The United Kingdom’s S&P Global Composite PMI for January came in at 53.7, narrowly missing the expected 53.9. This figure highlights a steady yet modest growth across both the services and manufacturing sectors, according to FXStreet

Browsing: economic data

Vehicle sales in Spain skyrocketed to an impressive 1,148,650 units in 2025, marking a striking 12.9% surge compared to 2024. For the second consecutive year, sales have shattered the one million barrier, showcasing strong and steady market momentum.

Spain’s manufacturing sector faced a steep decline in January, as falling demand sparked a significant contraction. Experts warn this downturn could signal more serious economic challenges ahead for the country

France’s consumer morale remained robust in January, reflecting steady confidence amid economic uncertainties, according to the latest data on TradingView. Analysts are eagerly watching for any shifts in the coming months

Japan’s export growth in December slowed to 5.1%, missing expectations as shipments to the U.S. faced a sharp decline. This downturn raises concerns over weakening demand amid global economic uncertainties, casting a shadow on the country’s trade momentum

Spain’s final 12-month EU-harmonised inflation rate remained steady at 3.0% in December, highlighting a robust economic recovery amid the persistent inflation challenges sweeping across Europe

German industrial production defied expectations last month with a powerful surge, driven primarily by a remarkable boom in automobile manufacturing, Bloomberg reports. This impressive upswing in the auto sector energized overall factory output, dispelling recent concerns about an economic slowdown

Italian manufacturing contracted in December at its fastest pace since March, Reuters reports. The PMI reveals a sharp decline in new orders, spotlighting ongoing economic challenges and sluggish demand across the sector

Spain’s final 12-month EU-harmonised inflation rate dipped slightly to 3.2% in November, offering a glimmer of relief amid persistent price pressures. This number underscores the ongoing economic challenges confronting the eurozone

Japan’s household spending dipped in April, revealing persistent softness in domestic demand as consumers remain cautious amid economic uncertainties, Bloomberg reports. This decline raises concerns about the nation’s growth momentum and its future outlook

Italy’s EU-harmonised Consumer Price Index (CPI) for November dipped to 1.1% year-on-year, coming in below expectations, according to TradingView data. This cooling trend signals a welcome easing of inflationary pressures as the year winds down

KPMG’s latest report highlights Germany’s vibrant economy, featuring strong industrial output, steady export growth, and impressively low unemployment. Driving this momentum are key sectors such as automotive, technology, and renewable energy powering the nation’s success

India has unveiled ambitious plans to replace closed factories in its data collection system, aiming to dramatically enhance the accuracy of industrial output statistics, Reuters reports. This bold move promises to deliver a clearer and more trustworthy picture of the manufacturing sector’s real performance

BREAKING: France’s industrial production soars past expectations, showcasing robust economic momentum. This positive surge boosts market confidence, driving EURUSD slightly upward amid growing investor optimism. – XTB.com

China’s services sector growth slowed to its weakest pace in three months this October, according to the latest PMI data from Reuters. This cooling trend underscores ongoing challenges in domestic demand as economic uncertainties continue to cast a shadow over the market

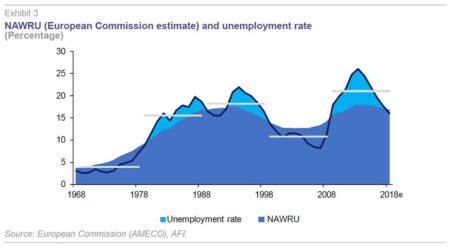

Spain’s unemployment surged by 0.91% in October compared to September, driving the total number of jobless individuals to a staggering 2.44 million, according to TradingView data. This increase highlights the ongoing challenges and uncertainties gripping Spain’s labor market

Canada’s factory sales are set to soar by 2.8% in September, according to a Statscan flash estimate reported by Reuters. This striking increase signals a powerful surge in manufacturing activity, underscoring the strong momentum driving the ongoing economic recovery

Germany’s services sector faced a surprising setback in August, slipping into contraction and signaling a rare stumble amid mounting economic uncertainty. According to Bloomberg, this downturn may be a warning sign of tougher times ahead for Europe’s largest economy

Spain’s services PMI dipped from 55.1 in July to 53.2 in August, signaling a cooling in the sector’s rapid expansion. Yet, with the index firmly above the 50-point mark, steady growth remains on track

China’s economic and social data continue to ignite fierce debate among experts. Despite official reports, glaring inconsistencies and a persistent lack of transparency fuel growing skepticism about the true accuracy of Beijing’s statistics, casting a long shadow over global assessments