The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions

Browsing: economic outlook

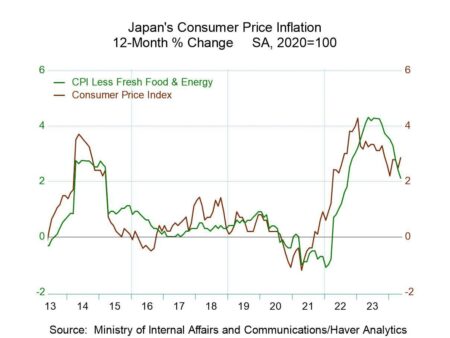

Japan’s core inflation slipped slightly but remained above the Bank of Japan’s 2% target, sparking market excitement over a potential rate hike as policymakers navigate the delicate balance between inflation pressures and economic growth

Canada’s banks are on the brink of remarkable growth, fueled by a trading frenzy and a surge of investor confidence that’s electrifying the market. Experts are buzzing with predictions that the sector is set to “pop,” signaling an exciting rally in banking stocks

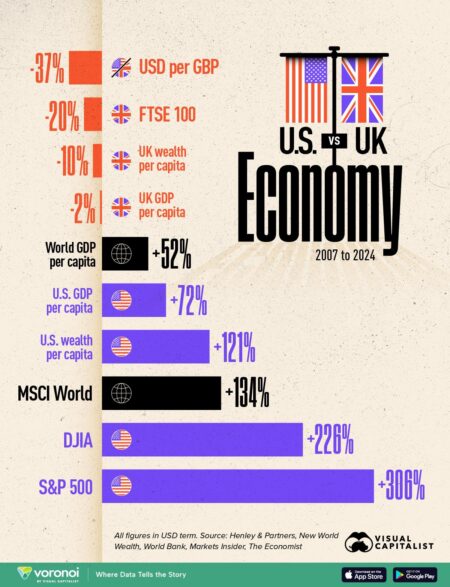

The UK economy contracted for the second consecutive month this May, raising fresh concerns about its growth outlook. Experts warn that ongoing challenges could seriously hinder future progress

The OECD Economic Survey: Argentina 2025 highlights the nation’s most urgent challenges and promising opportunities on its path to sustainable growth. It urges bold reforms in fiscal policy, inflation control, and investment approaches to boost resilience and foster greater inclusion

Goldman Sachs bankers foresee a surge of mergers and acquisitions in Brazil following the upcoming election, anticipating that renewed investor confidence and bold economic reforms will spark a dynamic wave of deal-making, Bloomberg reports

Shares soared on renewed optimism about China-US trade talks, igniting a surge of investor excitement. Meanwhile, the dollar slipped against major currencies, reflecting a cautious atmosphere amid ongoing geopolitical uncertainties

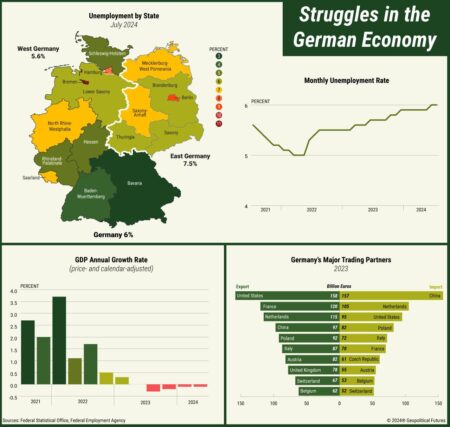

German export sentiment has taken a hit amid looming tariff threats, the Ifo Institute revealed on Thursday. Escalating trade tensions are stirring uncertainty among exporters, casting a shadow over growth prospects

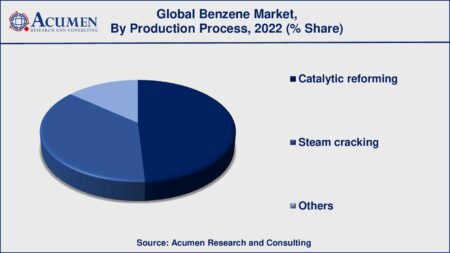

The UK’s benzene market is set for an exciting surge, projected to skyrocket to 2.1 million tons in volume and reach a staggering $1.6 billion in value by 2035, according to IndexBox’s latest report

Japan’s flash PMI shows a modest uptick in business activity, signaling cautious optimism among companies navigating ongoing economic uncertainties. Analysts expect a steady recovery ahead but stress the importance of staying vigilant as challenges persist

More than 70% of Japanese firms report that recent tariffs have impacted their business-yet only within anticipated boundaries-according to a Reuters poll, reflecting cautious optimism amid ongoing trade tensions

Germany’s economy is poised for an exciting surge in 2026, driven by groundbreaking technological innovations and a thriving export market, experts reveal in their latest forecasts

Bruegel’s latest report uncovers ten urgent challenges facing China’s economy-from slowing growth and rising debt risks to dramatic demographic shifts-highlighting major hurdles that threaten the nation’s economic stability and its role on the global stage

China’s consumer spending remains sluggish despite reopening efforts, as concerns over economic uncertainty, rising debt, and a cautious outlook weigh heavily on demand-posing a major hurdle to the nation’s post-pandemic recovery

The IMF’s 2025 Article IV Consultation for Spain highlights robust economic growth and improved fiscal stability, while emphasizing the need for continued reforms to boost productivity and address labor market challenges decisively

Australia’s modest Q1 economic growth has sparked rising concerns about a sluggish recovery, signaling a potential need for bolder fiscal stimulus to boost spending and protect jobs, Reuters reports

UK Chancellor Jeremy Reeves spotlights encouraging signs of economic recovery, but he also acknowledges rising public frustration over soaring inflation and stagnant wage growth-underscoring the tough challenges that lie ahead for government policy

Argentina’s inflation is set to ease to 28.6% by year-end, Reuters reveals. This encouraging decline marks a significant shift from earlier highs, showcasing the government’s relentless efforts to stabilize the economy amid ongoing challenges

The Bank of Canada held its key interest rate steady at 2.75%, underscoring ongoing uncertainties tied to tariff negotiations. With trade talks remaining unpredictable, the central bank chose a cautious approach amid a clouded economic outlook

Economists are sounding the alarm, declaring that Canada has slipped into a recession. With consumer spending taking a hit and inflation on the rise, the outlook is concerning. Analysts predict that these persistent economic pressures may spell extended difficulties for Canadian households and businesses alike.