China Vanke has secured a vital temporary reprieve on its overdue bond payments, easing concerns about its financial stability. This welcome relief gives the property giant crucial breathing room to confront ongoing market challenges with renewed strength

Browsing: debt

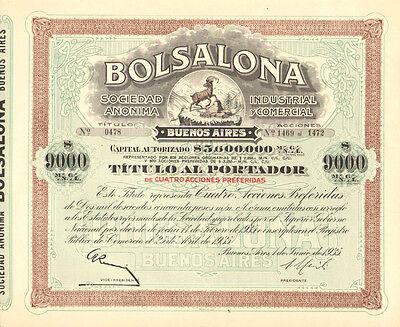

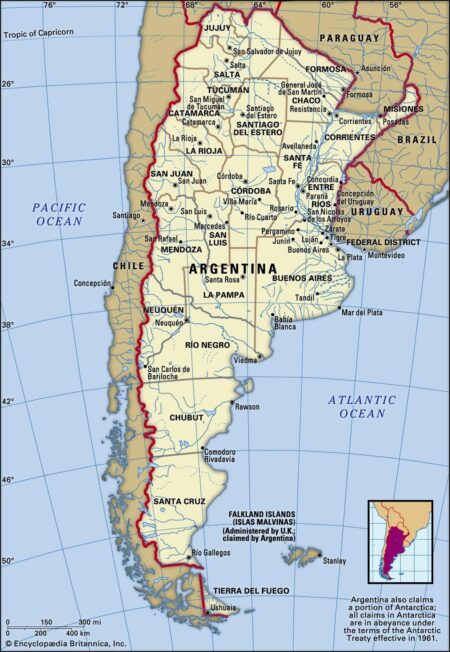

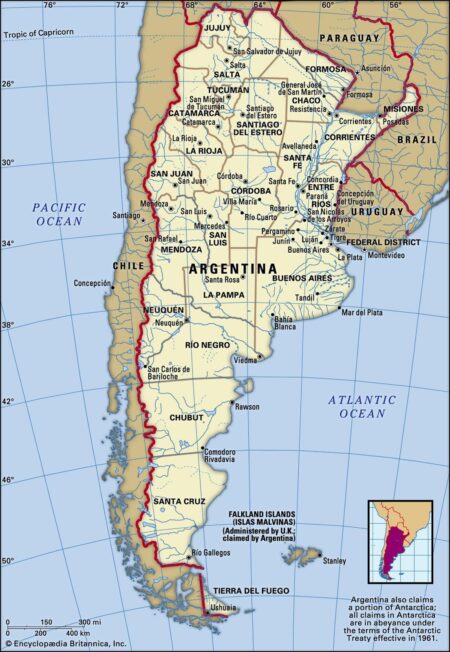

Argentina’s bonds surged in a thrilling trading session as investors reacted to a measured U.S. pledge of support. Market watchers remain on high alert, navigating persistent economic uncertainty and growing demands for further assistance

Argentina’s economy is in turmoil, wrestling with a severe crisis sparked by harsh fiscal cuts and policy missteps. Now, the nation is urgently reaching out to the U.S. for financial aid to stabilize its shaky markets and restore confidence among investors

Claire’s has filed for bankruptcy protection in the U.S. and Canada, battling overwhelming debt and intense competition. This beloved accessories retailer is now zeroing in on restructuring efforts to restore stability and reinvent itself in a rapidly changing market

Argentina is making daring moves to replenish its dangerously low cash reserves amid mounting economic challenges. The government’s bold shock therapy aims to steady the economy and spark renewed investor confidence, Bloomberg reports

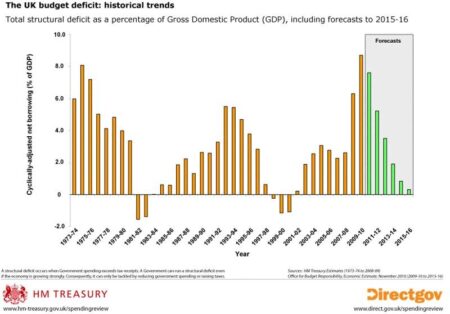

The UK’s borrowing has skyrocketed as soaring inflation drives up the cost of debt servicing, deepening Chancellor Jeremy Reeves’ fiscal challenges. Experts warn that this alarming trend could place heavy strain on public finances and limit future policy options

Germany is dramatically ramping up its borrowing to unprecedented heights, powering bold economic recovery plans and pioneering green initiatives. This daring surge in debt marks a significant shift in the nation’s fiscal strategy, sparking vibrant debate across Europe

In a surprising turn of events, Japan has relinquished its title as the world’s top creditor nation to Germany, marking the end of a remarkable 34-year reign. This significant shift highlights Japan’s mounting debts and sluggish economic growth, while Germany’s thriving exports continue to strengthen its financial prowess on the global stage.

In Italy, the spotlight on “lo spread”—the interest rate gap between Italian and German bonds—has started to fade as fresh priorities take center stage. Analysts suggest that this change signals deeper worries, emphasizing the importance of stability that goes beyond just figures

Argentina’s recent IMF deal marks a critical financial maneuver aimed at stabilizing its economy. Negotiations involved stringent fiscal reforms and commitments to reduce inflation, showcasing the government’s resolve to navigate ongoing economic challenges.

Italy has proposed a new initiative within the EU aimed at enhancing defense capabilities without increasing national debt. The plan involves leveraging EU guarantees, seeking to bolster security amidst rising geopolitical tensions.

Hudson’s Bay Company faces nearly $1 billion in debt, as recent court filings reveal a troubling financial outlook. The iconic retailer’s struggles underscore the challenges of a changing retail landscape and heightened competition.

As Germany embraces expansive fiscal policies to stimulate its economy, questions arise about the implications for the Eurozone. Will its robust spending capacity create tensions among member states or lead to a stronger, more unified Europe?

Ford has announced a significant €4.4 billion investment to support its struggling German subsidiary. This financial injection aims to address ongoing challenges and revitalize operations in a key European market amid a competitive automotive landscape.