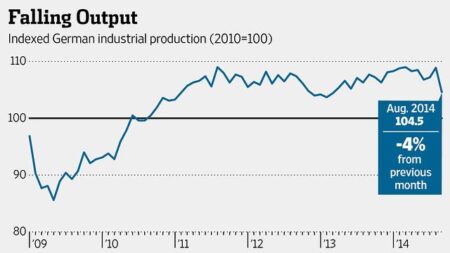

German industrial output surged an impressive 1.2% in May, surpassing analyst predictions, Reuters reports. This unexpected boost showcases the remarkable resilience of Germany’s manufacturing sector despite persistent global economic headwinds

Browsing: economic indicators

China’s latest PMI data paints a vivid picture of a manufacturing sector grappling with persistent challenges. Sluggish domestic demand and escalating global trade pressures are fueling this ongoing slowdown, the Wall Street Journal reports

Argentina has just posted its biggest current account deficit since Q3 2023, reveals TradingView data. This widening gap highlights the ongoing economic challenges the nation grapples with amid volatile trade dynamics and shifting currency values

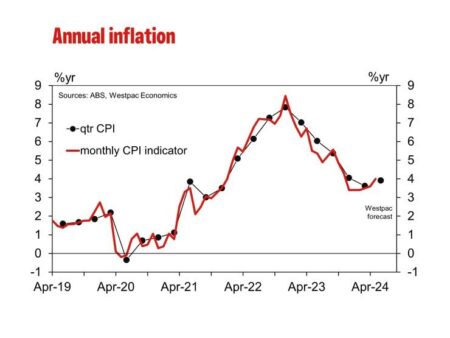

Australia’s CPI inflation slowed more than expected in May, easing pressure on the Reserve Bank and sparking renewed market optimism about potential rate cuts. Investors are now eagerly watching upcoming economic data for new clues

Japan’s flash PMI shows a modest uptick in business activity, signaling cautious optimism among companies navigating ongoing economic uncertainties. Analysts expect a steady recovery ahead but stress the importance of staying vigilant as challenges persist

Italy’s construction output is skyrocketing, according to the latest report, showcasing a dynamic resurgence in the sector. Driven by soaring demand and robust government investments, this surge is igniting fresh optimism about Italy’s economic revival

Japan’s net external assets have soared to an all-time high, yet the nation has relinquished its title as the world’s top creditor for the first time in more than ten years. This pivotal change underscores the evolving landscape of global economics and the hurdles confronting Japan’s economy

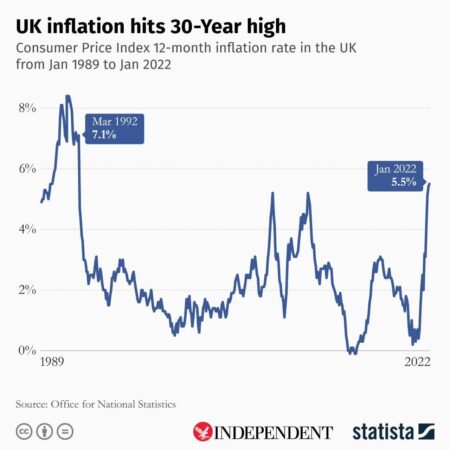

UK inflation rates have skyrocketed, sparking worries about the rising cost of living. Recent data reveals that prices are climbing at an alarming rate, affecting everything from your weekly grocery shop to soaring energy bills. As families prepare for tighter budgets, experts are weighing in on the potential economic fallout.

The Bank of Spain has raised a red flag about a slowdown in the growth of lending income, signaling potential hurdles for the financial sector. This shift could pose challenges to economic recovery efforts, sparking worries among both investors and policymakers.

The United States has expressed its strong support for Japan’s view that the dollar-yen exchange rate is primarily driven by economic fundamentals. This shared perspective seeks to bolster stability in financial markets during these times of global economic uncertainty, according to officials

Germany’s May flash manufacturing PMI registered at 48.8, just shy of the anticipated 48.9, highlighting a persistent contraction in the sector. This data underscores the ongoing hurdles faced amid economic uncertainties, suggesting that policymakers may need to consider adjustments to navigate these challenges effectively

Statistics Canada reveals a striking surge in debt growth, raising alarms for Canadian households and businesses alike. As borrowing continues to climb, experts are sounding the cautionary bell, emphasizing the potential risks this trend poses to our economic stability and overall financial well-being across the nation.

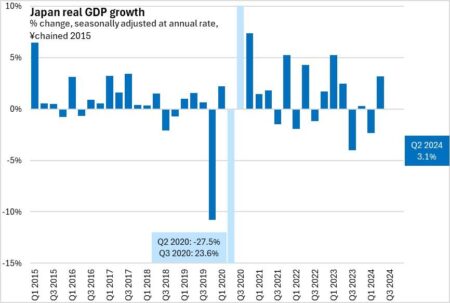

Japan’s economy faced a surprising setback in the first quarter of 2023, contracting at an annualized rate of 0.7%, as reported by Reuters. This unexpected downturn underscores persistent challenges, such as sluggish consumer spending and global economic headwinds that continue to hinder recovery efforts.

Japan’s stock market wrapped up the day on a positive note, with the Nikkei 225 inching up by 0.01%. Investors are navigating through a landscape of mixed corporate earnings and global market dynamics. Analysts are keeping a watchful eye on potential economic shifts and the evolving relationship between the U.S. and China.

Japan’s economy has taken a surprising turn, contracting for the first time in a year and sparking worries among analysts. This unexpected downturn arrives just as looming tariff increases threaten to add more pressure on growth. Economists are sounding the alarm, suggesting that this trend could be an early warning of more significant economic hurdles on the horizon.

Australia witnessed an impressive boost in employment during April, with job opportunities soaring across multiple sectors. At the same time, the unemployment rate held firm at 3.5%, showcasing a resilient labor market as the economy continues its path to recovery.

Asian markets saw a retreat from earlier gains following optimistic reactions to China’s rate cuts and ongoing talks between U.S. officials. Investors remain cautious amid global economic uncertainties, reflecting a complex landscape for regional stocks.

China’s economy is under the microscope as vital data becomes increasingly elusive, sparking worries among analysts. The Wall Street Journal emphasizes the difficulties in gauging economic vitality when key statistics are disappearing, making it harder to predict trends and formulate effective policies

Germany’s preliminary GDP for Q1 has shown a modest growth of 0.2%, perfectly aligning with expectations. This slight increase highlights the ongoing resilience of Europe’s largest economy, even in the face of global economic uncertainties. However, analysts are approaching this news with caution, as various challenges continue to loom on the horizon.

As we step into January 2025, the UK’s private capital market is navigating a vibrant and challenging macroeconomic landscape. With interest rates on the rise and inflation making its presence felt, investors are rethinking their strategies. They are on a quest for resilience in the face of market fluctuations while skillfully adapting to evolving regulatory changes.