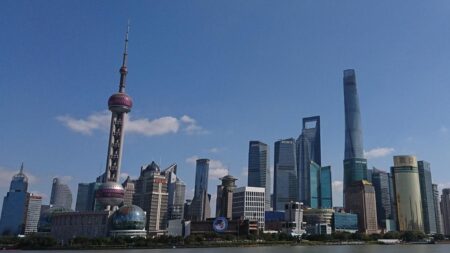

China has delivered a bold message to former President Trump, showcasing its formidable control over U.S. dollar debt and underscoring Beijing’s vital role in sustaining global financial stability, Asia Times reports

Browsing: currency

The Nikkei 225 surged an impressive 3% following Japan’s announcement of a snap election, driven by a softer yen against major currencies. Investors are eagerly embracing market-friendly policies, igniting fresh optimism and momentum in the equity markets, IG.com reports

A warning has been raised about the future of cash in Australia following a groundbreaking government decision. Experts caution that this move could accelerate the shift toward a cashless society, igniting urgent concerns over accessibility and privacy

The Brazilian Real surged dramatically following upbeat labor market data that highlighted the economy’s impressive strength. Traders quickly seized the opportunity, igniting a surge of optimism across currency markets-vividly reflected in real-time TradingView analytics

The Bank of Japan is signaling a bold shift from its ultra-loose monetary policy, hinting at possible rate hikes as the yen weakens and inflation concerns mount. Markets are buzzing with anticipation, closely watching for policy moves and their potential impact on the economy

Canada has been dethroned as the U.S.’s top trading partner, marking a major shift in the economic relationship between these longtime neighbors. This shake-up could ripple through cross-border trade costs, impact consumer prices, and soon, it might be felt right in your wallet

The U.S. Mint has just struck its very last pennies, closing an extraordinary chapter in American history. These rare coins will be meticulously preserved and eventually auctioned, igniting excitement among collectors and history enthusiasts worldwide

Ukraine is gearing up to rename the kopeck coin, its smallest currency unit, in a bold move to break away from Russian influence. This change underscores the nation’s strong resolve to strengthen its national identity amid rising tensions, Reuters reports

Contrary to recent rumors, India has not withdrawn 500 billion euros from the UK economy. The Quint clears the air, confirming that no such massive financial transaction has taken place between the two nations

Argentina’s Central Bank has slashed reserve requirements to unleash a wave of liquidity into the financial system, sparking hopes for a much-needed boost in economic activity amid ongoing market hurdles, Bloomberg reports

Argentina’s bonds, stocks, and currency surged dramatically following Javier Milei’s presidential victory, igniting a wave of excitement among investors eager for bold economic reforms and a fresh chapter of market-friendly policies, analysts reveal

China is rapidly slashing its reliance on the dollar, aggressively pushing efforts to elevate the yuan’s influence in global trade and finance. This daring move marks a pivotal moment in reshaping the future of the international monetary system

China’s central bank has subtly boosted the yuan, riding a surge of economic optimism and signaling robust confidence in the country’s growth prospects. This calculated step aims to stabilize the currency and attract foreign investment, Bloomberg reports

China is intensifying its push to rein in the yuan’s surge, a daring move designed to protect its export advantage amid a storm of global economic uncertainties, reports the Council on Foreign Relations

The Russian rouble and Moscow stock market surged dramatically after former U.S. President Trump shared optimistic remarks about Russia, Reuters reports. Investors eagerly seized the opportunity, igniting a fresh wave of confidence amid persistent geopolitical tensions

Argentina’s Finance Minister Javier Milei is staking his political future on a strong peso, fiercely committed to curbing inflation and reigniting investor confidence amid economic chaos-though this daring strategy could send shockwaves through the markets

China is accelerating its drive to transform the renminbi into a global powerhouse, expanding its influence across international trade and finance. This ambitious move aims to challenge the dominance of the US dollar and boost China’s economic impact worldwide

China is gearing up to turbocharge the yuan’s global reach with an exciting new operations centre, unveiled by the People’s Bank of China. This ambitious move aims to boost the currency’s international clout and speed up cross-border transactions like never before

The United States has expressed its strong support for Japan’s view that the dollar-yen exchange rate is primarily driven by economic fundamentals. This shared perspective seeks to bolster stability in financial markets during these times of global economic uncertainty, according to officials

The U.S. dollar may be on the brink of a further decline as enthusiasm for ‘Brand USA’ wanes. Analysts suggest that changing global perceptions and various economic factors could weaken the currency’s position in the months ahead.