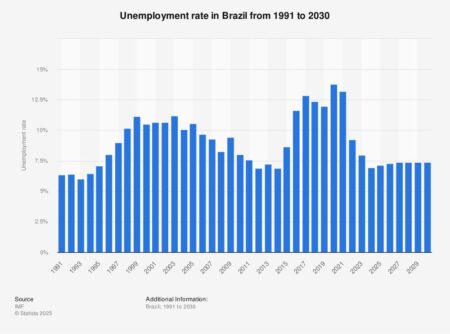

Brazil has witnessed a remarkable plunge in unemployment, showcasing a powerful economic comeback. The latest figures from MercoPress reveal that key industries are booming with job creation, sparking fresh hope and excitement for the future of the nation’s workforce

Browsing: economic news

Argentina’s markets tumbled sharply following Javier Milei’s defeat in the Buenos Aires election, sparking investor concerns over political uncertainty and the fate of crucial economic reforms, Reuters reports via Investing.com

Most of Canada’s counter-tariffs on U.S. goods have now been lifted, marking a significant step toward easing trade tensions between the two countries. This encouraging progress follows months of intense negotiations aimed at restoring a smoother and more collaborative bilateral trade relationship

German unemployment has surged beyond 3 million, highlighting a dramatic increase amid persistent economic struggles. This alarming rise intensifies concerns over the stability of the job market in Europe’s largest economy, DW reports

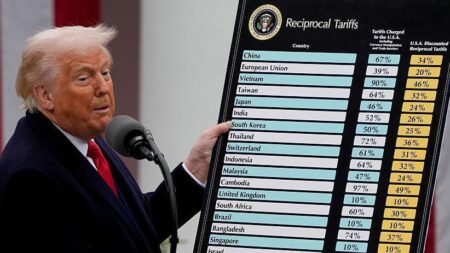

The US has officially informed India that new tariffs, originating from former President Trump’s trade penalties, will take effect starting tomorrow. This move directly impacts key Indian exports and intensifies the already heated trade tensions between the two countries

Canada has announced it will lift most retaliatory tariffs on U.S. goods, marking a significant breakthrough in easing trade tensions between the two neighbors. This move follows encouraging progress in bilateral talks aimed at resolving ongoing disputes, Al Jazeera reports

The U.S. dollar exchange rate in Argentina has soared to an unprecedented AR$1,380, underscoring the nation’s escalating economic crisis. This sharp plunge in the peso’s value is fueling soaring inflation and putting immense pressure on everyday budgets, reports the Buenos Aires Herald

Germany’s economy contracted in the latest quarter, signaling mounting challenges ahead. Surging inflation, skyrocketing energy costs, and global uncertainties are weighing heavily, casting a shadow over Europe’s largest economy, according to Semafor

USA Rare Earth stock is plunging today amid growing concerns over supply chain disruptions and skyrocketing production costs. Investors are on high alert as rising geopolitical tensions add fuel to the fire, putting extra pressure on the rare earth materials market

France now faces the startling prospect of borrowing costs overtaking those of Italy, highlighting growing investor concerns about its fiscal outlook. This surprising development reveals changing tides in the Eurozone debt markets, reports Le Monde.fr

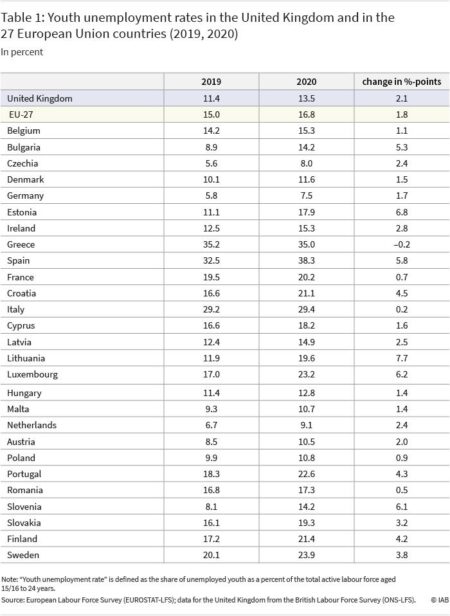

Youth unemployment in Canada is skyrocketing to record highs, driven by persistent economic hurdles. Experts warn that if this urgent issue isn’t addressed swiftly, it could threaten not just the career prospects of young people but the stability of the entire economy

On the eve of new U.S. tariffs, Brazilian beef exports soared to an all-time high in July, showcasing strong global demand despite looming trade restrictions, Reuters reports

Argentina’s YPF experienced a dramatic nearly 90% drop in Q2 profits, battered by plunging fuel prices. The state-run oil giant faces mounting challenges as global market turmoil and softening demand weigh heavily on its performance, Reuters reports

The IMF has granted Argentina a crucial reserve waiver and eased its reserve accumulation target, offering a vital boost to the country as it tackles persistent economic challenges, Buenos Aires Herald reports

Trump ramps up trade tensions with fresh tariffs on Canada and unveils unexpected trade moves. Stay tuned for live updates on the unfolding impact and worldwide reactions!

No tariff pause emerged from the latest US-China trade talks, as tensions continue to simmer. Meanwhile, President Trump is preparing to impose new tariffs of 20-25% on Indian imports, intensifying the ongoing trade conflicts

A surprise trade deal with Japan has sparked a wave of excitement across the globe, igniting hopes for wider and more powerful economic alliances. This unexpected agreement signals major changes on the horizon for regional trade dynamics

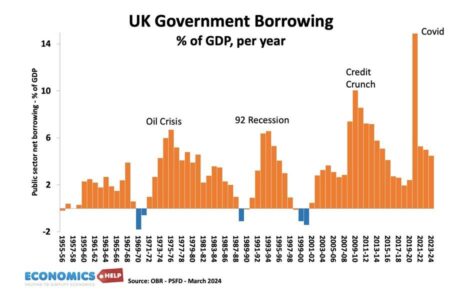

UK borrowing has surged dramatically as soaring inflation drives debt servicing costs to unprecedented levels, Reuters reports. With interest rates climbing steadily, the government is under increasing fiscal strain, raising serious concerns about the country’s long-term economic future

The yen soared after forecasts showed Japan’s ruling LDP coalition is set to lose its parliamentary majority. Market watchers view this shift as a strong signal that major policy changes could be on the way

UK inflation has soared to its highest level since January 2024, intensifying pressure on the Bank of England as it weighs potential rate cuts. Markets are navigating cautiously, with policymakers walking a delicate tightrope between curbing inflation and supporting economic growth