As Trump extends bailout offers to Argentina, analysts warn of a looming “debt trap” linked to expanding financial ties with China. Concerns are mounting over the far-reaching geopolitical and economic impacts this could have on the region

Browsing: economic policy

France is gripped by nationwide strikes as workers rise up against austerity measures. Public transport, schools, and essential services are facing major disruptions. Unions are calling on the government to reconsider budget cuts amid mounting public frustration. (Le Monde.fr)

Trump’s tariff threats are sending shockwaves through the UK’s trade negotiations, putting a seamless post-Brexit deal at serious risk. Officials warn that these looming tariffs could strike key sectors hard, throwing ongoing talks into chaos

The Guardian reveals that Trump’s support for Argentina’s bailout goes beyond mere economics-unveiling a shrewd political move with far-reaching effects amid rising global financial tensions

The Bank of Canada caught markets off guard by slashing interest rates, despite ongoing uncertainty surrounding the inflation outlook, according to minutes from the latest meeting. Officials weighed economic risks with caution before deciding to ease monetary policy

The Atlantic Council explores the US currency rescue for Argentina, igniting a heated debate: Is this a smart strategy to stabilize the region, or a high-stakes gamble that could unleash broader economic chaos?

UK Labour leader Keir Starmer emphasized the need for “firm and fair” action to address the nation’s soaring debt. He called for balanced policies that not only secure economic stability but also protect essential public services, Reuters reports

Japan’s emerging leaders are facing criticism for overlooking stock market investment as a vital driver of economic growth. Despite increasing demands for reform, their reluctance raises concerns about missed opportunities to revitalize the economy

Farmers in Argentina are raising their voices against former President Trump’s proposed bailout, claiming it heavily favors big corporations and leaves small-scale producers out in the cold. They caution that this plan threatens local agriculture and could destabilize the region’s economy

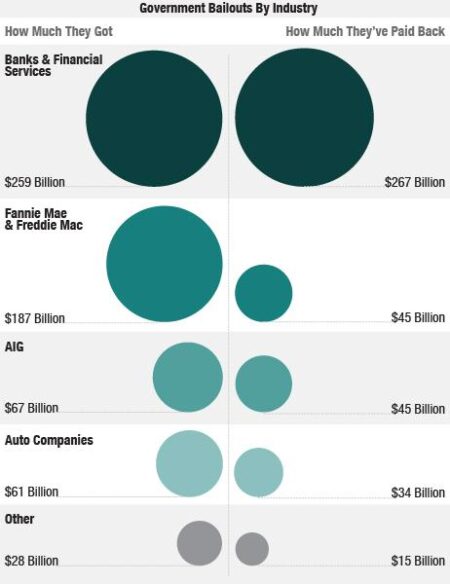

Argentina has just locked in a staggering $20 billion aid package from the US amid its ongoing economic turmoil, agreeing to hand over control of its economic policy as part of the deal. This bold step aims to stabilize the nation’s finances and spark renewed investor confidence

China has officially launched an investigation into Mexico’s tariffs on imports from Asia, sparking concerns over rising trade barriers and unfair practices. This bold move aims to address escalating tensions in their bilateral trade relationship directly

Argentina’s Javier Milei, once hailed by markets for his daring free-market vision, is now facing a sharp decline in investor confidence. Confronted with growing economic hurdles, he has turned to Donald Trump’s populist playbook in a desperate effort to regain support

The U.S. is ramping up financial support for Argentina, signaling that this focused aid is a strategic move-not an indication of widespread economic issues in the region, reports MarketWatch

Finance Minister seals a groundbreaking bilateral debt restructuring agreement with the United Kingdom, set to ease repayment terms and strengthen economic ties. This transformative deal offers crucial fiscal relief, opening the door to a more resilient and prosperous financial future

US financial aid to Argentina offers vital short-term relief amid economic turmoil, but experts warn it falls short of addressing the country’s deep-rooted structural issues-underscoring an urgent call for bold, comprehensive domestic reforms

As the US tightens its grip on visa approvals, Germany is eagerly rolling out the welcome mat for skilled Indian professionals. The Economic Times shines a spotlight on how Germany’s friendly policies are unlocking thrilling new opportunities right when US restrictions are making entry tougher

U.S. Treasury Secretary signals potential financial aid for Argentina as it faces economic hurdles, emphasizing a strong commitment to collaborate on stabilizing the nation’s debt and accelerating its recovery, The Wall Street Journal reports

Former President Trump is preparing to unleash stronger tariff powers by imposing a 15% baseline tariff on Japanese imports. This bold strategy targets trade imbalances head-on and aims to turbocharge U.S. manufacturing, signaling a tougher, more determined stance toward Japan

The Bank of Japan is preparing to accelerate the sale of its asset holdings, signaling a decisive shift away from its ultra-loose monetary policy amid rising inflationary pressures, The Wall Street Journal reports

Berlin is closely monitoring France’s mounting debt crisis, a government minister revealed, underscoring rising concerns about its potential ripple effects on the eurozone’s economy. Officials are urging swift fiscal reforms to restore stability and avert deeper turmoil