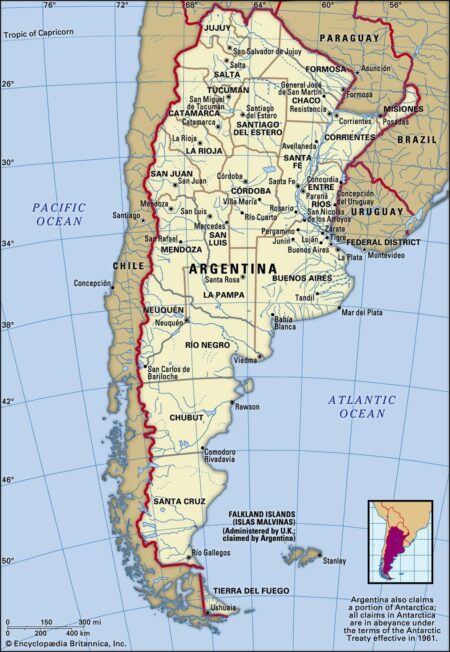

Argentina is poised for a record wheat harvest this season, bolstered by favorable weather and an increase in plantings. Experts suggest that extending cuts to export taxes could further enhance production and stimulate the economy, benefiting farmers nationwide.

Brazil’s booming offshore oil sector is becoming a crucial supplier for China’s energy needs. As Chinese firms invest heavily in Brazilian oil projects, the two nations strengthen their economic ties, reshaping global energy dynamics amidst rising demand.

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

Brazil’s Petrobras announced plans to resume operations at its Paraná fertilizer plant in June, aiming to boost domestic production. The move aligns with the company’s strategy to enhance Brazil’s agricultural sector amidst rising global fertilizer demands.

Brazil could emerge as a significant beneficiary of the U.S. tariffs on imports, economists suggest. As American companies seek alternative suppliers, Brazilian exports in agriculture and manufacturing may see a substantial boost.

Russia’s economy faces a severe crisis as oil prices plummeted by 31%, marking a significant blow to President Vladimir Putin’s financial stability. The sharp decline raises concerns about the nation’s fiscal resilience and potential implications for global markets.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

In a bold economic move, former President Donald Trump proposed a 25% tariff on countries that purchase oil and gas from Venezuela. The policy aims to pressure the Maduro regime while altering global energy dynamics amid ongoing sanctions.