Profit remittances are poised to put intense pressure on Brazil’s real this December, as investors scramble to repatriate earnings amid growing global uncertainty. Bloomberg reports that the currency is facing substantial strain due to persistent capital outflows

Browsing: currency exchange

The US sanctions targeting Russia’s oil giants are set to tighten Moscow’s financial grip, ramping up pressure on the rouble and squeezing the Russian economy by slashing crucial revenue from its energy exports, Reuters reports

The dollar soared even higher against the yen on Tuesday, fueled by traders’ keen anticipation of the upcoming U.S. jobs report-a crucial indicator poised to influence Federal Reserve decisions and drive market movements, Reuters reports

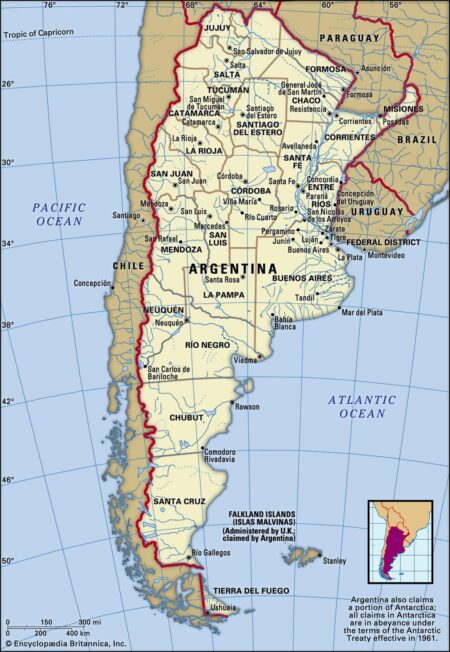

Argentina’s bonds, stocks, and currency surged dramatically following Javier Milei’s presidential victory, igniting a wave of excitement among investors eager for bold economic reforms and a fresh chapter of market-friendly policies, analysts reveal

Stocks slipped as global investors reacted to the twists and turns in U.S. Treasury yields, while the Argentine peso surged on a fresh wave of market optimism. This Treasury shake-up sparked a cautious atmosphere across emerging markets

The U.S. dollar exchange rate in Argentina has soared to an unprecedented AR$1,380, underscoring the nation’s escalating economic crisis. This sharp plunge in the peso’s value is fueling soaring inflation and putting immense pressure on everyday budgets, reports the Buenos Aires Herald

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions

The yen soared after forecasts showed Japan’s ruling LDP coalition is set to lose its parliamentary majority. Market watchers view this shift as a strong signal that major policy changes could be on the way

Argentina’s black market for dollars is witnessing a notable decline as the government takes steps to relax stringent currency controls. This strategic shift is designed to bring stability to the economy, yet hurdles remain. With inflation and economic uncertainty still looming large, public confidence continues to waver.

Argentina has triumphantly secured a staggering $42 billion in funding from the International Monetary Fund and various other sources, signaling a bold new chapter in its economic policy. By lifting long-standing currency controls, the country is taking decisive steps to stabilize its economy amidst persistent financial challenges. This pivotal move could pave the way for renewed growth and prosperity.

Japan’s Finance Minister Kato has proposed an intriguing idea: the nation’s substantial holdings of US Treasury securities might just become a powerful bargaining chip in trade negotiations. This bold statement highlights Japan’s strategic maneuvering as it navigates the complex landscape of economic discussions with the United States.

In a significant policy shift, President Javier Milei has lifted tight currency and capital controls in Argentina, aiming to stimulate economic growth. This move is expected to increase market confidence but may also raise concerns about inflation and financial stability.

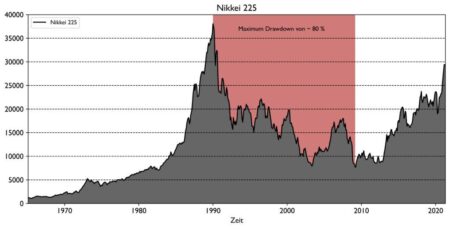

Japan’s Nikkei index fell significantly as escalating trade war concerns and a strengthening yen dampened investor sentiment. Market analysts highlight the negative impact of ongoing U.S.-China tensions on Japanese exports and economic stability.

Indonesia has emerged as a budget-friendly travel destination, joining the ranks of Japan, Thailand, Vietnam, Laos, and Cambodia following a significant decline in its currency. This shift offers travelers affordable experiences in Indonesia’s rich culture and stunning landscapes.

Japan’s Nikkei index fell to a four-month low, driven by concerns over the U.S. economic outlook and a strengthening yen. Investors are wary of potential impacts on export competitiveness, prompting a cautious approach in the market.

The recent discussions at the Council on Foreign Relations highlight the intricate relationship between the iPhone’s global supply chain, the IMF’s fiscal policies, and China’s shifting balance of payments, signaling potential implications for international trade dynamics.